Medicare Supplement Plan F Not Worth It Anymore

Medicare Supplement Plan F Not Worth It Anymore Youtube Medigap plan f is no longer available for adults who turned 65 on or after jan. 1, 2020. however, you may still be able to enroll in plan f if it’s available in your state and zip code and you. Medicare supplement plan f is being phased out as a result of “the medicare access and chip reauthorization act of 2015”, also known as macra. as a result of macra, anybody who becomes eligible for medicare in 2020 will not be able to purchase plan f. this means that if you turn 65 on january 1st, 2020, or after, you will not be able to.

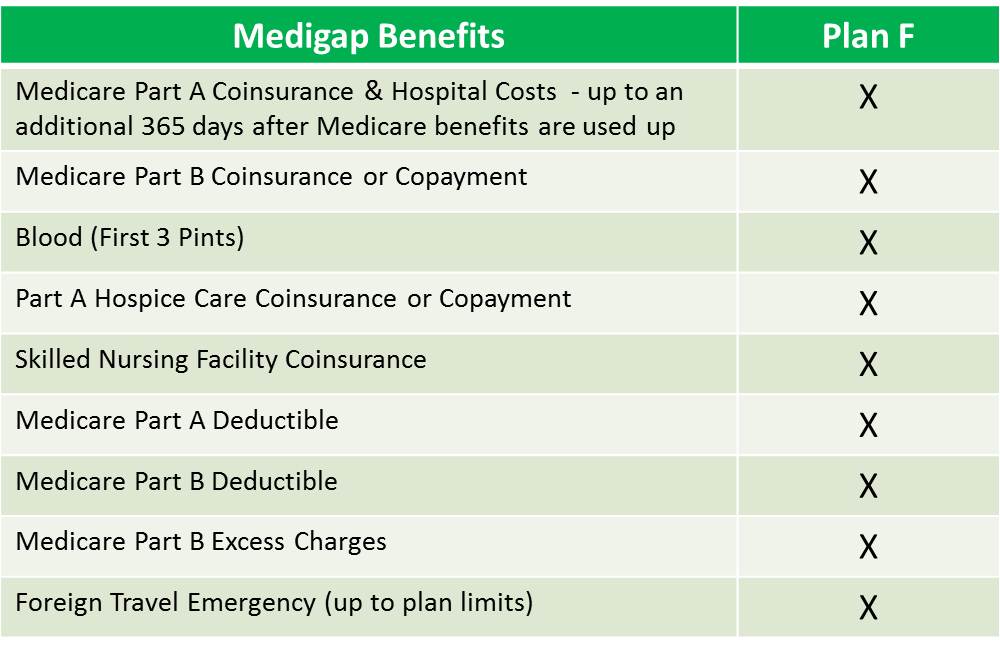

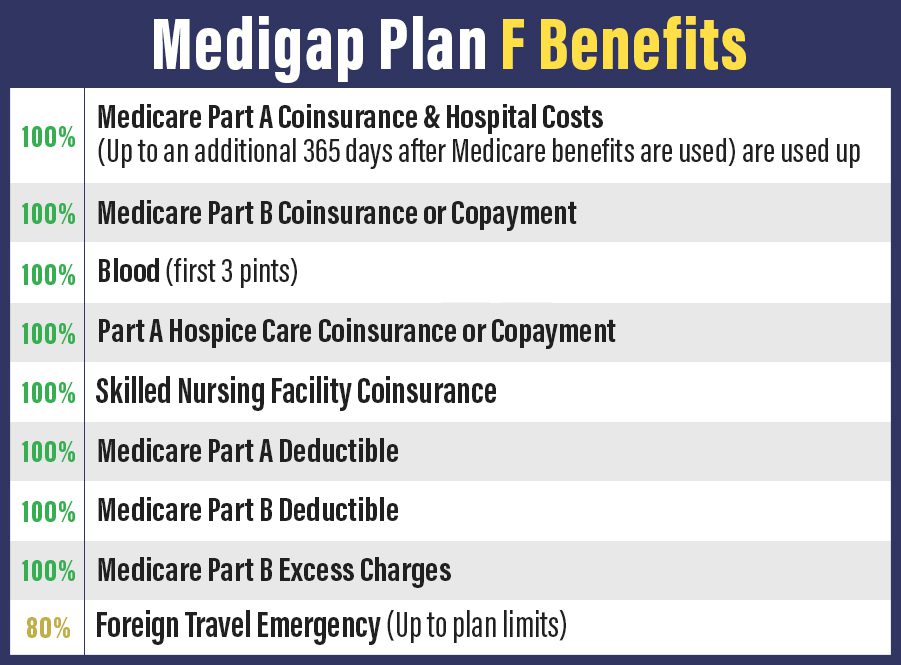

Medigap Plan F Medicare Supplement Plan F 65medicare Org Call 844 363 8979 (tty 711) in northeast wisconsin. from oct. 1 through march 31, we take calls 8 a.m. to 8 p.m. ct, seven days a week. from april 1 through sept. 30, we take calls 8 a.m. to 8 p.m. ct, monday – friday. medicare plan f was phased out in 2020. Simplicity: plan f covers most out of pocket costs for medicare part a and part b, so you don’t need to worry much about copays, coinsurance and deductibles. cons. cost: plan f premiums can get. Only plan k and plan l have out of pocket limits in 2021. these limits are $6,220 for plan k and $3,110 for plan l. in some states, a person enrolled in plan f could have a high deductible plan. This new rule affected medigap plans that cover the part b deductible, including plan f. this means that, as of january 2020, plan f is no longer an option for people who enroll in medicare. if.

Medigap Plan F Tupelo Ms Bobby Brock Insurance Only plan k and plan l have out of pocket limits in 2021. these limits are $6,220 for plan k and $3,110 for plan l. in some states, a person enrolled in plan f could have a high deductible plan. This new rule affected medigap plans that cover the part b deductible, including plan f. this means that, as of january 2020, plan f is no longer an option for people who enroll in medicare. if. Medicare supplement plan f is a specific type of medicare supplement plan. medicare supplement (also called medigap) insurance may help pay for medicare part a and part b out of pocket costs. these costs might include coinsurance, copayments, or (in some cases) deductibles. please note: medicare part a and part b make up the federal government. However, the reason for the higher premium is that this plan provides the highest level of benefits to enrollees. the plan’s average cost is about $230 per month. however, many factors impact the premium price. premium costs for medigap plan f can range from around $150 $400 per month or more.

Comments are closed.