Medicare Supplement Plan N Vs Plan G Which Is Best Remedigap

Medicare Plan G Vs Plan N Which Is Right Plan For You In 2021 Not only are there differences in coverage between these 2 plans, but the cost of these policies have shown a tendency to vary as well.in some cases by a significant amount. premiums for these plans will vary by the medigap company that sells it. plan g may have higher monthly premiums than plan n. Medigap plan g is the most comprehensive medicare supplement insurance plan that’s available for purchase by all medicare members. medigap plan n covers a bit less, but its premiums are lower, too.

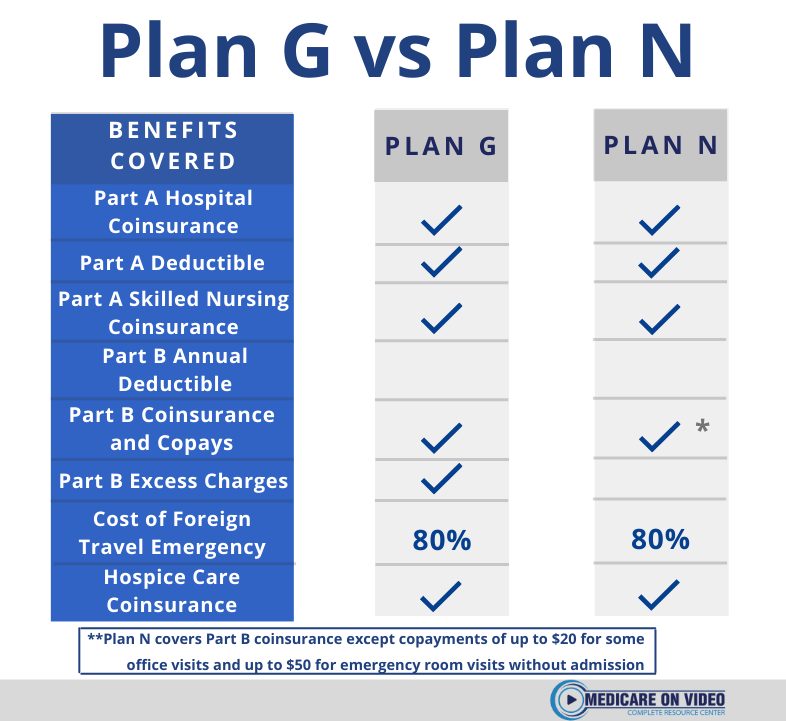

Medicare Plan G Vs Plan N Which Plan Is Best Medicare Hero Medigap plan g and plan n are the two most popular medicare supplement insurance plans available for new medicare members. plan n covers a little less than plan g, but it generally has lower premiums. These include: plan g covers part b excess charges, while plan n does not. plan g covers 100% of the costs of services you receive under medicare part b, while plan n covers these costs except for. Medicare plan f vs. g vs. n: deductibles. the other major difference to consider when comparing plans f, g and n is that plan f covers the annual part b deductible of $240, but plans g and n don. Plan g vs plan n cost. the average monthly premium for plan g was $135 in 2023, while the average plan n premium was $110 per month. 2. typically, plan g has higher monthly premiums than plan n due to its more extensive coverage. but plan n may lead to more out of pocket expenses due to copayments and potential excess charges.

Medicare Supplement Plan N For 2022 Best Medigap Plan N Medicare plan f vs. g vs. n: deductibles. the other major difference to consider when comparing plans f, g and n is that plan f covers the annual part b deductible of $240, but plans g and n don. Plan g vs plan n cost. the average monthly premium for plan g was $135 in 2023, while the average plan n premium was $110 per month. 2. typically, plan g has higher monthly premiums than plan n due to its more extensive coverage. but plan n may lead to more out of pocket expenses due to copayments and potential excess charges. Best overall: aarp unitedhealthcare medicare supplement insurance. best for additional coverage options: anthem medicare supplement insurance. best for high deductible medigap plan g: mutual of. Best medicare supplement plans and providers of 2024. best nationwide coverage: bluecross blueshield. best additional plan benefits: humana. best membership perks: aarp by unitedhealthcare. best.

Comments are closed.