Life Insurance Policy Review Types Steps Reasons Tips

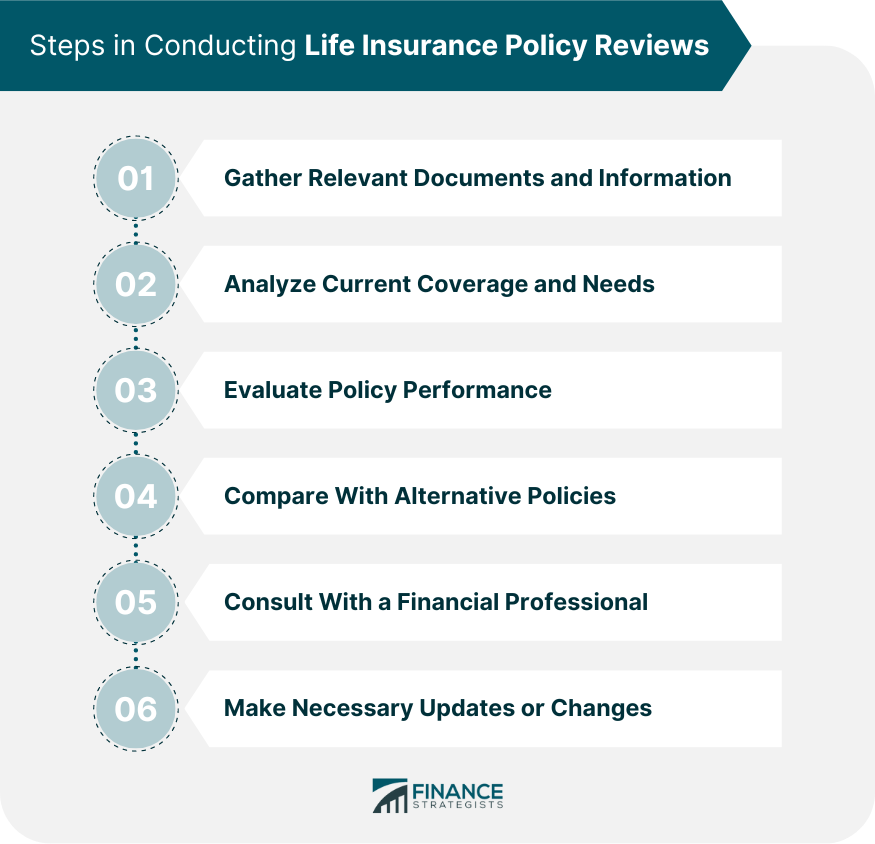

Life Insurance Policy Review Types Steps Reasons Tips By understanding the various types of life insurance policies available and the reasons for conducting reviews, you can evaluate your coverage and make adjustments as needed. following the steps involved in conducting policy reviews and keeping in mind the tips for effective reviews can help ensure that your coverage remains aligned with your. We recommend reviewing your life insurance every year. having the right coverage in place means less for you — and those you care for — to worry about. because so much can happen in 12 short months, it's important to make sure your policy is right for you and your family today. to get you started, we’ve put together a list of 9 key.

