Medicare Supplement Plan G Vs Plan N 2024 Update

Medicare Plan N 2024 Fancy Claretta This brief video outlines some of the key differences between medicare supplement plan g and plan n. overview of key medicare supplement characteristics di. Plan g vs plan n cost. the average monthly premium for plan g was $135 in 2023, while the average plan n premium was $110 per month. 2. typically, plan g has higher monthly premiums than plan n due to its more extensive coverage. but plan n may lead to more out of pocket expenses due to copayments and potential excess charges.

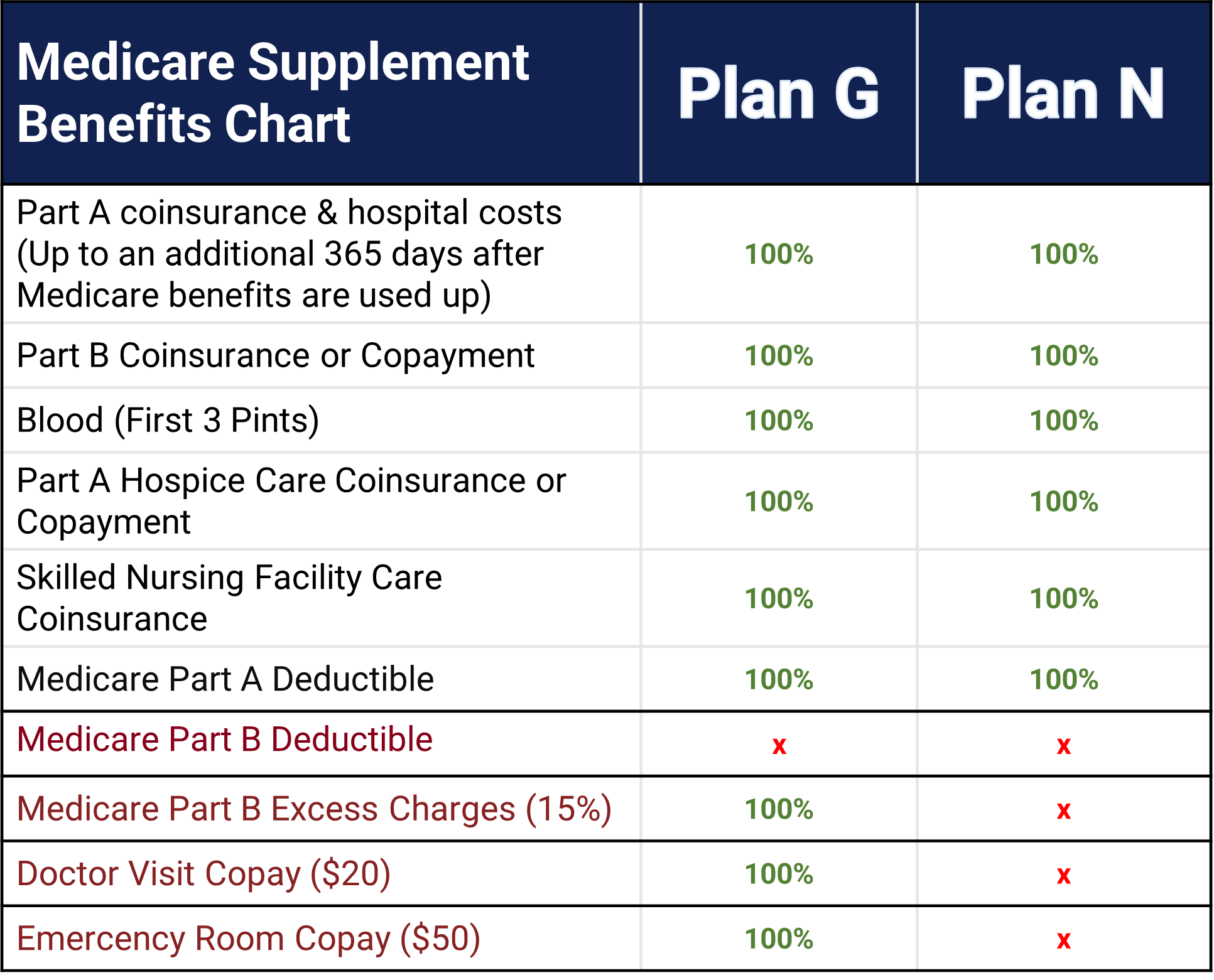

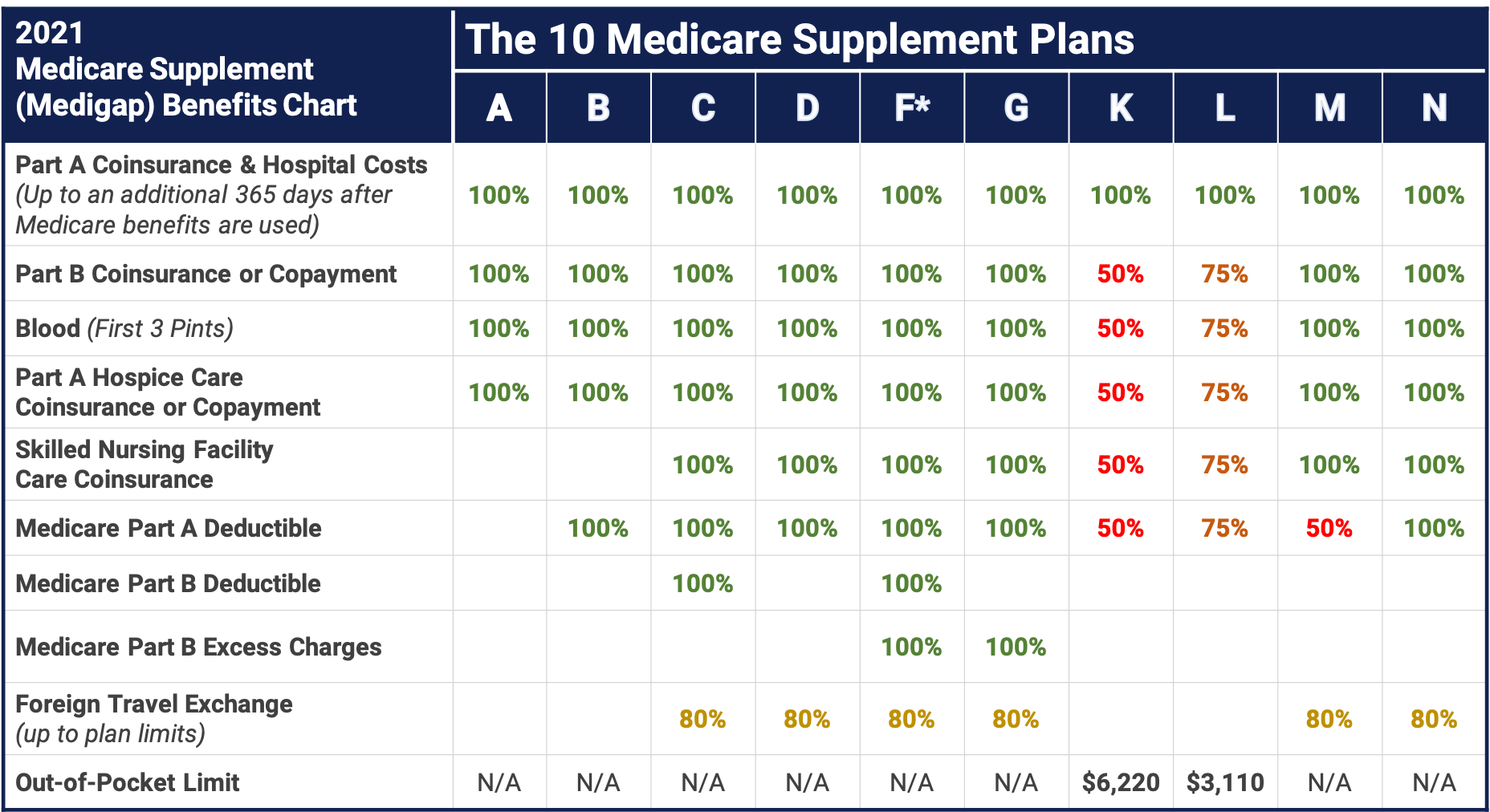

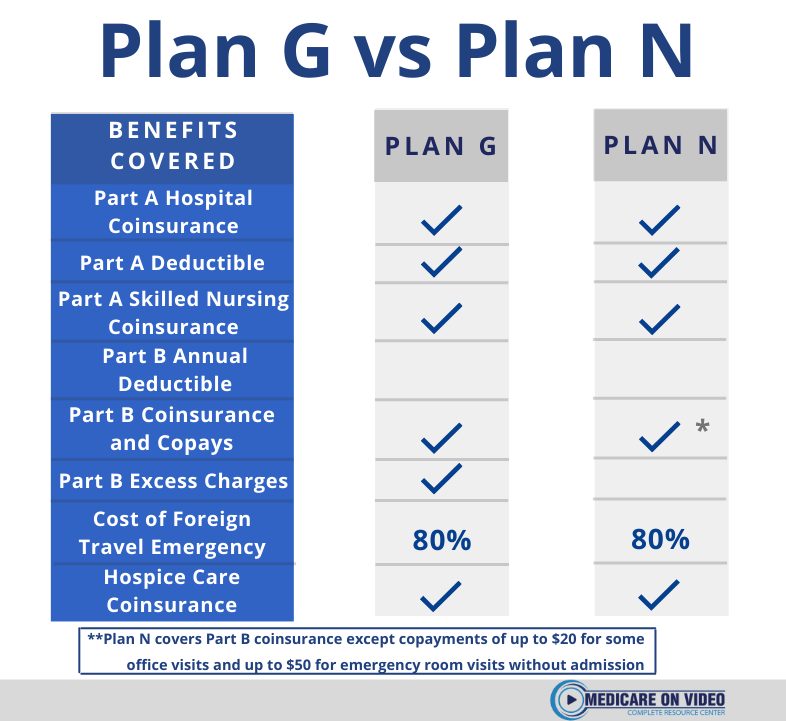

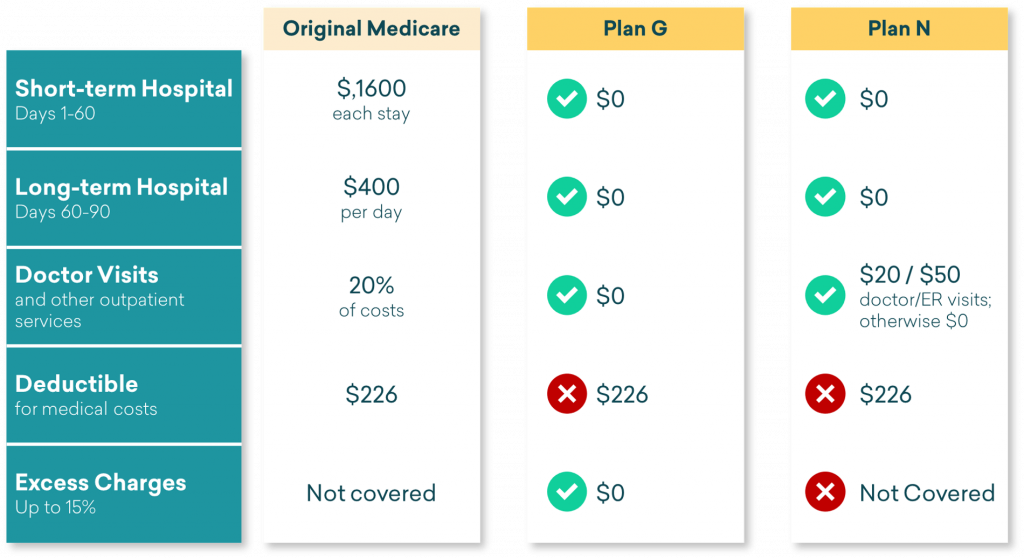

Medicare Plan G Vs Plan N Medicare Hero Medicare plan f vs. g vs. n: deductibles. the other major difference to consider when comparing plans f, g and n is that plan f covers the annual part b deductible of $240, but plans g and n don. The biggest difference between medigap plan g and medigap plan n is that plan n has copays for certain medical office and emergency department visits, whereas