Is Peer To Peer Lending Safe Risk Guarantees Explained

How Safe Is Peer To Peer Lending What Are Its Risks And Regulations Key takeaways. peer to peer (p2p) lending allows individuals to lend money to or borrow money from other individuals without going through a bank. p2p lenders are individual investors who. Peer to peer (p2p) lenders fees. peer to peer lending platforms can charge fees to both borrowers and investors. which fees apply and the amount of these fees can vary from lender to lender. a common fee that borrowers may encounter is an origination fee, which is typically a percentage of the loan amount.

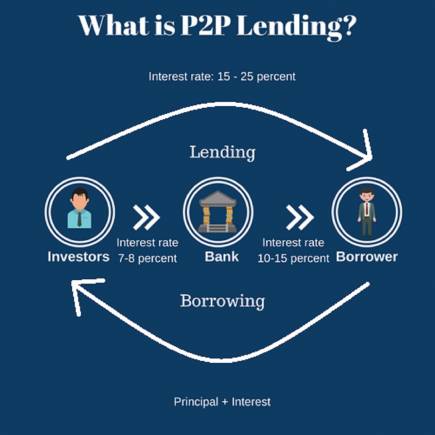

P2p Lending Explained What Is Peer To Peer Lending Peer to peer (or p2p) lending is a way to lend directly to individuals and businesses. the other feature of this lending method is that financial intermediaries are out of the equation. p2p lending is a form of fintech. it is also known as "social" or "crowd" lending and was launched in 2005. the business model of this lending method is based. For many new investors, this can be quite confusing to figuring out whether peer to peer lending is safe. understanding p2p investing is not hard, it only takes a bit of time. if you have any questions about the safety of p2p lending or want to share your thoughts, feel free to comment below. Peer to peer lending is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary in the deal. p2p lending is generally done through online platforms that match lenders with the potential borrowers. p2p lending offers both secured and unsecured loans. Peer to peer lending is an online transaction between a lender and a borrower. the two parties connect through an online p2p lending platform, such as kiva, prosper, or upstart. the lender—an.

P2p Lending Risks Is Peer To Peer Lending Safe The Home Bankers Club Peer to peer lending is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary in the deal. p2p lending is generally done through online platforms that match lenders with the potential borrowers. p2p lending offers both secured and unsecured loans. Peer to peer lending is an online transaction between a lender and a borrower. the two parties connect through an online p2p lending platform, such as kiva, prosper, or upstart. the lender—an. Peer to peer lending, also called p2p lending, is a form of investing that involves lending to individual borrowers, small businesses or funding development projects, usually via a lending platform. the investor earns interest on what they lend as the borrower is paying interest on the money lent to them. Peer to peer (p2p) lending is an innovative form of borrowing and investing money without the involvement of traditional financial institutions. by using online platforms, borrowers and lenders can make mutually beneficial transactions directly without the need for a bank as a middleman. p2p lending is a type of crowdfunding investment also.

.jpg)

How Safe Is Peer To Peer Lending A Risk Analysis Peer to peer lending, also called p2p lending, is a form of investing that involves lending to individual borrowers, small businesses or funding development projects, usually via a lending platform. the investor earns interest on what they lend as the borrower is paying interest on the money lent to them. Peer to peer (p2p) lending is an innovative form of borrowing and investing money without the involvement of traditional financial institutions. by using online platforms, borrowers and lenders can make mutually beneficial transactions directly without the need for a bank as a middleman. p2p lending is a type of crowdfunding investment also.

Comments are closed.