Life Stage Financial Planning Mt Savings 01292015

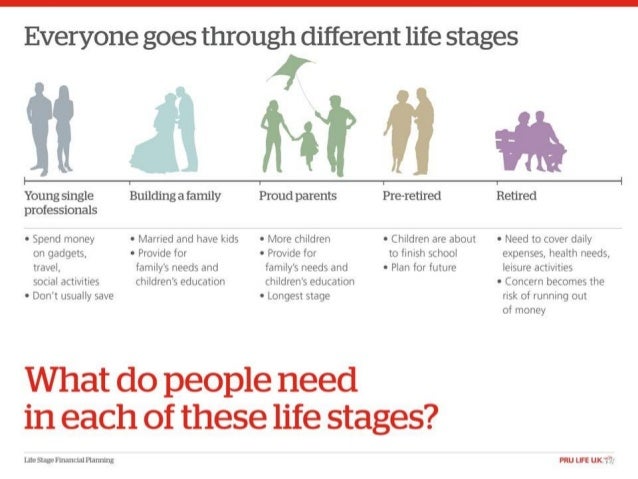

Life Stage Financial Planning Mt Savings 01292015 Life stage financial planning mt savings 01292015. this document discusses life stage financial planning and savings for different periods of one's life. it notes that expenses tend to be highest during the family formation stage when one has young children at home. retirement savings and healthcare costs also increase significantly for those. Life cycle planning is about knowing where you are—and, crucially, where you’re headed. it helps ensure that you’re financially equipped for each next stage of the journey ahead. consider.

Life Stage Financial Planning Mt Savings 01292015 Life stage financial planning mt savings 01292015. life stage financial planning mt savings 01292015. bille cristiane temanel . 2. mid career and consolidation stage: in the mid career and consolidation stage, individuals often have increased financial responsibilities and may be looking to grow their wealth while mitigating risks. key investment strategies for this stage include: asset allocation: help clients establish a well diversified portfolio with a mix of asset. Financial planning at this stage. at this stage of your life, you may be considering: moving forward in a career. caring for a young or growing family. starting to save for children‘s education. buying a home. health and how it impacts finances and family. investing in general or through a 401 (k). Financial advice for any age. there are a few tips, including some we’ve already mentioned here, that are important at every financial life stage: save as much as you can: saving money should always be a priority. some financial experts recommend the 50 30 20 rule, where 20% of your money goes into savings.

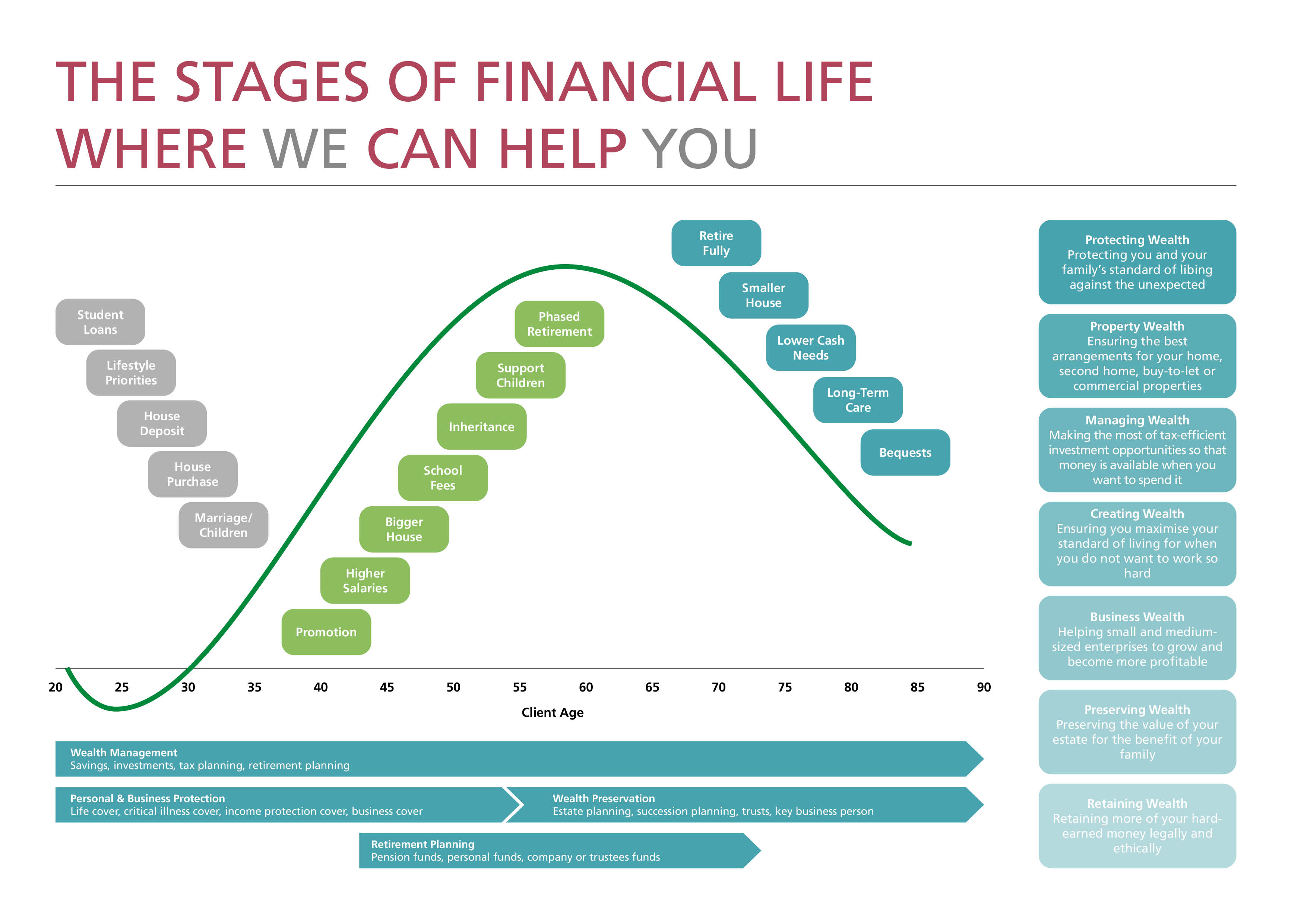

Financial Life Cycle Financial planning at this stage. at this stage of your life, you may be considering: moving forward in a career. caring for a young or growing family. starting to save for children‘s education. buying a home. health and how it impacts finances and family. investing in general or through a 401 (k). Financial advice for any age. there are a few tips, including some we’ve already mentioned here, that are important at every financial life stage: save as much as you can: saving money should always be a priority. some financial experts recommend the 50 30 20 rule, where 20% of your money goes into savings. Home services our services wealth management retirement planning 401k rollovers & management financial planning about our philosophy our team case studies office tour faq resources financial blog most popular content video library download our brochure life stages planning client center disclosures contact. Our age based financial map illustrates those aspects of insurance, investment management, tax planning and estate planning that are generally most relevant at different times in a person’s life. a breakdown of how these financial planning considerations evolve is included below: in your 30s and 40s.

Comments are closed.