Life Insurance Statistics And Trends For 2024 Choice Mutual

Life Insurance Statistics And Trends For 2024 Choice Mutual Life insurance statistics, facts, and industry trends for 2024. life insurance coverage is one of the simplest ways to ensure your family’s financial security and peace of mind, though 48% of americans don’t have it. we pulled the most current life insurance statistics to showcase the benefits of coverage, evolving consumer beliefs and. Only 3% of americans correctly guessed the cost of a 10 year, $500,000 term life insurance policy for a healthy, 40 year old buyer. the largest percentage of respondents (28.4%) thought the cost.

Life Insurance Statistics And Trends For 2024 Choice Mutual From traditional to bizarre: how america wants to be buried in 2020. the results of a national survey we conducted where we asked 1500 people of various backgrounds what type of funeral they would a collection of choice mutual surveys and research documents. 56% of individuals with a household income of less than $50,000 don’t have (48%) or don’t have enough (8%) life insurance coverage, representing the largest need gap across income brackets. 39. Gender differences in life insurance. according to limra, 46% of women have life insurance in 2024, compared to 57% of men. this data represents the largest disparity in coverage between men and women in the study’s 14 year history. 45% of women report needing life insurance or more life insurance coverage in 2024. Top reasons for buying life insurance in the u.s. according to 2023 statistics from trade research organization limra and the non profit organization life happens, these are the most common reasons americans said they bought life insurance: 82% burial final expenses. 68% wealth transfer. 60% income replacement.

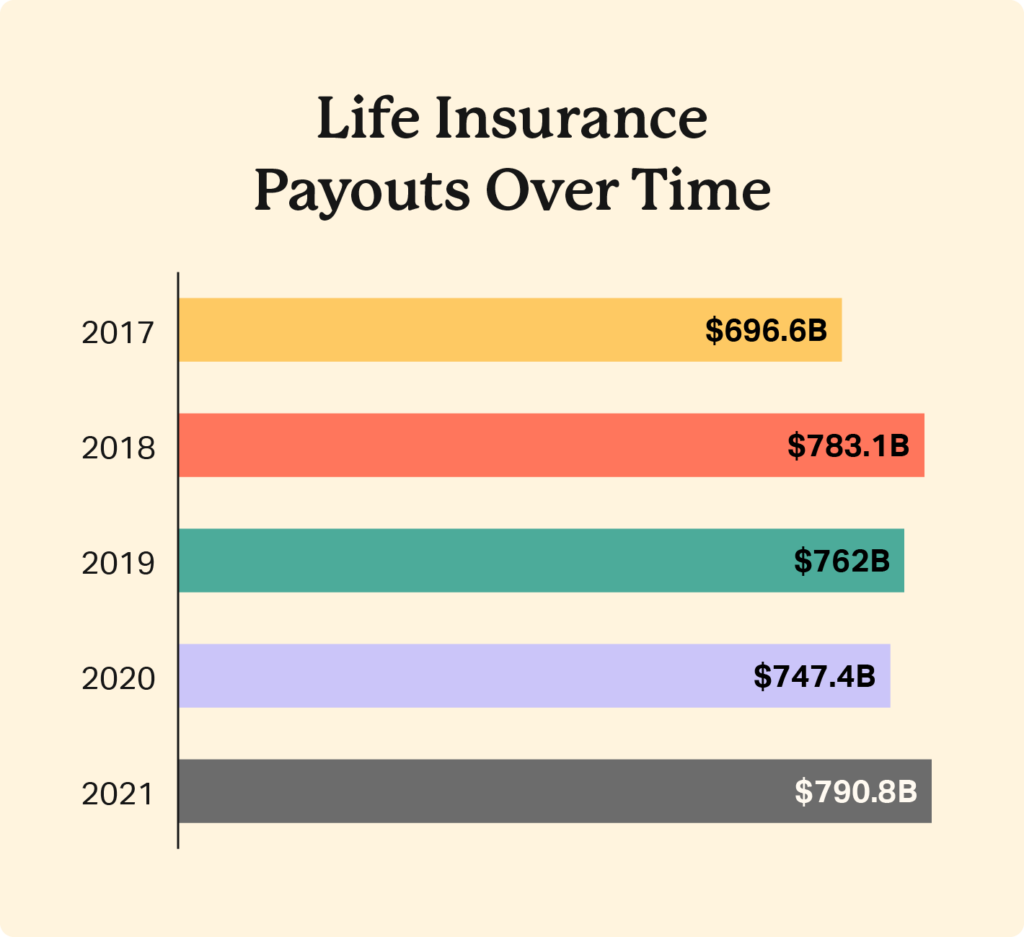

Life Insurance Statistics And Trends For 2024 Choice Mutual Gender differences in life insurance. according to limra, 46% of women have life insurance in 2024, compared to 57% of men. this data represents the largest disparity in coverage between men and women in the study’s 14 year history. 45% of women report needing life insurance or more life insurance coverage in 2024. Top reasons for buying life insurance in the u.s. according to 2023 statistics from trade research organization limra and the non profit organization life happens, these are the most common reasons americans said they bought life insurance: 82% burial final expenses. 68% wealth transfer. 60% income replacement. Other interesting life insurance statistics around age include: according to the 2024 insurance barometer study, the percentage of life insurance ownership tends to increase with age. gen z (ages. According to the triple i, in 2022, the total amount of life insurance benefits and claims amounted to $797.7 billion. based on data from the acli and our research, delaware has the highest.

Life Insurance Statistics And Trends For 2024 Other interesting life insurance statistics around age include: according to the 2024 insurance barometer study, the percentage of life insurance ownership tends to increase with age. gen z (ages. According to the triple i, in 2022, the total amount of life insurance benefits and claims amounted to $797.7 billion. based on data from the acli and our research, delaware has the highest.

Comments are closed.