Life Insurance Meaning Elements And Types Of Life Insurance Policies

Life Insurance Meaning Elements And Types Of Life Insurance Policies Life insurance is a contract between an insurance company and a policy owner in which the insurer guarantees to pay a sum of money to one or more named beneficiaries when the insured person dies. Permanent life insurance. a type of life insurance that usually lasts a lifetime and includes a cash value component. premium. the cost of maintaining a life insurance policy. term life insurance.

Types Of Life Insurance Policygenius The best type of life insurance for you will depend on your coverage needs and budget. here’s everything you need to know about the most popular types of life insurance policies, including how they work, pros and cons, how long they last, and who they’re best for. term life insurance. whole life insurance. universal life insurance. The two major types of life insurance are term life insurance and permanent life insurance. allows you to lock in rates for a specific period of time, such as 10, 15, 20 or 30 years. once the. When you start looking into life insurance plans, there are two main types: term and permanent. term life covers you for a limited period, while permanent can stay in place for the rest of your. Term life insurance is best if you are: younger, on a budget and don’t need coverage for more than 15 years. learn more about term life insurance. whole life insurance. the most common type of life insurance policy, whole life insurance (also known as cash value life insurance) is a permanent form of coverage that combines a death benefit.

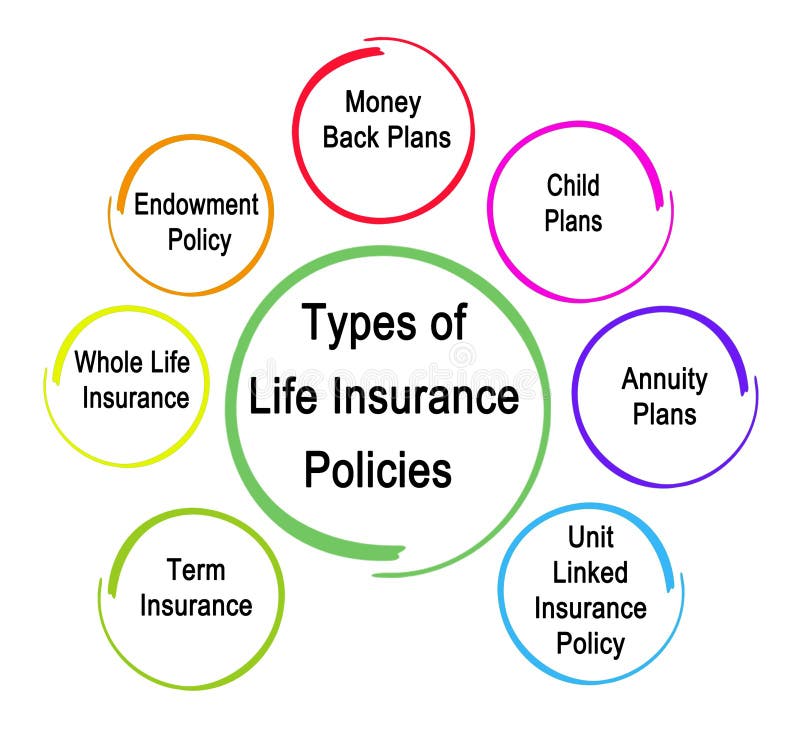

Articles Junction Types Of Life Insurance Policies Life Insurance When you start looking into life insurance plans, there are two main types: term and permanent. term life covers you for a limited period, while permanent can stay in place for the rest of your. Term life insurance is best if you are: younger, on a budget and don’t need coverage for more than 15 years. learn more about term life insurance. whole life insurance. the most common type of life insurance policy, whole life insurance (also known as cash value life insurance) is a permanent form of coverage that combines a death benefit. The main purpose of life insurance is to provide money for your beneficiaries when you die. but how you die can determine whether the insurer pays out the death benefit. depending on the type of. What are the main types of life insurance? term, whole, universal, variable, and final expense insurance are the five main types of life insurance policies on the market — though there are many additional subtypes. term life insurance. term life insurance is one of the most popular and affordable types of insurance. it’s a straightforward.

Types Of Life Insurance Explained Chart The main purpose of life insurance is to provide money for your beneficiaries when you die. but how you die can determine whether the insurer pays out the death benefit. depending on the type of. What are the main types of life insurance? term, whole, universal, variable, and final expense insurance are the five main types of life insurance policies on the market — though there are many additional subtypes. term life insurance. term life insurance is one of the most popular and affordable types of insurance. it’s a straightforward.

Comments are closed.