Macro Unit 4 Question 2 Bank Balance Sheet

Macro Unit 4 Question 2 Bank Balance Sheet Youtube Mr. clifford's app is now available at the app store and google play. his mobile app is perfect for students in ap macroeconomics or college introductory mac. This video covers bank banlace sheets in topic 4.4 of the ap macroeconomics course exam description (ced). it explains everything you need to know about bank.

Ap Macroeconomics Unit Four Bank Balance Sheets Practice By Reeceonomics This is the 2016 ap macroeconomics frq #2 and how i would go about answering the question. #2: unit 4: bank balance sheet, money multiplier: question rubric: review past ap macroeconomics free response questions (frqs). work out your answers, then use. Study with quizlet and memorize flashcards containing terms like assume that the reserve requirement is 15 percent and that a bank receives a new checking deposit of $200. which of the following will most likely occur in the bank's balance sheet?, if a commercial bank has no excess reserves and the reserve requirement is 10 percent, what is the value of new loans this single bank can issue if. Part 2 practice use the balance sheet for leon’s bank below to answer the following questions. assets liabilities required reserves $1, excess reserves $ customer loans $8, government securities (bonds) $7, building and fixtures $4, demand deposits $10, owner’s equity $10, calculate the required reserve ratio. explain how you got your.

Ap Macroeconomics Frq Unit 4 Bank Balance Sheet Youtube Study with quizlet and memorize flashcards containing terms like assume that the reserve requirement is 15 percent and that a bank receives a new checking deposit of $200. which of the following will most likely occur in the bank's balance sheet?, if a commercial bank has no excess reserves and the reserve requirement is 10 percent, what is the value of new loans this single bank can issue if. Part 2 practice use the balance sheet for leon’s bank below to answer the following questions. assets liabilities required reserves $1, excess reserves $ customer loans $8, government securities (bonds) $7, building and fixtures $4, demand deposits $10, owner’s equity $10, calculate the required reserve ratio. explain how you got your. D, 9000. what is the answer to a? 10 percent. why did the money supply not change? cash and checkable deposits are part of m1. check all of the following that are tools for the federal reserve. reserve rate, discount rate, federal funds rate. study with quizlet and memorize flashcards containing terms like is a home loan an asset or a liability. 1. assume that the united states economy is currently in a short run equilibrium with the actual unemployment rate above the natural rate of unemployment. draw a single correctly labeled graph with both the long run phillips curve and short run phillips curve. label the current short run equilibrium point p.

Nb4 Bank Balance Sheet Ap Macro Youtube D, 9000. what is the answer to a? 10 percent. why did the money supply not change? cash and checkable deposits are part of m1. check all of the following that are tools for the federal reserve. reserve rate, discount rate, federal funds rate. study with quizlet and memorize flashcards containing terms like is a home loan an asset or a liability. 1. assume that the united states economy is currently in a short run equilibrium with the actual unemployment rate above the natural rate of unemployment. draw a single correctly labeled graph with both the long run phillips curve and short run phillips curve. label the current short run equilibrium point p.

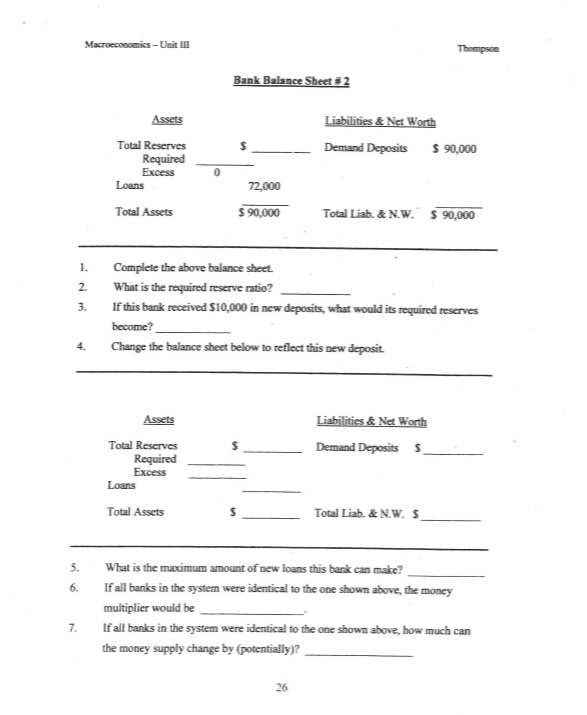

Solved Macroeconomics Unit In Bank Balance Sheet 2 Assets Chegg

Unit 4 Balance Sheet Practice Docx Unit 4 Bank Balance Sheet

Comments are closed.