Leveraging Rating Transition Matrices J P Morgan Asset Management

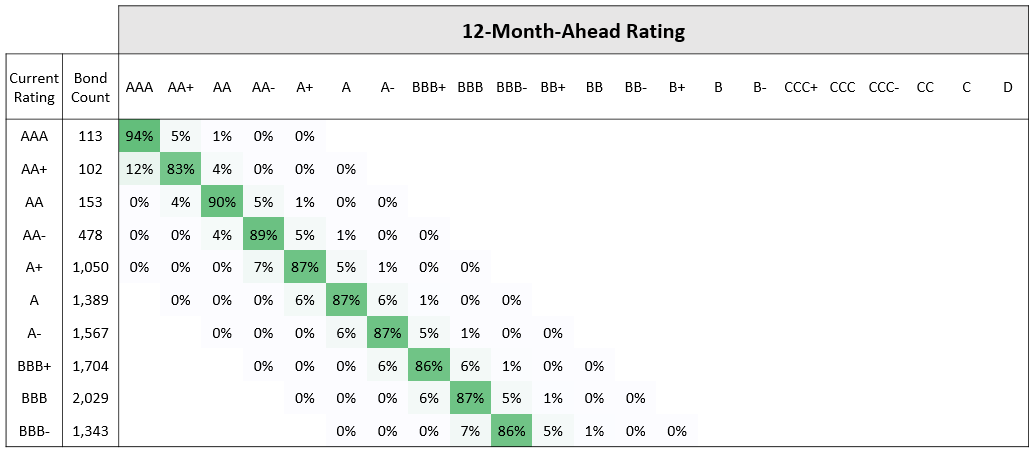

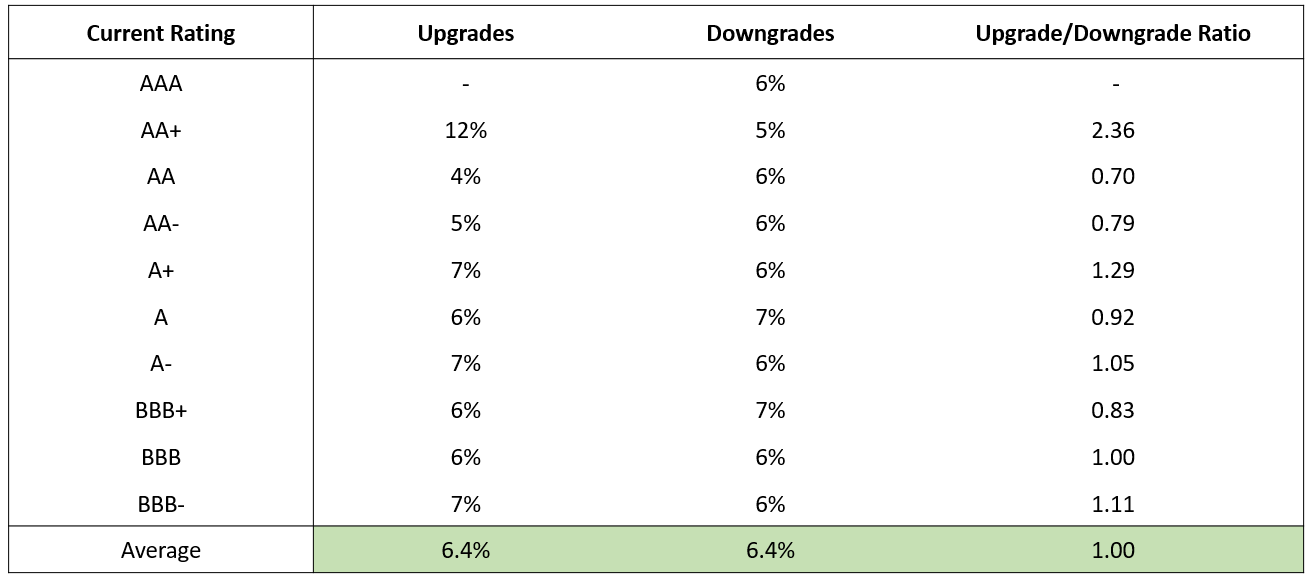

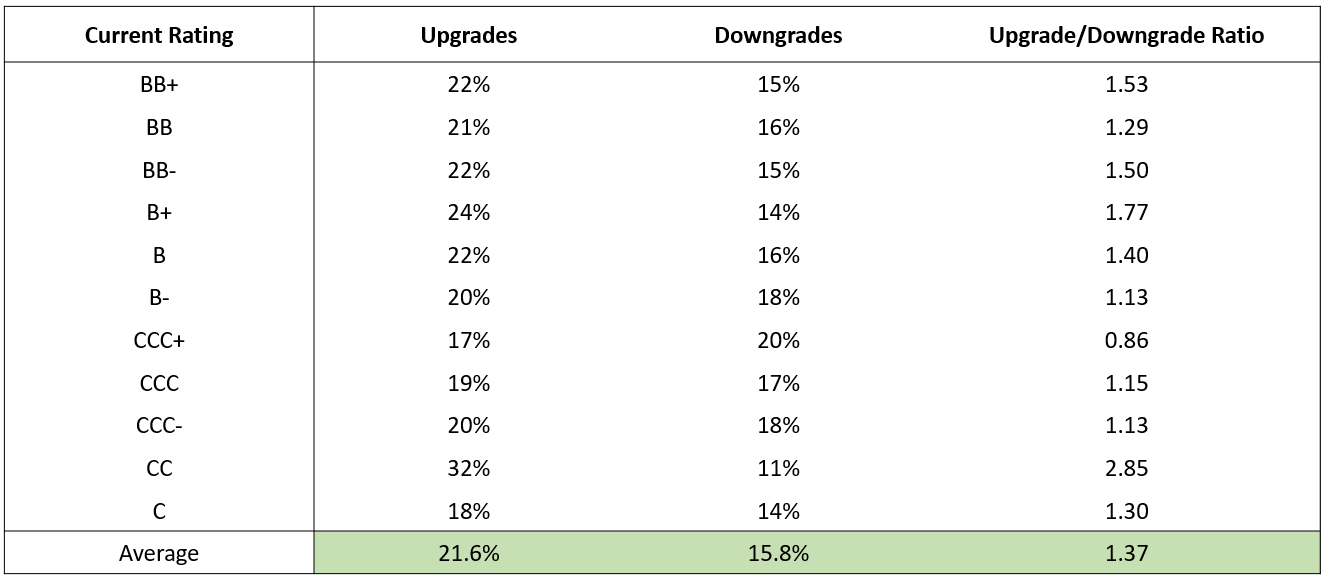

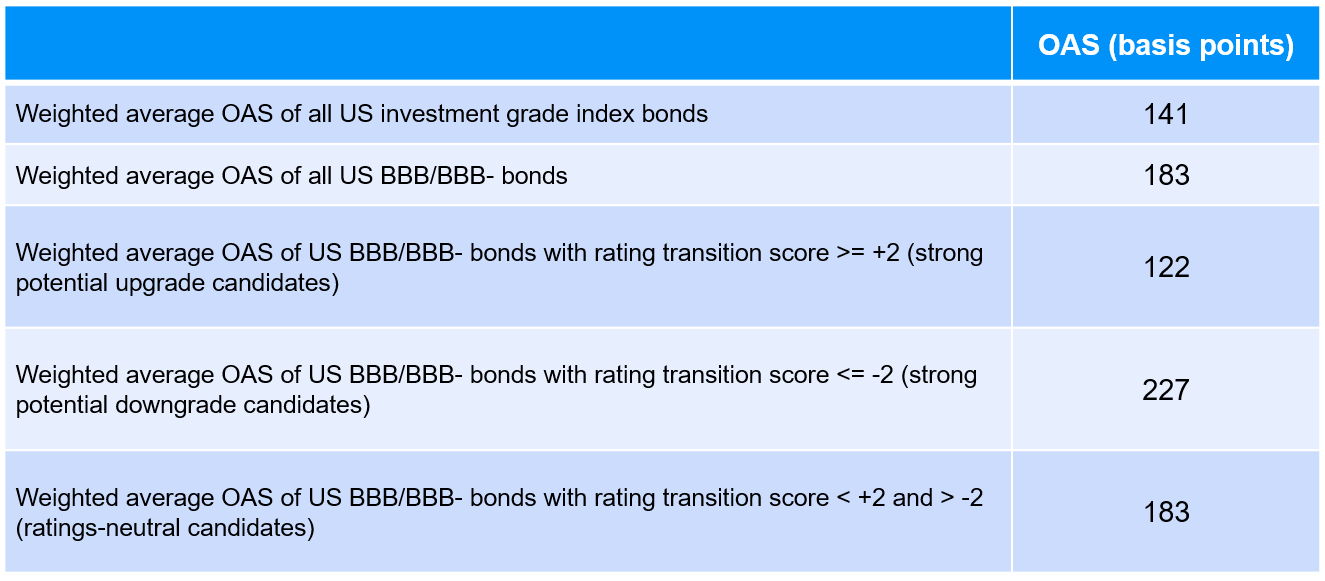

Leveraging Rating Transition Matrices J P Morgan Asset Management Source: bloomberg fixed income indices, ice bofa indices, s&p, moody’s, fitch, jp morgan asset management. data as of 15 th june 2023. the “prediction” data to the right in figure 1 depicts the upgrade and downgrade summary statistics from the 12 month ahead rating transition matrix as of 15 th june 2023. these bars show that the current. Figure 4: rating transition score outcomes. rating transition score: historical hit rates vis à vis future changes in composite bond ratings. daily data, 1st jan 2016 – 31st mar 2023. source: bloomberg fixed income indices, ice bofa indices, s&p, moody’s, fitch, jp morgan asset management.

Leveraging Rating Transition Matrices J P Morgan Asset Management Credit quality of names through time. morgan developed transition matrices for this purpose as early as 1987. we have since built upon a broad literature of work which applies migration analysis to credit risk evaluation. the first publication of transition matrices was in 1991 by. Managing director at j.p. morgan asset management 9mo sharing a new blog, written with with my colleague jonathan msika, on "leveraging rating transition matrices". leveraging rating transition. Credit rating