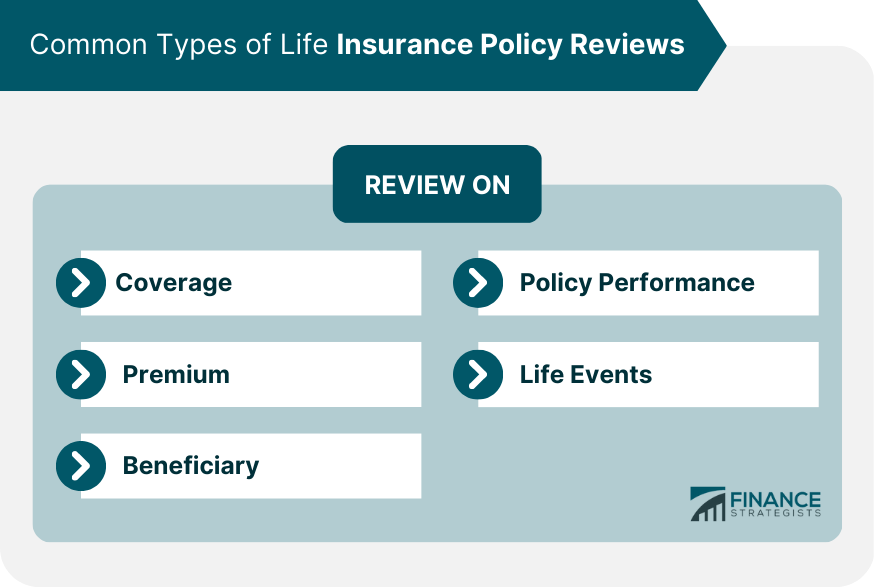

Life Insurance Policy Review Types Steps Reasons Tips 7. wait for approval. life insurance companies evaluate the risk of insuring you and how much you’ll pay for your policy through a process called underwriting. during underwriting, your insurer will evaluate your overall risk based on your gender, age, health history, and lifestyle. A licensed representative from progressive life by efinancial will talk you through your options. or, call 1 866 912 2477. learn more about policies. you should review your life insurance policy at least once a year, more if you have any life events. find out what to look for and what changes to make. Started a family. taken out a mortgage to buy a property. written a will. getting divorced. started a business. taken on business loans. sold your business. planning to retire. whatever your circumstances, a formal review can help you decide if you need to take out life insurance cover. This may include making changes to your life insurance. given that life is not on autopilot, it's best to review your policy needs at least annually and following things like: getting married. going through divorce. buying a house. having or adopting a child.

