Its A Money Thing Building A Budget

It S A Money Thing Budgeting Basics Oregonians Credit Union It’s simple and flexible, 50 30 20 is a proportional budgeting system, meaning you divide your monthly income into different categories based on percentage. Budgets: we all know we should have one, and we all know it’s a fairly simple thing to follow—at least in theory. we often map out budgets with the best of i.

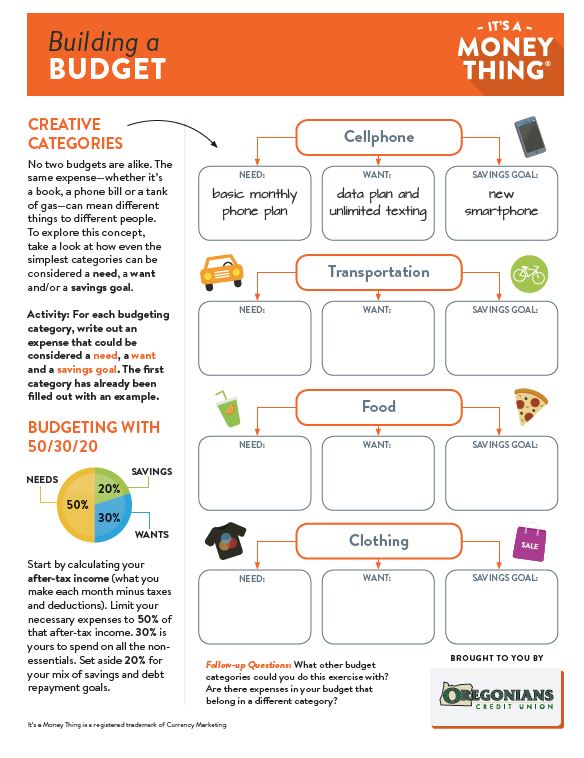

Building A Budget It S A Money Thing Youtube Budgeting is a skill that helps you make smart decisions with your money. it ensures that you’re spending less than you earn, it prepares you for life’s curv. Step 1: determine your limits. the 50 30 20 budget recommends that you spend 50% of your income on needs, 30% on wants and 20% on savings. your first step is to calculate how much money those percentages represent for your particular financial situation. take your monthly net income (that’s your take home pay after taxes and deductions) and. Step 1: determine your limits. the 50 30 20 budget recommends that you spend 50% of your income on needs, 30% on wants and 20% on savings. your first step is to calculate how much money those percentages represent for your particular financial situation. take your monthly net income (that’s your take home pay after taxes and deductions) and. Follow up questions: what other budget categories could you do this exercise with? are there expenses in your budget that belong in a di erent category? no two budgets are alike. the same expense whether it s a book, a phone bill or a tank of gas can mean di erent things to di erent people. to explore this concept, take a look at how even the.

Asychronous It S A Money Thing Building A Bu Docx It S A Money Thing Step 1: determine your limits. the 50 30 20 budget recommends that you spend 50% of your income on needs, 30% on wants and 20% on savings. your first step is to calculate how much money those percentages represent for your particular financial situation. take your monthly net income (that’s your take home pay after taxes and deductions) and. Follow up questions: what other budget categories could you do this exercise with? are there expenses in your budget that belong in a di erent category? no two budgets are alike. the same expense whether it s a book, a phone bill or a tank of gas can mean di erent things to di erent people. to explore this concept, take a look at how even the. Budgeting. when it comes to building a budget, priorities play a key role. by identifying and categorizing common expenses, young people can learn to look after their essential needs, stay on top of savings, and prepare themselves to handle unexpected expenses. with the help of a solid budgeting strategy, youths can build a future of financial. It's a money thing buying goods and services. one key to financial success is building a budget. watch the videos below to learn more! it's a money thing.

