Key Differences Between Angel Investor And Venture Capitalist

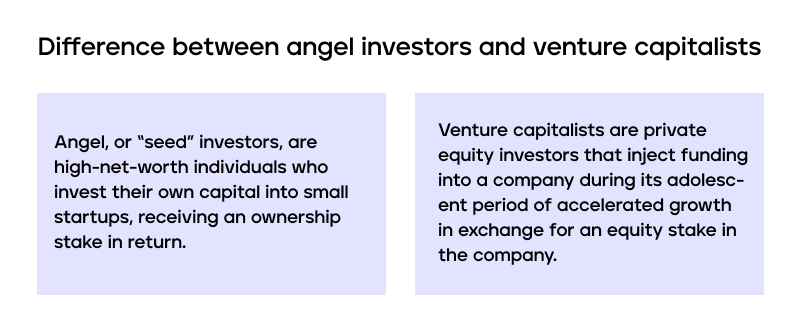

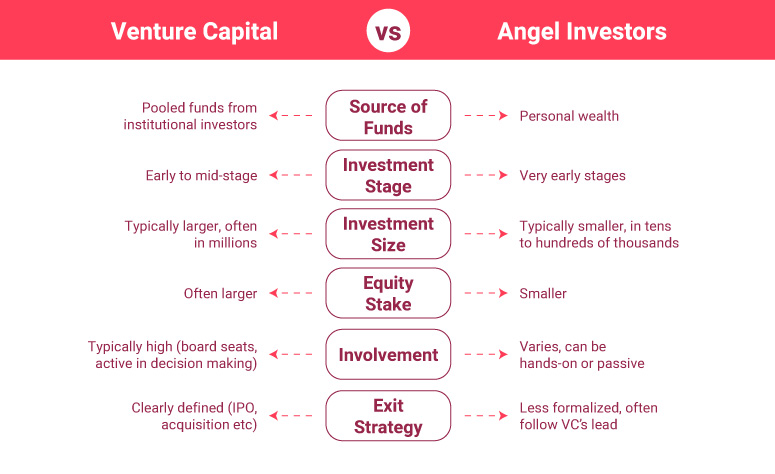

Venture Capitalist Vs Angel Investor Who Should You Pitch To Key differences between angel investors and venture capitalists. the following points are substantial so far as the difference between angel investors and venture capitalists is concerned: angel investors are the individuals, usually wealthy, who invest their money in a high growth potential budding company, in return for an ownership stake. Angel investors invest smaller amounts than venture capitalists. venture capitalists ask for more company equity than angel investors. angel investors fund younger, less established businesses than venture capitalists. venture capitalists look for a bigger return on investment than angel investors. angel investors spend more time working with.

Comparing Angel Investors And Venture Capitalists Angel investors: angel investors have a more flexible and faster decision making process, often based on personal discretion and can quickly decide to invest. 5. control and influence. venture capital: vcs exert significant control, often taking board seats and influencing the company's strategic direction. Despite their shared goal of supporting innovation, there are several critical differences between angel investors and venture capitalists: source of funds: angel investors use their personal capital, while venture capitalists manage pooled funds. this difference in capital sources influences how each group operates. While angel investors tend to come on board as investors earlier on in the startup journey, vcs typically look for more established startups to invest in. venture capital investors usually want to see a more flushed out proof of concept, strong business plan, established customer base, and a solid strategy for turning a profit over the long term. Venture capitalists and angel investors differ in several key ways, including their backgrounds, expertise, and investment approach. one of the main differences between venture capitalists and angel investors is their backgrounds and expertise. venture capitalists are typically professional investors who have a wealth of experience and.

Angel Investor Vs Venture Capital 5 Most Awesome Differences To Learn While angel investors tend to come on board as investors earlier on in the startup journey, vcs typically look for more established startups to invest in. venture capital investors usually want to see a more flushed out proof of concept, strong business plan, established customer base, and a solid strategy for turning a profit over the long term. Venture capitalists and angel investors differ in several key ways, including their backgrounds, expertise, and investment approach. one of the main differences between venture capitalists and angel investors is their backgrounds and expertise. venture capitalists are typically professional investors who have a wealth of experience and. However, there are some crucial differences between venture capitalists and angel investors. 1. an angel investor works alone, while venture capitalists are part of a company. angel investors, sometimes known as business angels, are individuals who invest their finances in a startup. Key points. angel investors and venture capitalists are known to fund new or early stage business endeavors. angels are more likely to be passive investors—friends or family—whereas venture capitalists typically work for professional firms. venture capital firms are more likely to take an active role in managing a company, as well as a.

The Key Differences Between Venture Capital And Angel Investors However, there are some crucial differences between venture capitalists and angel investors. 1. an angel investor works alone, while venture capitalists are part of a company. angel investors, sometimes known as business angels, are individuals who invest their finances in a startup. Key points. angel investors and venture capitalists are known to fund new or early stage business endeavors. angels are more likely to be passive investors—friends or family—whereas venture capitalists typically work for professional firms. venture capital firms are more likely to take an active role in managing a company, as well as a.

Angel Investors Vs Venture Capitalists Equitynet

Angel Investors Vs Venture Capitalists Truic

Comments are closed.