Journal Entries Exercises With Answers Pdf

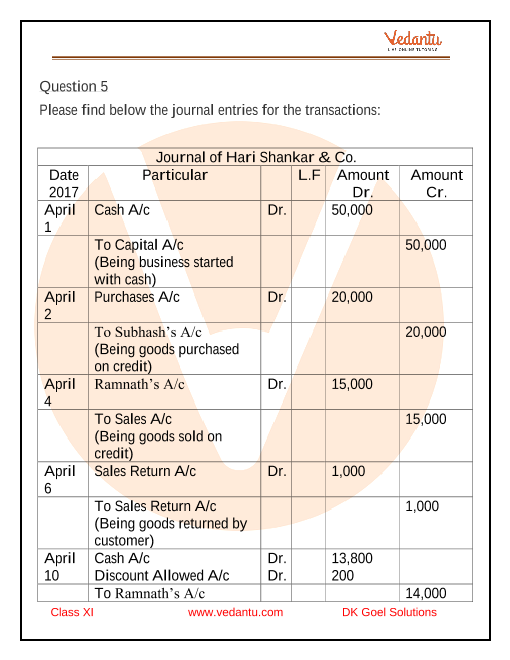

Adjusting Journal Entries Exercises With Answers Gestuas Problems 2: prepare general journal entries for the following transactions of a business called pose for pics in 2016: aug. 1: hashim khan, the owner, invested rs. 57,500 cash and rs. 32,500 of photography equipment in the business. 04: paid rs. 3,000 cash for an insurance policy covering the next 24 months. Capital is an internal liability for the business hence credit the increase in liabilities. example – max started a business with 10,000 in cash. cash a c. 10,000. to capital a c. 10,000. (capital introduced by max in cash for 10,000) related topic – all journal entries on one page. 2.

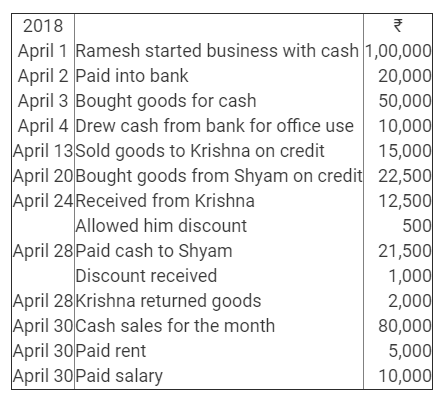

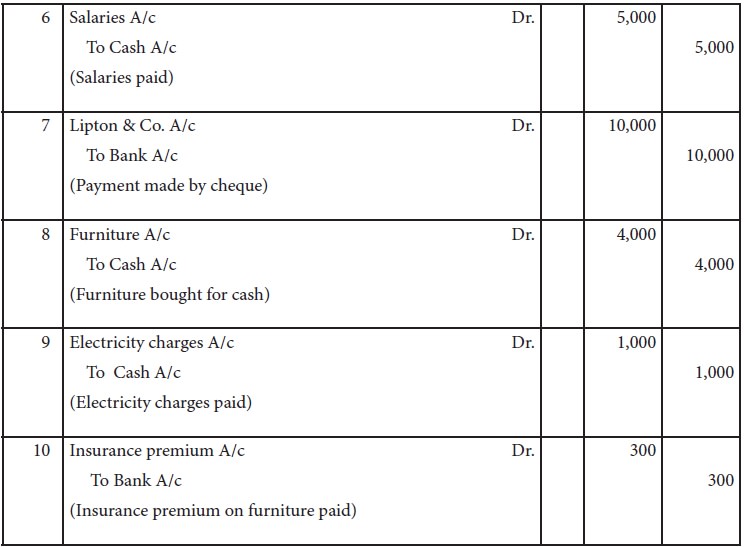

Journal Entry Exercises Pdf Feqtulf 17. record journal entries for the following transactions. after recording the transactions, prepare a “t account” and balance the accounts payable account. a. borrowed $50,000 from the bank, agreed to repay it in 3 years b. purchased manufacturing equipment for $20,000 cash c. purchased office furniture on account, $2,700 d. Prepare the general journal entries to record the following transactions for the business for the month of may 2016 (ignore gst): may 1 owner deposited $50,000 of his own money into the business’ bank account. 3 employed a part time worker to begin work on the first monday of next month, earning a salary of $450 per week. The “t” account is used to summarize the account and determine the balance. take the amounts in the journal entries and put them in the “t” accounts. 1) put the debits on the left. 2) put the credits on the right. 3) add up all the debits, the left side. 4) add up all the credits, the right side. Building blocks to a general journal entry and t account. issued common stock for cash, $100,000. purchase supplies with cash, $289. purchase equipment on account, $2100. provide services on account, $5975. received $750 from customers on account. paid office rent, $1500. paid creditors on account for equipment, $900.

Journal Entry Exercises With Answers The “t” account is used to summarize the account and determine the balance. take the amounts in the journal entries and put them in the “t” accounts. 1) put the debits on the left. 2) put the credits on the right. 3) add up all the debits, the left side. 4) add up all the credits, the right side. Building blocks to a general journal entry and t account. issued common stock for cash, $100,000. purchase supplies with cash, $289. purchase equipment on account, $2100. provide services on account, $5975. received $750 from customers on account. paid office rent, $1500. paid creditors on account for equipment, $900. Financial accounting: a managerial perspective. (3rd, ed.) new delhi: prentice hall of india. ramchandran, n., & kakani, r. k. (2007). financial accounting for management. (2nd, ed.) new delhi: tata mcgraw hill. journal entry problems pdf is document containing format for questions. variety of questions are design to understand basic journal. 1) you get something (asset) and you give up something to get it (an asset or a liability) 2) you provide goods or services in exchange for an asset. 3) you are provided services (expense) that you pay for now or will pay for later (liab) 4) you use an asset (expense) in your day to day business to get revenues.

Journal Entries Meaning Format Steps Different Types Application Financial accounting: a managerial perspective. (3rd, ed.) new delhi: prentice hall of india. ramchandran, n., & kakani, r. k. (2007). financial accounting for management. (2nd, ed.) new delhi: tata mcgraw hill. journal entry problems pdf is document containing format for questions. variety of questions are design to understand basic journal. 1) you get something (asset) and you give up something to get it (an asset or a liability) 2) you provide goods or services in exchange for an asset. 3) you are provided services (expense) that you pay for now or will pay for later (liab) 4) you use an asset (expense) in your day to day business to get revenues.

Exercise 2 Journal Entries Pdf My Single Proprietorship Journal

Comments are closed.