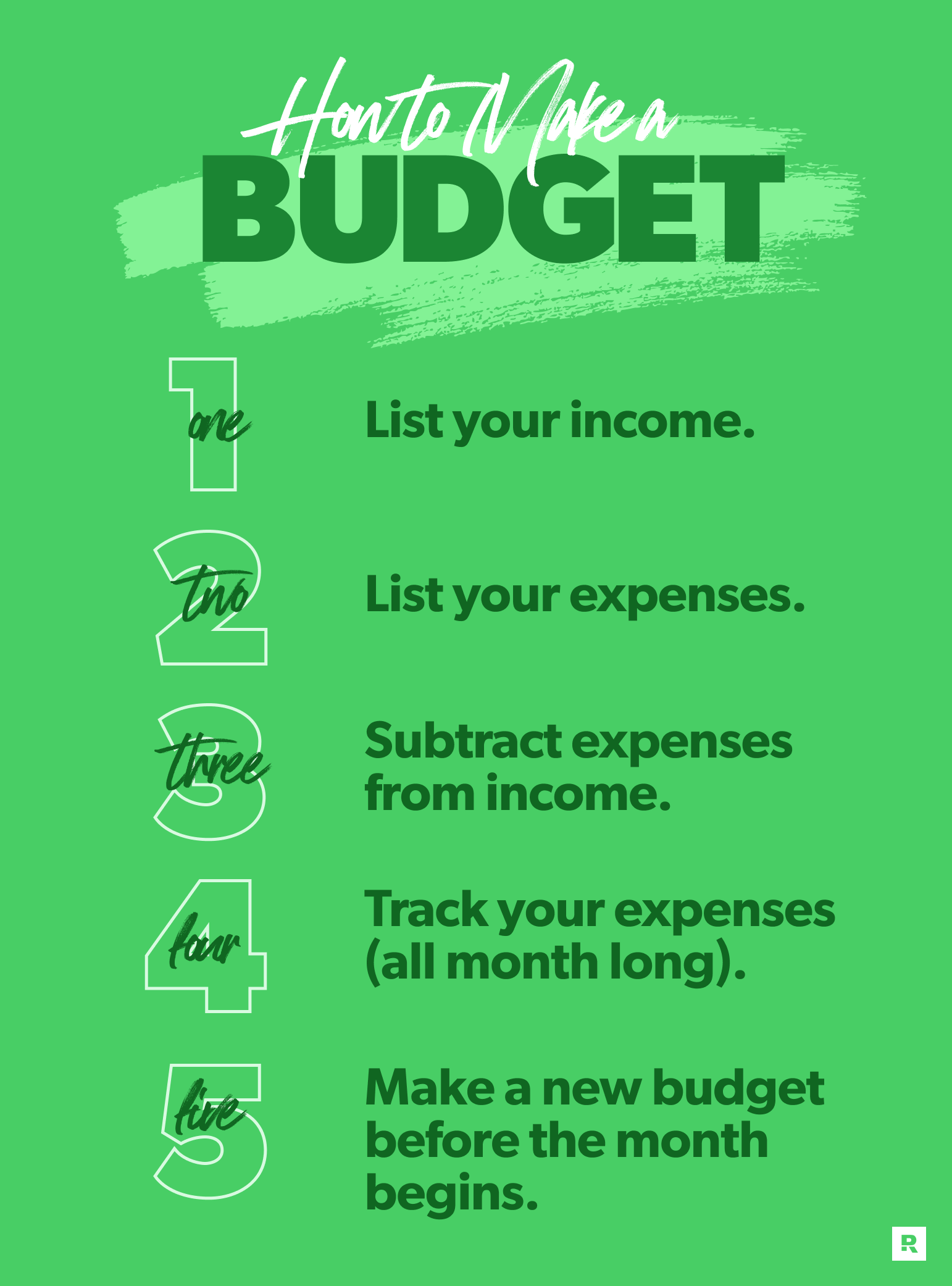

How To Make A Budget Your Step By Step Guide Ramsey Budgeting. when it comes to building a budget, priorities play a key role. by identifying and categorizing common expenses, young people can learn to look after their essential needs, stay on top of savings, and prepare themselves to handle unexpected expenses. with the help of a solid budgeting strategy, youths can build a future of financial. It's a money thing buying goods and services. one key to financial success is building a budget. watch the videos below to learn more! it's a money thing.

Comments are closed.