Know About Peer To Peer Lending P2p Lending Financenerd

Know About Peer To Peer Lending P2p Lending Financenerd Well, many of us might have heard about the new ‘thing’ in the market called p2p lending or peer to peer lending.you may have dozen questions about it like is it legal? how safe is it? how good it is for investing? how are the returns? and many more. this article will tell everything about p2p lending from an investor point of view. Key takeaways. peer to peer (p2p) lending allows individuals to lend money to or borrow money from other individuals without going through a bank. p2p lenders are individual investors who.

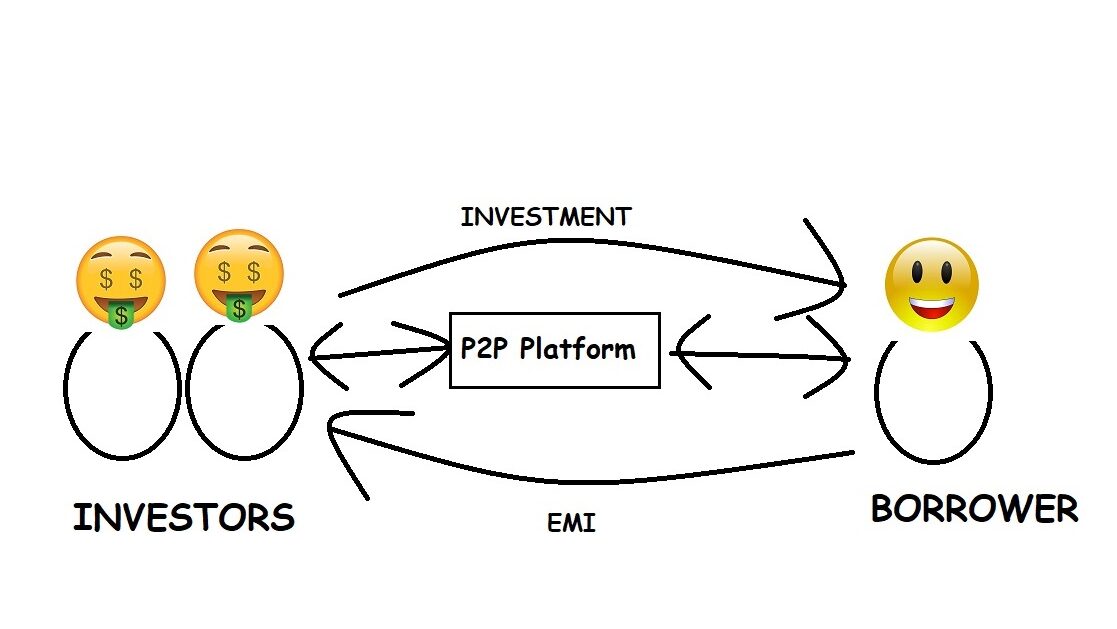

What Is Peer To Peer Lending How Does It Work Rbi S Latest Peer to peer lending, also called p2p lending, is a form of investing that involves lending to individual borrowers, small businesses or funding development projects, usually via a lending platform. the investor earns interest on what they lend as the borrower is paying interest on the money lent to them. Peer to peer lending is a form of direct lending of money to individuals or businesses without an official financial institution participating as an intermediary in the deal. p2p lending is generally done through online platforms that match lenders with the potential borrowers. p2p lending offers both secured and unsecured loans. Compare interest rates and fees. similar to personal loans, interest rates on peer to peer loans generally range from 6% to 36%. many lenders impose origination fees between 1% and 8% of the loan. Highlights: peer to peer (p2p) lending allows borrowers to apply for loans from individual investors instead of banks or other financial institutions. p2p lending takes place through specialized websites that connect individual lenders with borrowers who are looking for a loan. all loans involve some level of risk.

What Is Peer To Peer P2p Lending A Quick Introduction Compare interest rates and fees. similar to personal loans, interest rates on peer to peer loans generally range from 6% to 36%. many lenders impose origination fees between 1% and 8% of the loan. Highlights: peer to peer (p2p) lending allows borrowers to apply for loans from individual investors instead of banks or other financial institutions. p2p lending takes place through specialized websites that connect individual lenders with borrowers who are looking for a loan. all loans involve some level of risk. Peer to peer lending directly connects borrowers with individual lenders—instead of a financial institution like a bank—using online platforms. make sure you know about the potential risks of p2p lending before you decide to become a p2p borrower or lender. Peer to peer (p2p) lending is an innovative form of borrowing and investing money without the involvement of traditional financial institutions. by using online platforms, borrowers and lenders can make mutually beneficial transactions directly without the need for a bank as a middleman. p2p lending is a type of crowdfunding investment also.

Comments are closed.