Medicare Explained Medicare Supplement Plans ✅

Compare Medicare Supplement Plans In Your Area Medicare supplement insurance (medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out of pocket costs in. original medicare. a fee for service health insurance program that has 2 parts: part a and part b. you typically pay a portion of the costs for covered services as you get them. Medicare advantage is a type of private insurance that provides additional coverage to medicare part a and part b, including vision, hearing and dental coverage. most medicare advantage plans.

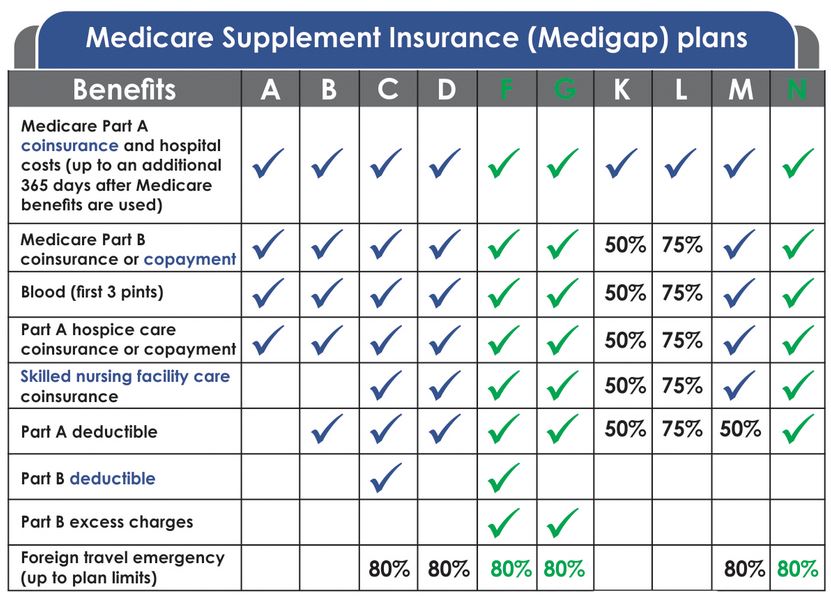

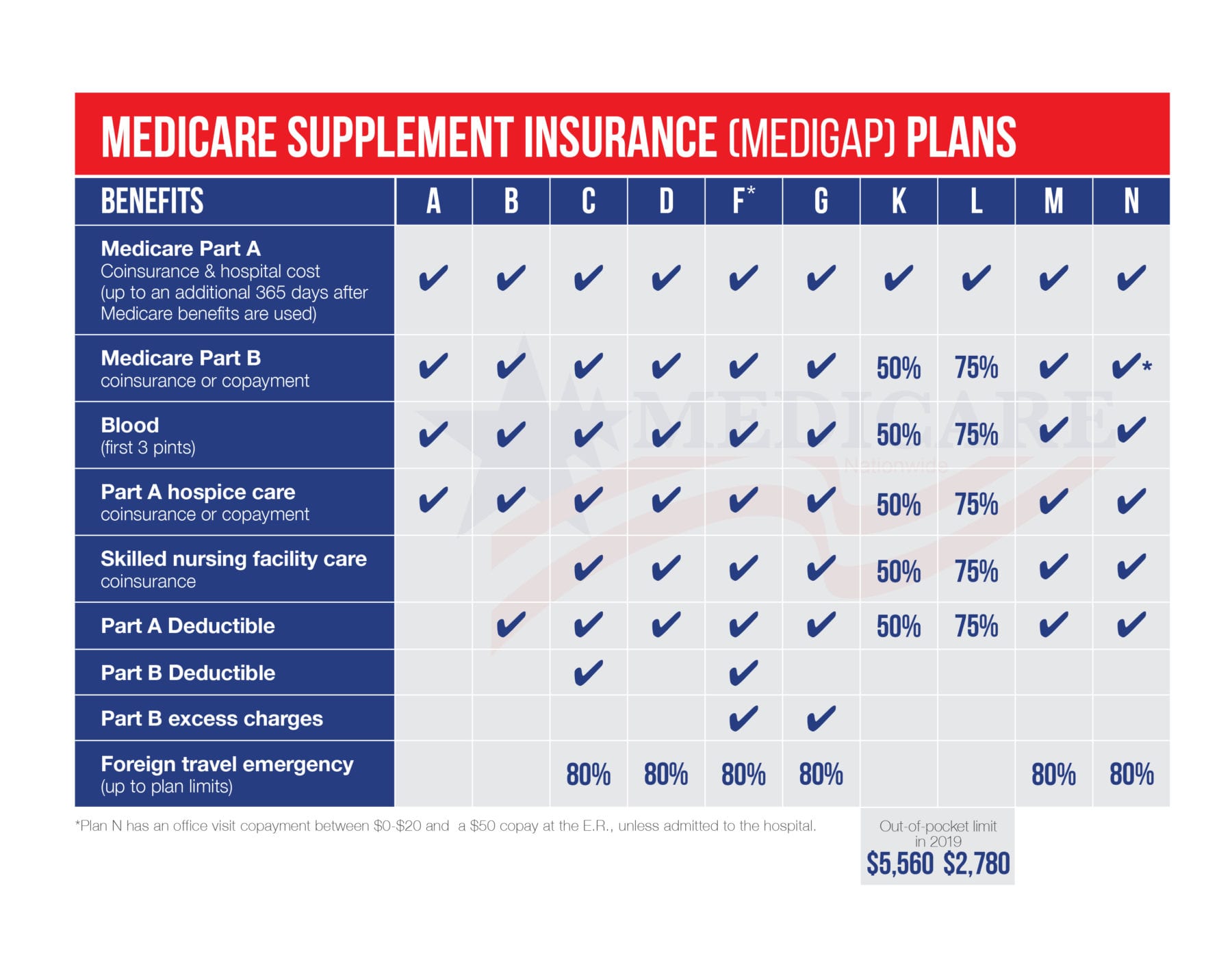

Standardized Medicare Supplement Plans Liberty Medicare Medigapseminars.org | call us at 800 847 9680medicare explained medicare supplement plans (all information valid for 2023) medigapsemi. Medigap, also known as medicare supplement insurance, is an insurance policy that supplements original medicare. it’s designed to cover some or all of the out of pocket costs that a beneficiary would otherwise have to pay for services covered by original medicare. original medicare does not have a cap on out of pocket costs, and most people. Medicare supplement plans work alongside your original medicare coverage to help cover some of the costs you would otherwise have to pay on your own. these plans, also known as "medigap", are standardized plans. each plan has a letter assigned to it, and offers the same basic benefits. the basic benefit structure for each plan is the same, no. Covers certain doctors’ services, outpatient care, medical supplies, and preventive services. before you can buy a medigap policy. you get a 6 month “medigap open enrollment” period, which starts the first month you have medicare part b and you’re 65 or older. during this time, you can enroll in any medigap policy and the insurance.

Best Medicare Supplement Plans Medicare Nationwide Medicare supplement plans work alongside your original medicare coverage to help cover some of the costs you would otherwise have to pay on your own. these plans, also known as "medigap", are standardized plans. each plan has a letter assigned to it, and offers the same basic benefits. the basic benefit structure for each plan is the same, no. Covers certain doctors’ services, outpatient care, medical supplies, and preventive services. before you can buy a medigap policy. you get a 6 month “medigap open enrollment” period, which starts the first month you have medicare part b and you’re 65 or older. during this time, you can enroll in any medigap policy and the insurance. Original medicare pays for many, but not all, health care services and supplies. medicare supplement insurance (medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out of pocket costs in original medicare, like copayments, coinsurance, and deductibles. if you have a medigap policy and get. Plan options from aetna, anthem, bcbs, cigna, humana, and more. licensed, experienced and dedicated medicare professionals are here to help you navigate your options. call 855 644 2121 to speak.

Comments are closed.