Medicare Supplement Plan F Vs Plan G Vs Plan N

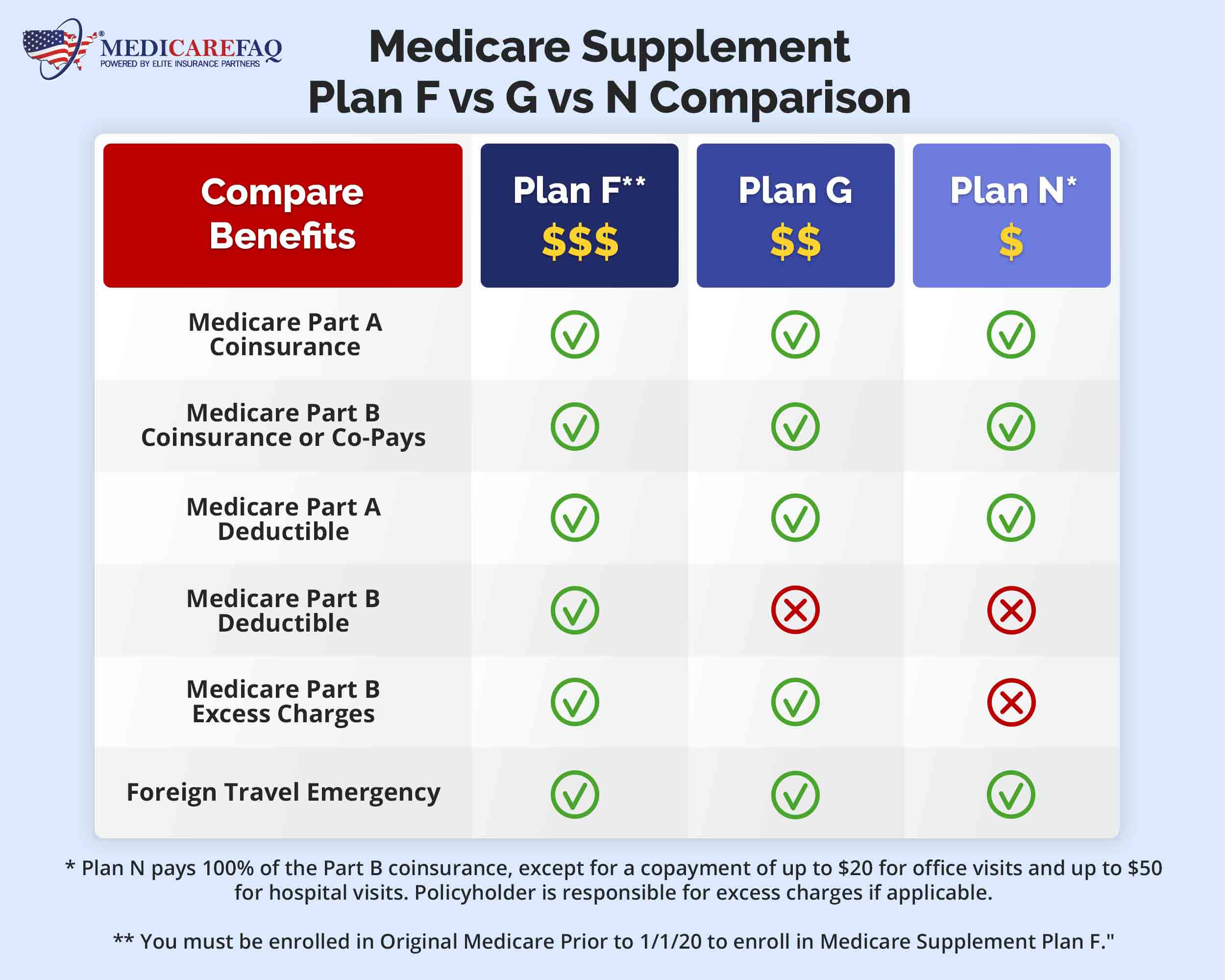

Medicare Supplement Medigap Plan F Vs Plan G Vs Plan N Medicare plan f vs. g vs. n: deductibles. the other major difference to consider when comparing plans f, g and n is that plan f covers the annual part b deductible of $240, but plans g and n don. Before the plan begins to pay. as of january 1, 2020, new medicare enrollees are not eligible for plan c or plan f. if you were eligible for medicare before january 1, 2020, but did not enroll, you may still be eligible. plan n pays 100% of the part b coinsurance except for copays of up to $20 for doctor visits and up to $50 copay for emergency.

