Medigap Plan F Medicare Supplement Plan F 65medicare Org

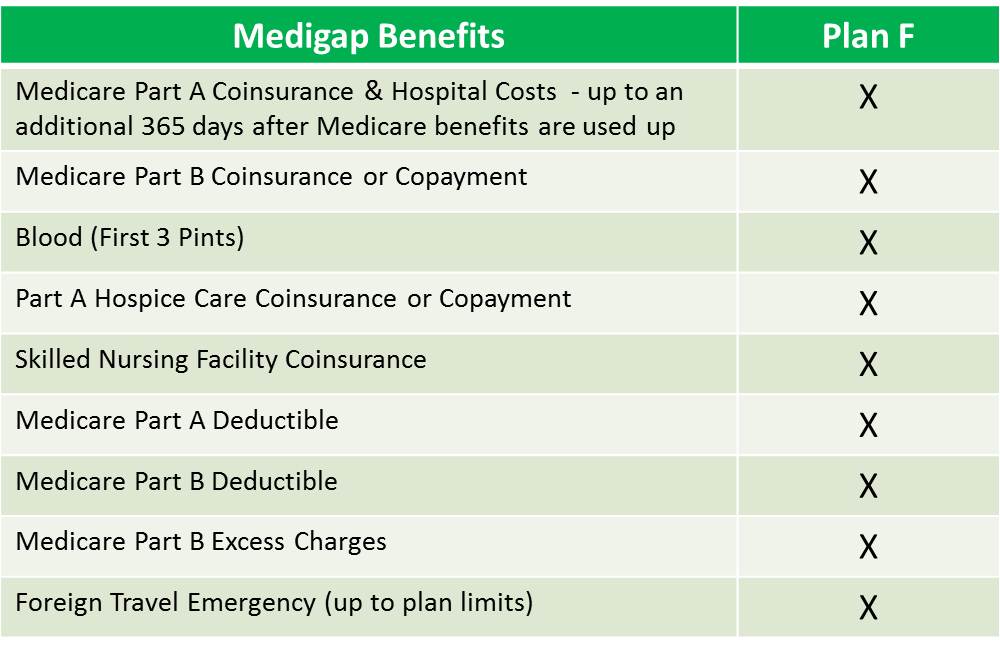

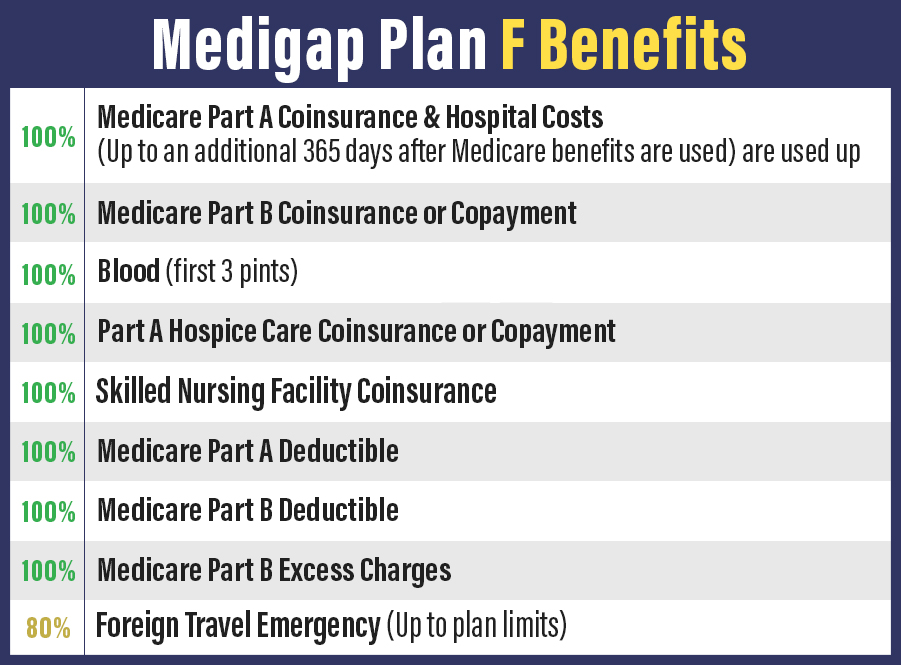

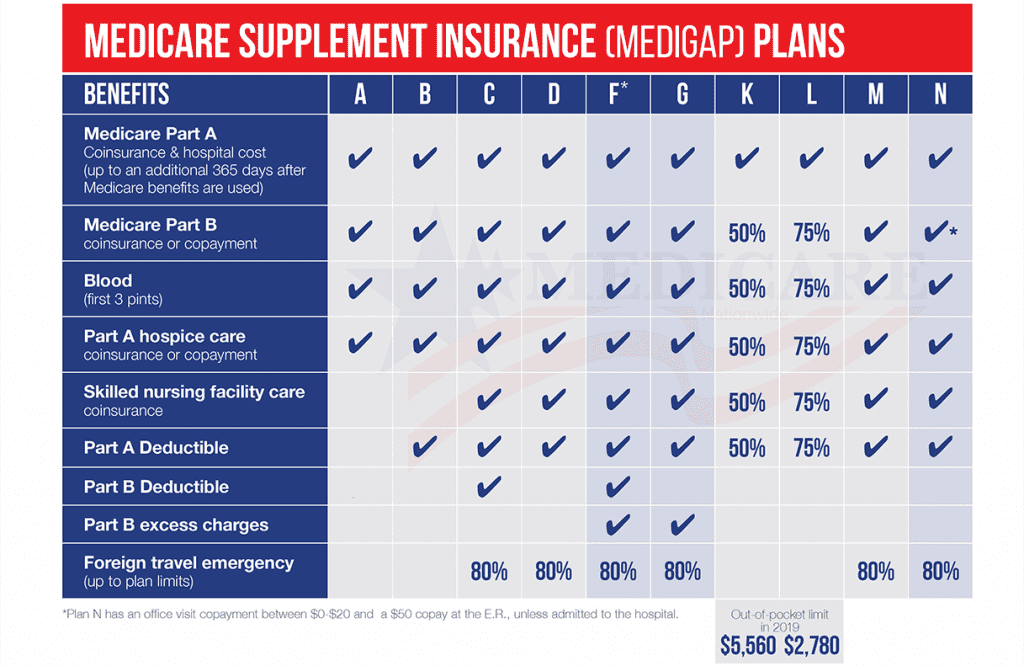

Medigap Plan F Medicare Supplement Plan F 65medicare Org To get more information about medigap plan f or a list of companies and rates for your area, please feel free to contact us or call us at 877.506.3378. medigap plan f is the most common and comprehensive medigap plan. plan f fills in all the "gaps" in original medicare, but may not be the best deal for you. Medigap plan f covers many of the out of pocket expenses that original medicare does not, including the following benefits: 100% coverage of the first 3 pints of blood for a transfusion. 100% coverage of part a’s coinsurance or copayment for hospice care. 100% coverage of the coinsurance at a skilled nursing facility.

