Medicare Supplement Plan G How To Save Money On Medicare Medigap

Medicare Supplement Plan G For 2023 Medigap Medigap plan g and plan n are the two most popular medicare supplement insurance plans available for new medicare members. plan n covers a little less than plan g, but it generally has lower premiums. Cons. the downside of high deductible plan g can, of course, be your upfront cost before you receive help with out of pocket expenses. assuming you have this high deductible medigap plan and receive a medicare part b covered service, you’ll be responsible for the part b deductible, which is $240 in 2024. then medicare will pay 80% of covered.

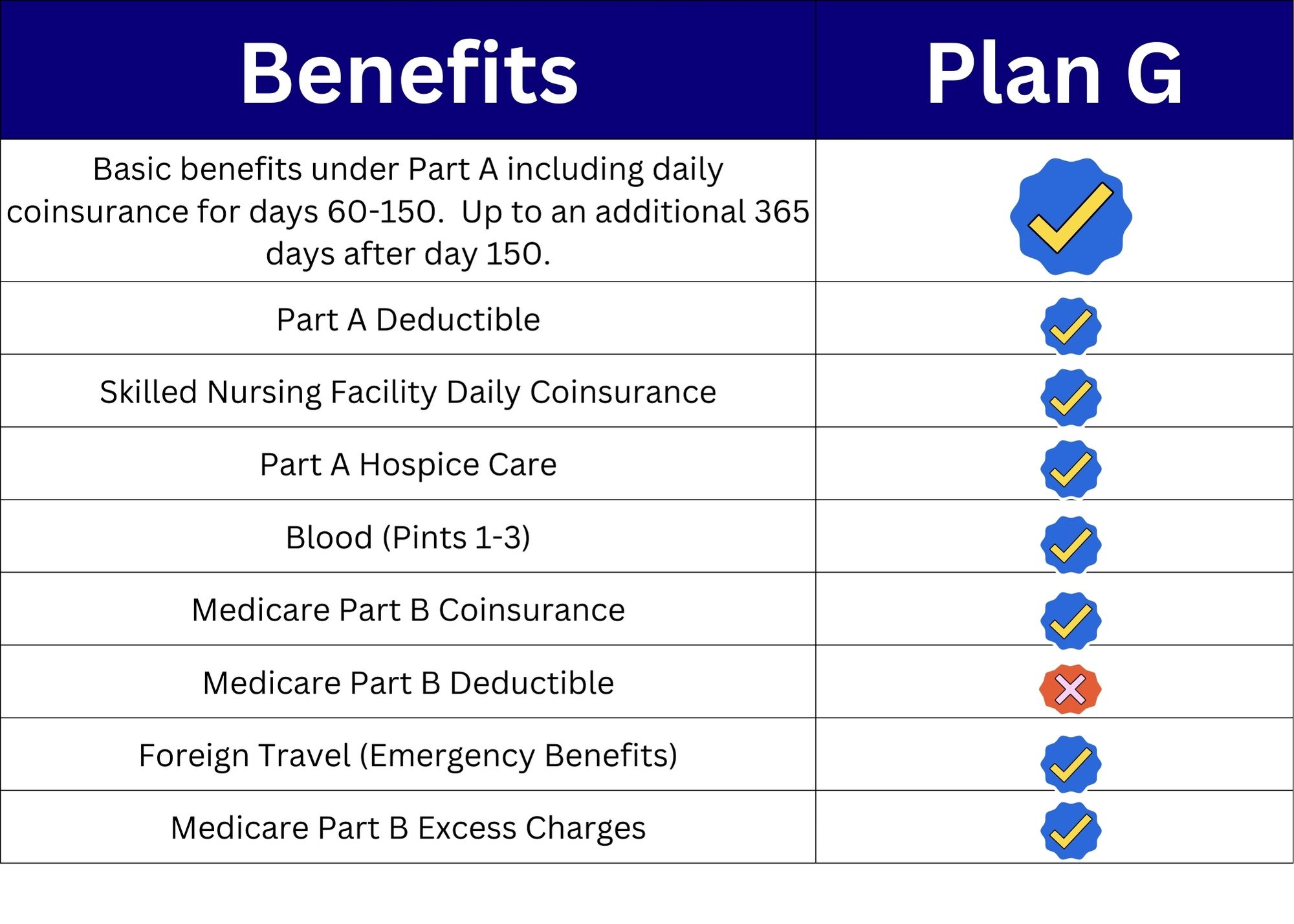

Medicare Supplement Plan G For 2023 Medigap Benefits for high deductible medigap plans kick in after a deductible of $2,800 in 2024. divided over 12 months, that’s $233.33 per month. a high deductible plan would need to have premiums at. Best medicare supplement plans and providers of 2024. best nationwide coverage: bluecross blueshield. best additional plan benefits: humana. best membership perks: aarp by unitedhealthcare. best. Plan g covers nearly all costs not covered by original medicare, including: part a coinsurance and hospital costs up to an additional 365 days after a person uses all their medicare benefits. part. Medicare supplement plan g covers: part a coinsurance and hospital costs up to an additional 365 days after medicare benefits run out. part a deductible ($1,632 in 2024) part a hospice care coinsurance or copayment. part b coinsurance or copayment. part b excess charges. blood (the first three pints needed for a transfusion).

Medicare Supplement Plan G How To Save Money On Medicare Medigap Plan g covers nearly all costs not covered by original medicare, including: part a coinsurance and hospital costs up to an additional 365 days after a person uses all their medicare benefits. part. Medicare supplement plan g covers: part a coinsurance and hospital costs up to an additional 365 days after medicare benefits run out. part a deductible ($1,632 in 2024) part a hospice care coinsurance or copayment. part b coinsurance or copayment. part b excess charges. blood (the first three pints needed for a transfusion). Medicare supplement plan g helps keep your out of pocket costs as low as possible. benefits of medicare supplement plan g include: 100% coverage for medicare part a deductible. 100% coverage for hospice copayments and coinsurance. additional foreign travel emergency benefits. 100% coverage for medicare part b excess charges. The average medigap plan g premium in 2023 was $135 per month. the only benefit not covered by plan g — the annual medicare part b deductible — costs just $240 per year in 2024 ($20 per month). beneficiaries who have a choice between plan g and plan f may benefit from choosing plan g if the cost of the plan is at least $20 lower per month.

Start Saving With Aetna S Senior Products Plan G Medicare supplement plan g helps keep your out of pocket costs as low as possible. benefits of medicare supplement plan g include: 100% coverage for medicare part a deductible. 100% coverage for hospice copayments and coinsurance. additional foreign travel emergency benefits. 100% coverage for medicare part b excess charges. The average medigap plan g premium in 2023 was $135 per month. the only benefit not covered by plan g — the annual medicare part b deductible — costs just $240 per year in 2024 ($20 per month). beneficiaries who have a choice between plan g and plan f may benefit from choosing plan g if the cost of the plan is at least $20 lower per month.

Comments are closed.