plan g doesn’t. if you wouldn’t. These include: plan g covers part b excess charges, while plan n does not. plan g covers 100% of the costs of services you receive under medicare part b, while plan n covers these costs except for. Medicare supplement plan g is the highest coverage plan available for new medicare members. which provides the same benefits after a deductible of $2,800 in 2024 is paid. monthly premiums for.

Medicare Plan G Vs Plan N Which Is Right Plan For You In 2021 These include: plan g covers part b excess charges, while plan n does not. plan g covers 100% of the costs of services you receive under medicare part b, while plan n covers these costs except for. Medicare supplement plan g is the highest coverage plan available for new medicare members. which provides the same benefits after a deductible of $2,800 in 2024 is paid. monthly premiums for. When you are admitted for inpatient hospital care, you are required to meet a part a deductible, which is $1,632 per benefit period in 2024. you could potentially have to pay the part a deductible more than one time in a single year. medigap plan n covers your deductible in full for each benefit period you require. Medicare supplement plan g covers: part a coinsurance and hospital costs up to an additional 365 days after medicare benefits run out. part a deductible ($1,632 in 2024) part a hospice care coinsurance or copayment. part b coinsurance or copayment. part b excess charges. blood (the first three pints needed for a transfusion).

Exploring The Pros And Cons Of Medicare Supplement Plan N Coverright When you are admitted for inpatient hospital care, you are required to meet a part a deductible, which is $1,632 per benefit period in 2024. you could potentially have to pay the part a deductible more than one time in a single year. medigap plan n covers your deductible in full for each benefit period you require. Medicare supplement plan g covers: part a coinsurance and hospital costs up to an additional 365 days after medicare benefits run out. part a deductible ($1,632 in 2024) part a hospice care coinsurance or copayment. part b coinsurance or copayment. part b excess charges. blood (the first three pints needed for a transfusion).

Comments are closed.