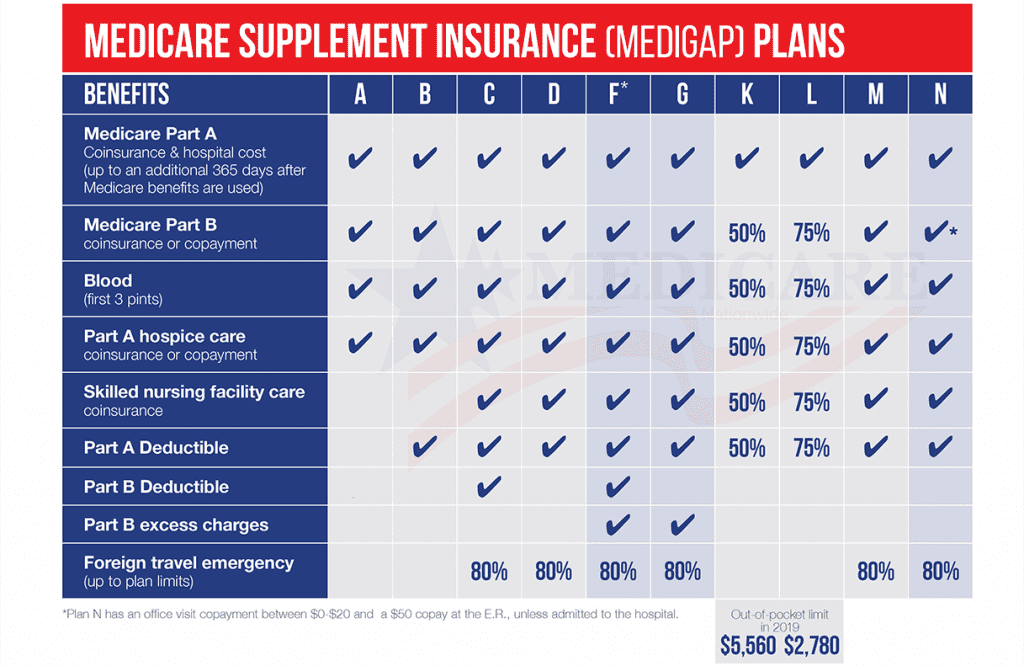

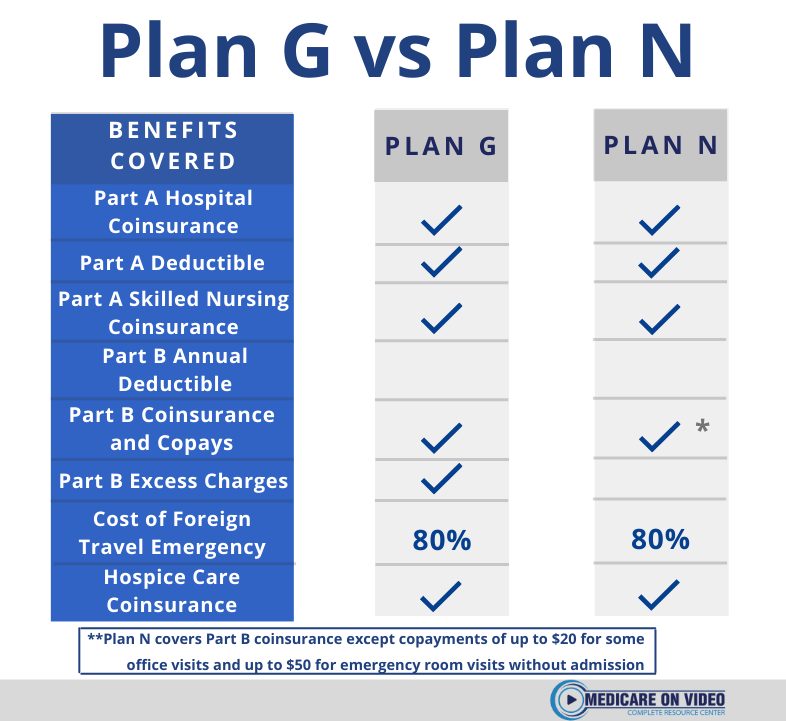

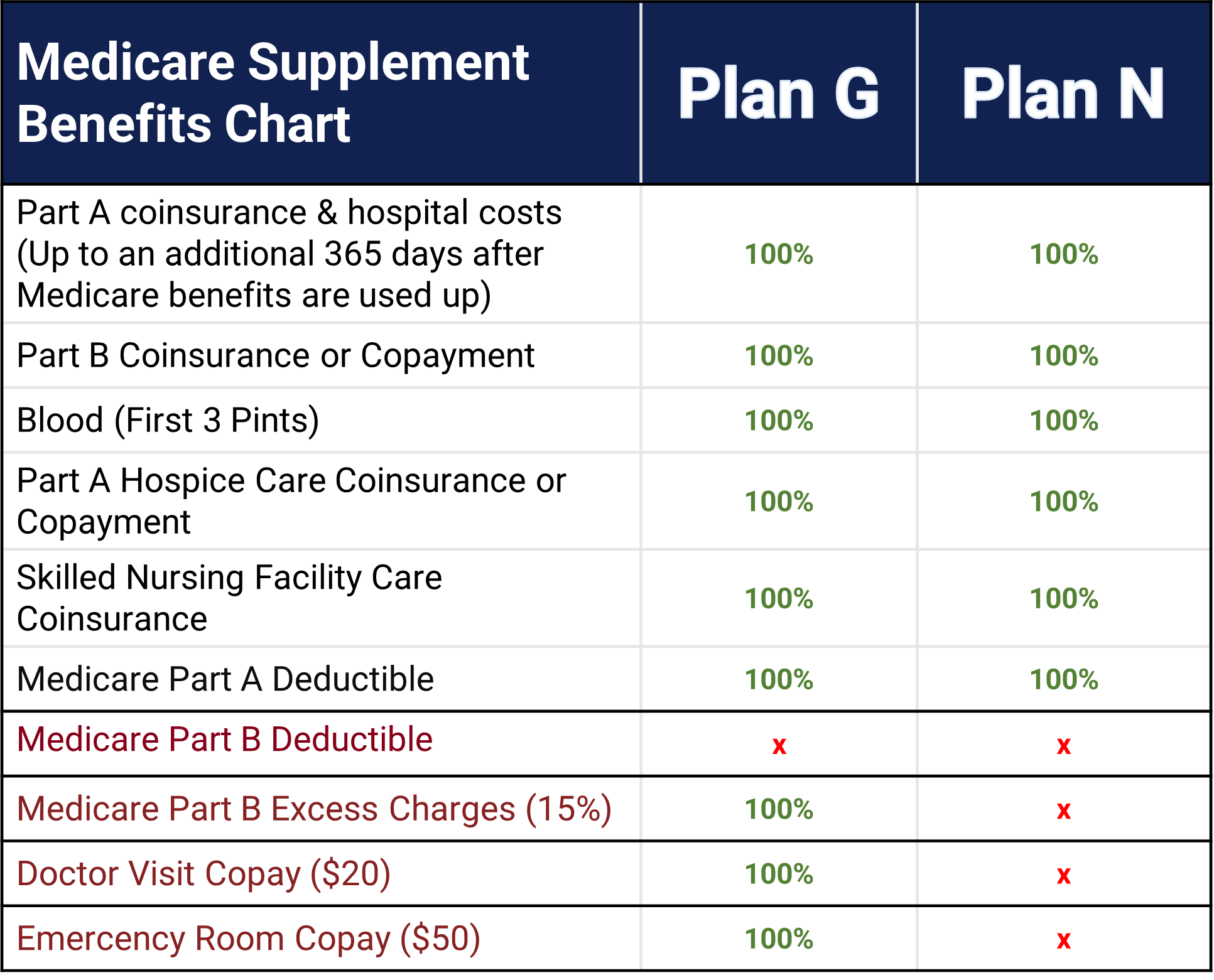

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Medigap plan n covers a bit less, but its premiums are lower, too. the biggest difference between medigap plan g and medigap plan n is that plan n has copays for certain medical office and. The main difference between the two plans is how plan g interacts with the part b deductible. with plan f, the medicare supplement plan pays for the part b deductible. under plan g, you are responsible for the part b deductible only. otherwise, all part a deductibles, copays, and coinsurance are covered. under part b, after the deductible, the. 1 plans f and g offer high deductible plans that each have an annual deductible of $2,800 in 2024. once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. the high deductible plan f is not available to new beneficiaries who became eligible for medicare on or after january 1, 2020. N a. $7,060 in 2024. $3,530 in 2024. n a. n a. note: plan c & plan f aren’t available if you turned 65 on or after january 1, 2020, and to some people under age 65. you might be able to get these plans if you were eligible for medicare before january 1, 2020, but not yet enrolled. learn more about who can buy this plan.

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide 1 plans f and g offer high deductible plans that each have an annual deductible of $2,800 in 2024. once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. the high deductible plan f is not available to new beneficiaries