transition matrices are key components in default models and credit portfolio management, but calibration can be a challenge. the simplest approach tracks actual credit migrations for a cohort of names over a specified time period, but this has the drawback that smaller industries or short time periods may be subject to high sampling variation and outliers; and even large samples. Abstract. rating transition matrices play an important role in credit risk management both as a method for summarizing the empirical behavior of a rating system and as a tool for computing probabilities of rating migrations in, for example, a portfolio of risky loans. analysis of statistical properties of rating transition matrices is.

Leveraging Rating Transition Matrices J P Morgan Asset Management Credit rating transition matrices are key components in default models and credit portfolio management, but calibration can be a challenge. the simplest approach tracks actual credit migrations for a cohort of names over a specified time period, but this has the drawback that smaller industries or short time periods may be subject to high sampling variation and outliers; and even large samples. Abstract. rating transition matrices play an important role in credit risk management both as a method for summarizing the empirical behavior of a rating system and as a tool for computing probabilities of rating migrations in, for example, a portfolio of risky loans. analysis of statistical properties of rating transition matrices is. 1. the importance of rating transition matrices: rating transition matrices are essential tools for credit risk analysis. they allow us to understand how credit ratings change over time, providing insights into the creditworthiness of borrowers, issuers, or portfolios. these matrices capture the probabilities of transitioning from one rating. This paper compares and improves the two primary default models—creditmetrics and kmv models. creditmetrics characterizes the past changes in credit quality through a credit transition matrix, and hence generates forecasts of the credit asset portfolio distribution. this approach focuses on a direct analysis of the relationship between credit.

Peering Over The Ratings Cliff J P Morgan Asset Management 1. the importance of rating transition matrices: rating transition matrices are essential tools for credit risk analysis. they allow us to understand how credit ratings change over time, providing insights into the creditworthiness of borrowers, issuers, or portfolios. these matrices capture the probabilities of transitioning from one rating. This paper compares and improves the two primary default models—creditmetrics and kmv models. creditmetrics characterizes the past changes in credit quality through a credit transition matrix, and hence generates forecasts of the credit asset portfolio distribution. this approach focuses on a direct analysis of the relationship between credit.

Comments are closed.