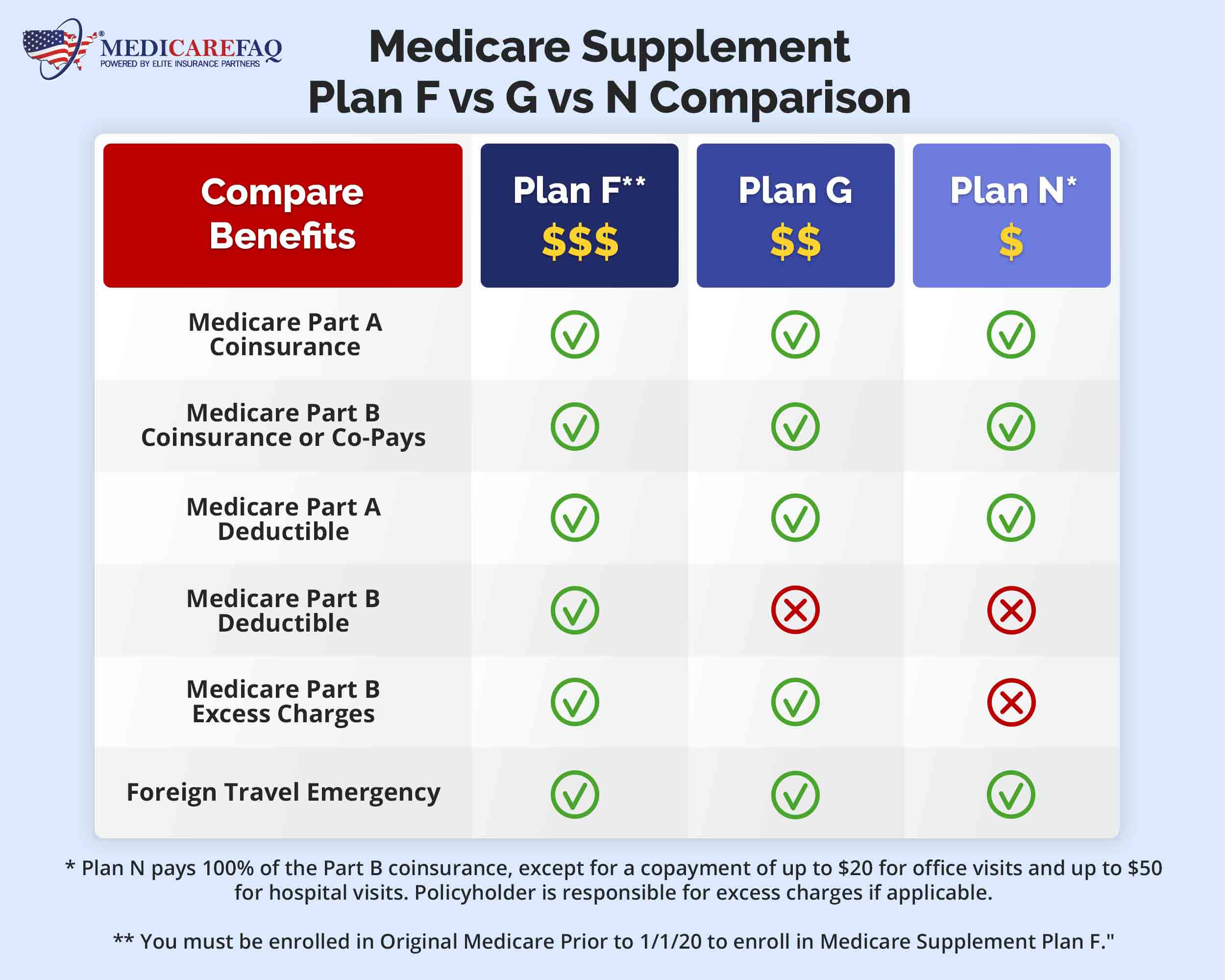

Medicare Supplement Medigap Plan F Benefits And Coverage Medigap plan f is no longer available for adults who turned 65 on or after jan. 1, 2020. however, you may still be able to enroll in plan f if it’s available in your state and zip code and you. Plan g is almost identical to plan f, with only one exception. that exception is that plan g does not cover the medicare part b deductible. for 2024, the medicare part b deductible is $240 year. all other benefits are identical to plan f. the only out of pocket cost you would face under plan g would be the $240 year part b deductible. No, it is not available to those turning 65 now. if you enrolled in a plan f prior to 1 1 2020, you are “grandfathered in” and you can keep your plan f – it is just not available to those newly eligible for medicare after 1 1 2020. although you may have plan f and be “grandfathered in” to keep it indefinitely if you signed up before 1. Simplicity: plan f covers most out of pocket costs for medicare part a and part b, so you don’t need to worry much about copays, coinsurance and deductibles. cons. cost: plan f premiums can get.

Medigap Plan F Strickland Insurance Financial Group No, it is not available to those turning 65 now. if you enrolled in a plan f prior to 1 1 2020, you are “grandfathered in” and you can keep your plan f – it is just not available to those newly eligible for medicare after 1 1 2020. although you may have plan f and be “grandfathered in” to keep it indefinitely if you signed up before 1. Simplicity: plan f covers most out of pocket costs for medicare part a and part b, so you don’t need to worry much about copays, coinsurance and deductibles. cons. cost: plan f premiums can get. Discover why plan f may be a good fit. plan with most comprehensive coverage. covers part a and part b deductibles (total $1,872 in 2024) comes with wellness extra services and discounts for dental, hearing, vision, and a gym membership 10. see any doctor and visit any hospital that accepts medicare patients. This coverage picks up all the costs original medicare leaves for you to pay. in addition to these costs, medicare supplement plan f also includes foreign travel emergency coverage. medicare supplement plan f will cover a lifetime limit of $50,000 of emergency foreign travel coverage after a $250 deductible.

Medicare Supplement Plan F In 2023 Medigap Discover why plan f may be a good fit. plan with most comprehensive coverage. covers part a and part b deductibles (total $1,872 in 2024) comes with wellness extra services and discounts for dental, hearing, vision, and a gym membership 10. see any doctor and visit any hospital that accepts medicare patients. This coverage picks up all the costs original medicare leaves for you to pay. in addition to these costs, medicare supplement plan f also includes foreign travel emergency coverage. medicare supplement plan f will cover a lifetime limit of $50,000 of emergency foreign travel coverage after a $250 deductible.

Medicare Supplement Medigap Plan F Benefits And Coverage

Medicare Supplement Medigap Plan F Benefits And Coverage

Comments are closed.