Mortgage 101 7 Things Not To Do After Applying For A Mortgage Ho

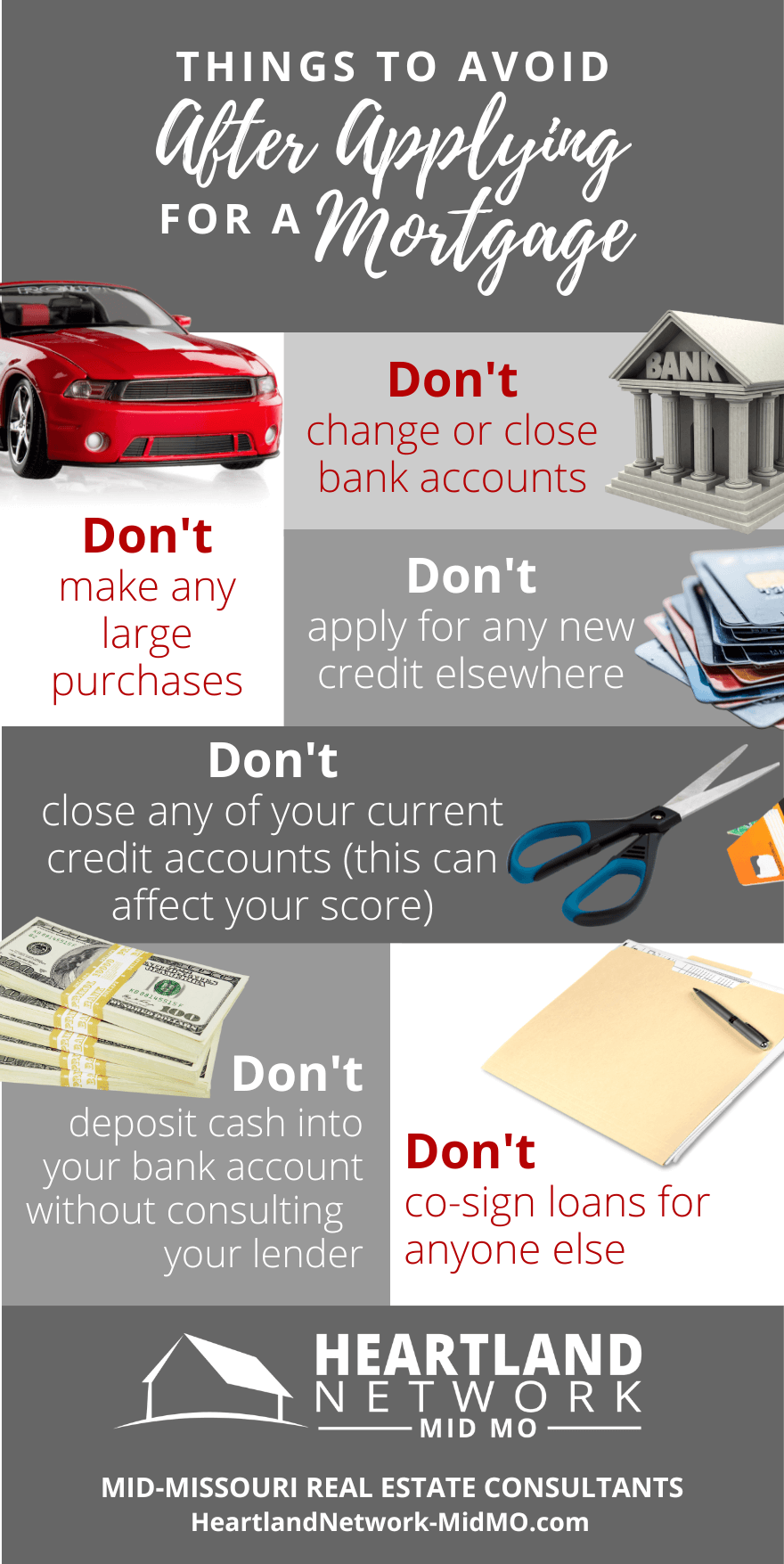

Things You Shouldn T Do After Applying For A Mortgage Infographic At this point, you probably know the list of things to do and not to do before applying for a mortgage. there are also certain actions involving your credit, finances and employment which can affect your credit score and which should wait until after closing on your mortgage. avoid making the following seven mistakes between application and. Below is a list of things you shouldn’t do after applying for a mortgage. they’re all important to know – or simply just good reminders – for the process. 1. don’t deposit cash into your bank accounts before speaking with your bank or lender. lenders need to source your money, and cash is not easily traceable.

Don T Make These 7 Common Mistakes After Applying For A Mortgage Check Just one 30 day late payment on a loan or credit card can kill your mortgage qualification. do keep all of your personal documents including pay stubs, bank statements, proof of earnest money deposit, and other docs requested by your lender, as they will be required before closing. do keep your lender and your new home specialist with highland. 3. don’t assume you need 20% down. many first time buyers assume they need a 20 percent down payment to buy a house. but while having 20 percent down comes with perks — like avoiding private. If you’re ready to shop for a new home, a mortgage preapproval letter shows sellers that you’re a serious buyer who can secure financing from a lender. it also gives you a clear idea of how. 1. start saving early. when calculating how much money you need to buy a house, consider one time expenses as well as new, recurring bills. here are the main upfront costs to consider when saving.

Things To Avoid Do After Applying For A Mortgage Infographic If you’re ready to shop for a new home, a mortgage preapproval letter shows sellers that you’re a serious buyer who can secure financing from a lender. it also gives you a clear idea of how. 1. start saving early. when calculating how much money you need to buy a house, consider one time expenses as well as new, recurring bills. here are the main upfront costs to consider when saving. Some of the top things to avoid after applying for a mortgage include: 1. don’t deposit large sums of cash into your bank account. lenders need to source your money, and cash is often difficult to trace. before making any large deposits, it’s wise to ask your loan officer how to properly document that money. 2. Do not change your job. lenders look for stability and verify all employment just before your mortgage is scheduled to close. do not have your credit run throughout the process. this could lower your credit score and affect the interest rate you receive. do not have any of your family members, friends, or colleagues pay or write a check for.

Mortgage 101 7 Things Not To Do After Applying For A Mortgage How To Some of the top things to avoid after applying for a mortgage include: 1. don’t deposit large sums of cash into your bank account. lenders need to source your money, and cash is often difficult to trace. before making any large deposits, it’s wise to ask your loan officer how to properly document that money. 2. Do not change your job. lenders look for stability and verify all employment just before your mortgage is scheduled to close. do not have your credit run throughout the process. this could lower your credit score and affect the interest rate you receive. do not have any of your family members, friends, or colleagues pay or write a check for.

Comments are closed.