Journal Entries Accounting Rules Of Debit And Credit

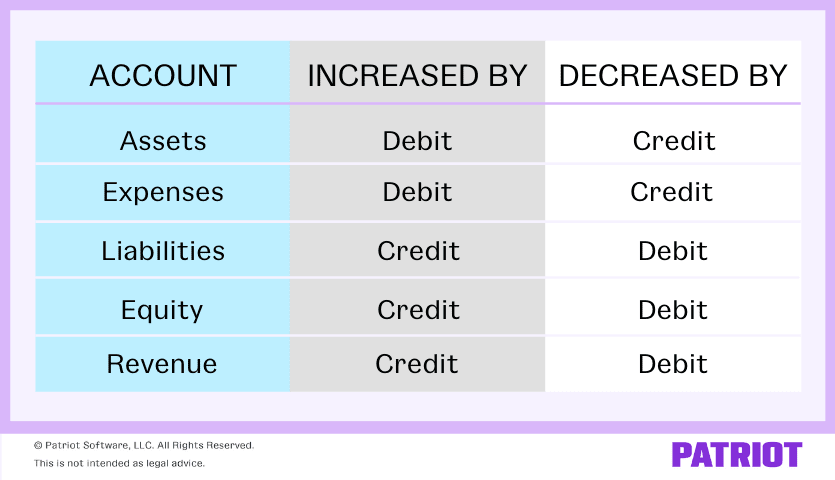

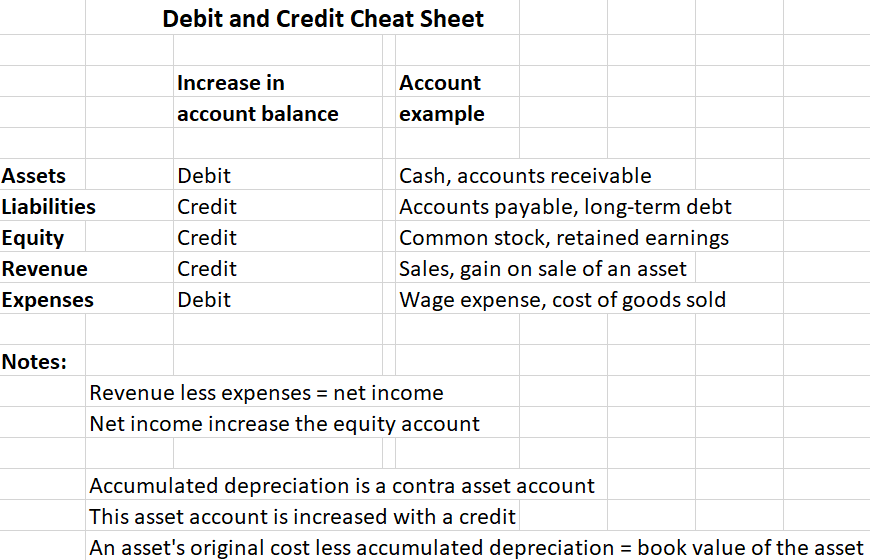

Debits And Credits In Accounting Patriot Software Rule 4: entries must balance. the total amount of debits must equal the total amount of credits in a transaction. otherwise, a transaction is said to be unbalanced, and the financial statements from which a transaction is constructed will be inherently incorrect. an accounting software package will flag any journal entries that are unbalanced. Application of the rules of debit and credit. the basic rules of debit and credit applicable to various classifications of accounts are listed below: (1). asset accounts: normal balance: debit. rule: an increase is recorded on the debit side and a decrease is recorded on the credit side of all asset accounts. (2).

Debits And Credits A Beginner S Guide Quickbooks Global The rules of debits and credits. some accounts are increased by a debit and some are increased by a credit. an increase to an account on the left side of the equation (assets) is shown by an entry on the left side of the account (debit). therefore, those accounts are decreased by a credit. an increase to an account on the right side of the. Here’s an example to illustrate how debits and credits, journal entries, and reports connect: scenario: a company sells products for $1,000 cash and incurs $200 in rent expenses (paid in cash). the sales transaction increases cash (asset) and sales revenue. the rent expense increases expenses and decreases cash. When learning bookkeeping basics, it’s helpful to look through examples of debit and credit accounting for various transactions. in general, debit accounts include assets and cash, while credit accounts include equity, liabilities, and revenue. check out these examples of journal entries for each type of account:. Example of rules for journal entries. now let’s take a few example transactions to understand these rules in the business context: on 1st april 2020, ron & daughters. started business with cash of $2000 that it received from the owner mr. ron. this transaction deals with two accounts, ron's account, and the cash account. ron's account is.

Comments are closed.