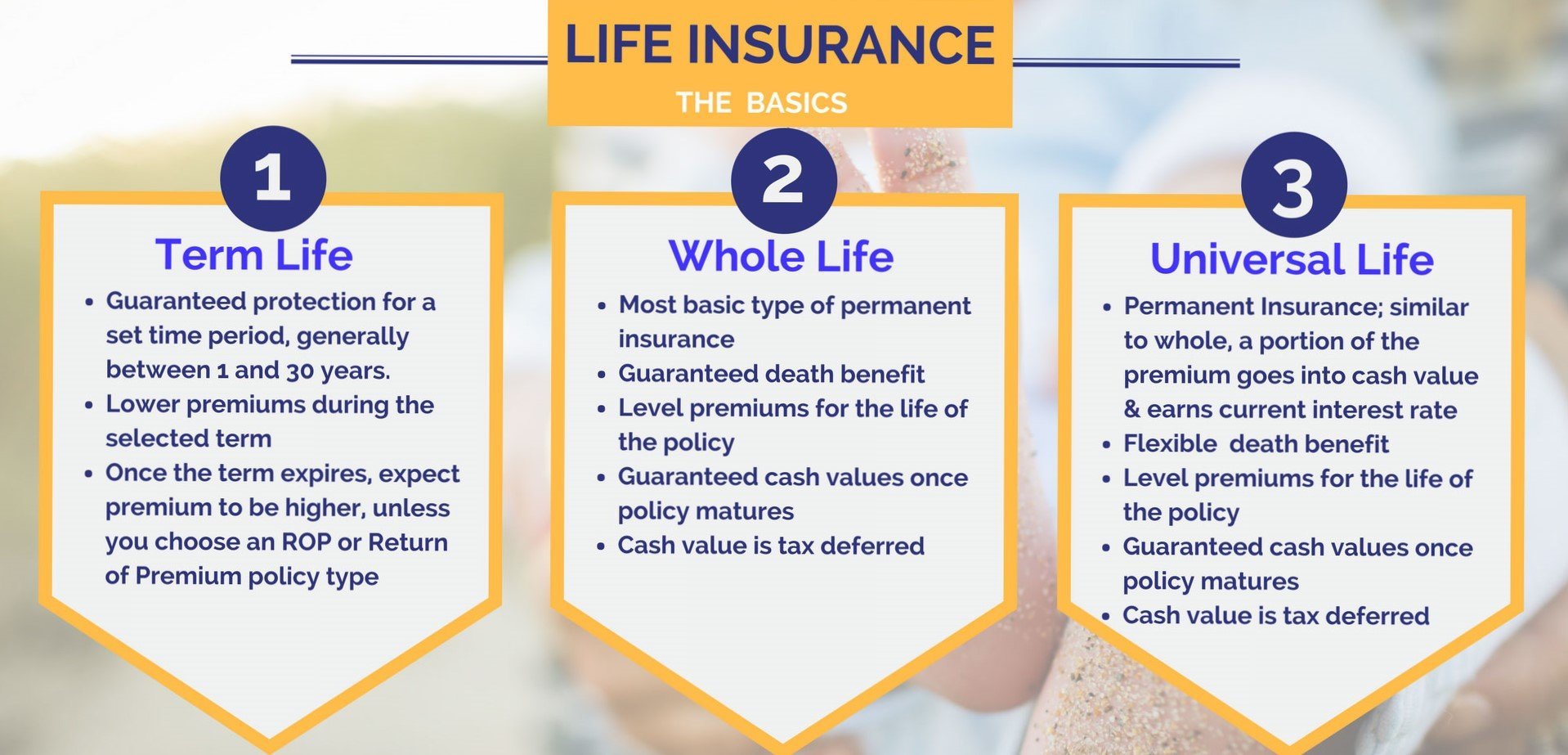

Life Insurance Policy Review Types Steps Reasons Tips Started a family. taken out a mortgage to buy a property. written a will. getting divorced. started a business. taken on business loans. sold your business. planning to retire. whatever your circumstances, a formal review can help you decide if you need to take out life insurance cover. This may include making changes to your life insurance. given that life is not on autopilot, it's best to review your policy needs at least annually and following things like: getting married. going through divorce. buying a house. having or adopting a child. If you are in the market for life insurance, here are the steps you may find helpful in purchasing a policy that is right for you. 1. decide how much coverage you need. before you start requesting. The two major types of life insurance are term life insurance and permanent life insurance. allows you to lock in rates for a specific period of time, such as 10, 15, 20 or 30 years. once the.

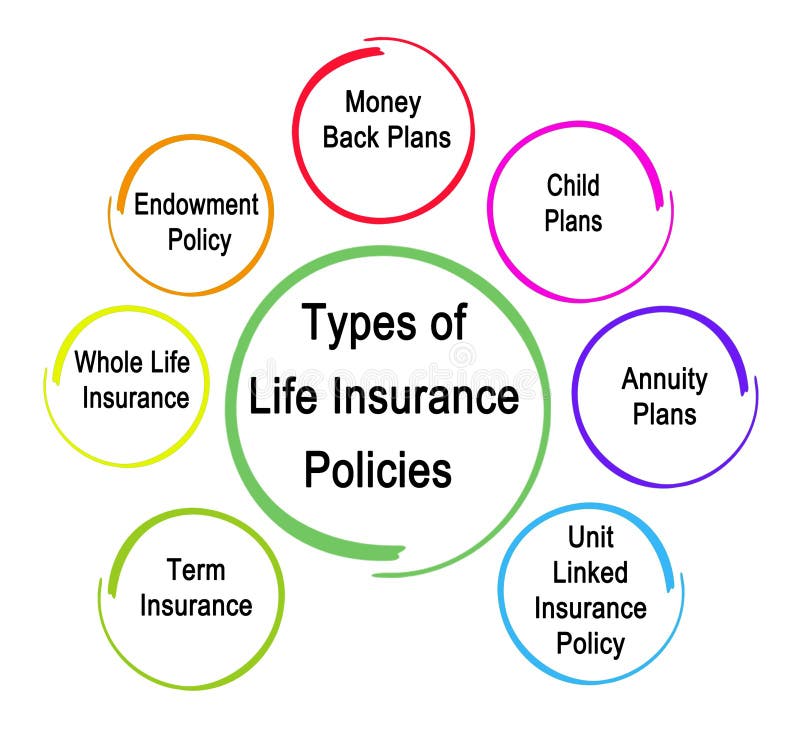

Types Of Life Insurance Policies Explained If you are in the market for life insurance, here are the steps you may find helpful in purchasing a policy that is right for you. 1. decide how much coverage you need. before you start requesting. The two major types of life insurance are term life insurance and permanent life insurance. allows you to lock in rates for a specific period of time, such as 10, 15, 20 or 30 years. once the.

Types Of Life Insurance Policies Stock Illustration Illustration Of

Comments are closed.