who became eligible for medicare on or after january 1, 2020. N a. $7,060 in 2024. $3,530 in 2024. n a. n a. note: plan c & plan f aren’t available if you turned 65 on or after january 1, 2020, and to some people under age 65. you might be able to get these plans if you were eligible for medicare before january 1, 2020, but not yet enrolled. learn more about who can buy this plan. These include: plan g covers part b excess charges, while plan n does not. plan g covers 100% of the costs of services you receive under medicare part b, while plan n covers these costs except for. For a comprehensive comparison of all medicare supplement plans, including detailed information about coverage and benefits, refer to the full plan comparison chart below. medigap benefits. plan f. plan g. plan n. part a coinsurance and hospital costs up to an additional 365 days after medicare benefits are used up. .

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide These include: plan g covers part b excess charges, while plan n does not. plan g covers 100% of the costs of services you receive under medicare part b, while plan n covers these costs except for. For a comprehensive comparison of all medicare supplement plans, including detailed information about coverage and benefits, refer to the full plan comparison chart below. medigap benefits. plan f. plan g. plan n. part a coinsurance and hospital costs up to an additional 365 days after medicare benefits are used up. .

Medicare Plan G Vs Plan N Which Is Right Plan For You In 2021

Medicare Plan G Vs Plan N Medicare Hero

Comments are closed.