Medicare Supplement Plans Explained Medigapseminars

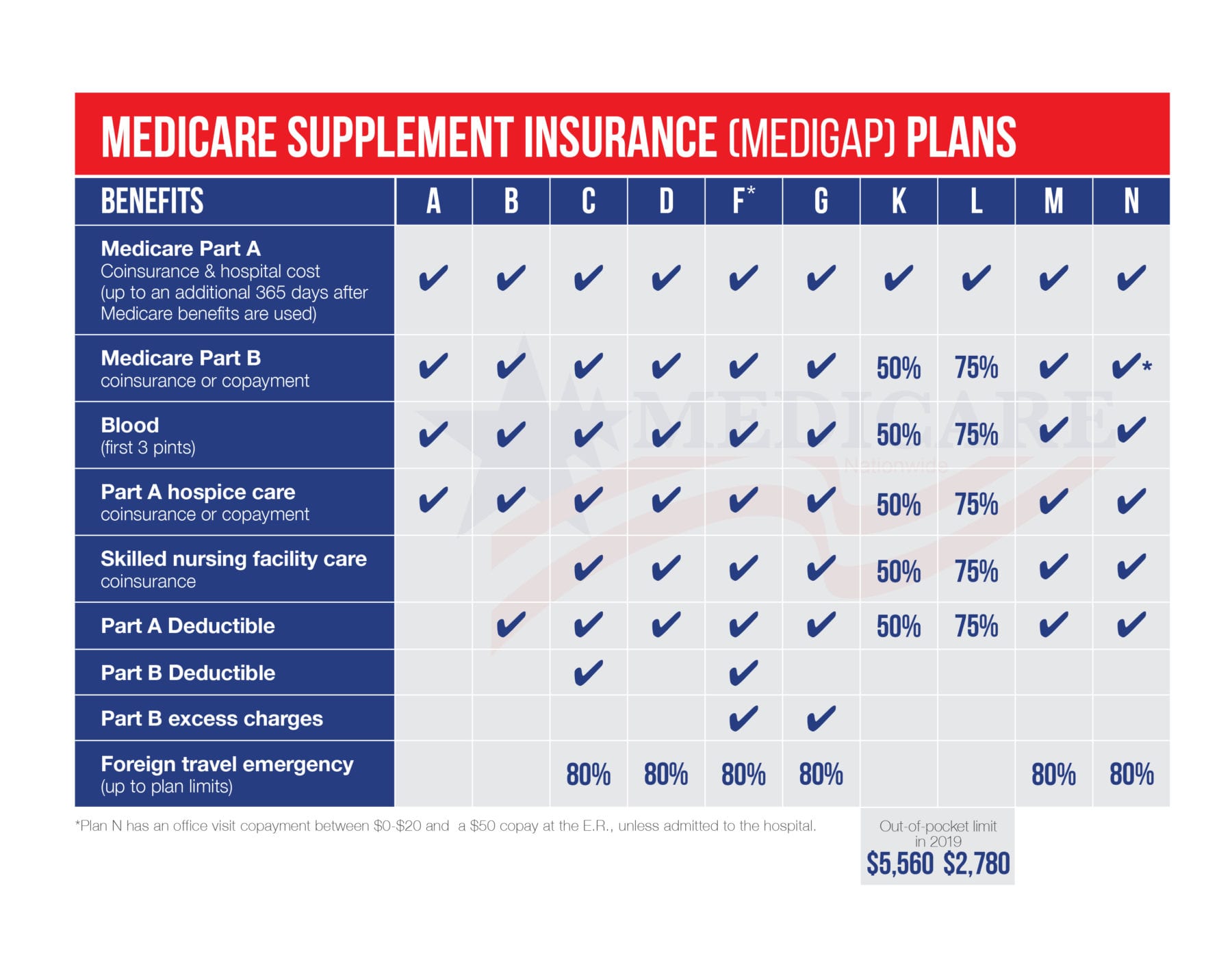

Medicare Supplement Plans Explained Medigapseminars Excess fees can be up to 15% more than medicare’s assigned rates. so, in choosing a medicare supplement plan you need to ask yourself how much insurance you want, and how much you can afford. the medicare supplement plan that is right for you is the one that fits both your needs and your budget. Medicare supplement plans are insurance plans that pay the deductibles, coinsurance and copays of original medicare government health insurance program. it is insurance in addition to original medicare. original medicare is your primary insurance with the supplement as secondary.

Best Medicare Supplement Plans Medicare Nationwide An independent medicare broker is an independent agent that specializes in helping people enroll in medicare and works with all the major insurance companies. a broker can help you understand your options and enroll in the plan that best meets your budget and your needs. they work in your best interest. we often interchange the term independent. This video is made for anyone turning 65 within the next two years. if you will soon be new to medicare, this is where you start your journey.medicare expla. Medigap, also known as medicare supplement insurance, is an insurance policy that supplements original medicare. it’s designed to cover some or all of the out of pocket costs that a beneficiary would otherwise have to pay for services covered by original medicare. original medicare does not have a cap on out of pocket costs, and most people. Medicare advantage is a type of private insurance that provides additional coverage to medicare part a and part b, including vision, hearing and dental coverage. most medicare advantage plans.

Medicare Supplement Plans Explained Medigapseminars Medigap, also known as medicare supplement insurance, is an insurance policy that supplements original medicare. it’s designed to cover some or all of the out of pocket costs that a beneficiary would otherwise have to pay for services covered by original medicare. original medicare does not have a cap on out of pocket costs, and most people. Medicare advantage is a type of private insurance that provides additional coverage to medicare part a and part b, including vision, hearing and dental coverage. most medicare advantage plans. Medicare supplement insurance (medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out of pocket costs in. original medicare. a fee for service health insurance program that has 2 parts: part a and part b. you typically pay a portion of the costs for covered services as you get them. Plan g covers nearly all costs not covered by original medicare, including: part a coinsurance and hospital costs up to an additional 365 days after a person uses all their medicare benefits. part.

Medicare Supplement Plans Medigap Plan Pros Cons Medicare Medicare supplement insurance (medigap) is extra insurance you can buy from a private health insurance company to help pay your share of out of pocket costs in. original medicare. a fee for service health insurance program that has 2 parts: part a and part b. you typically pay a portion of the costs for covered services as you get them. Plan g covers nearly all costs not covered by original medicare, including: part a coinsurance and hospital costs up to an additional 365 days after a person uses all their medicare benefits. part.

High Deductible Medicare Supplement Plans Medigapseminars

Comments are closed.