North Carolina Consumer Use Tax

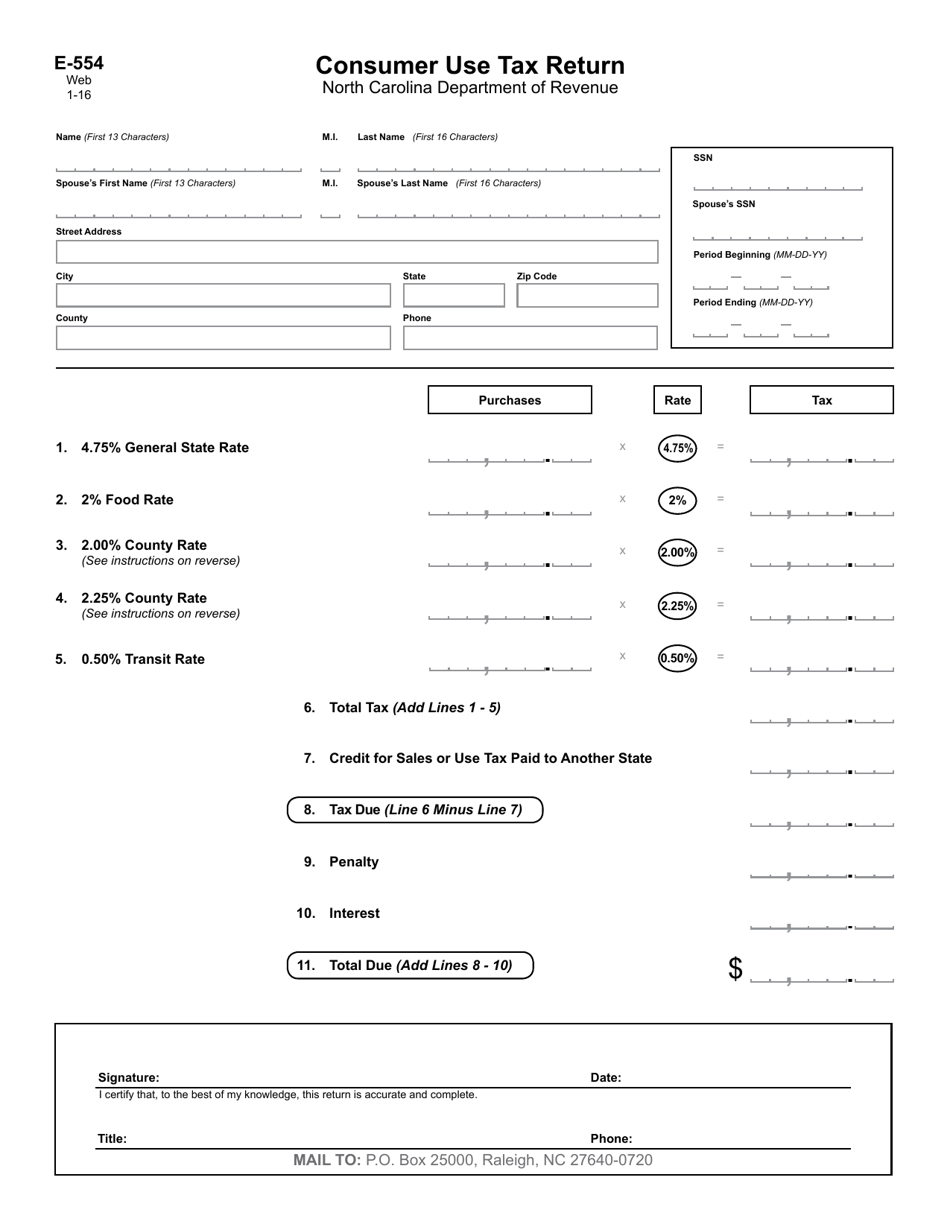

Download Instructions For Form E 554 Consumer Use Tax Return Pdf Items subject to north carolina use tax include tangible personal property, certain digital property and taxable services. you must pay use tax to the department when retailers, remote sellers, or facilitators fail to collect sales or use tax on taxable transactions. see n.c. gen. stat. § 105 164.6 for additional information about consumer use. Use tax is a tax due on purchases, leases, and rentals of tangible personal property and certain digital property purchased, leased or rented inside or outside this state for storage, use, or consumption in north carolina. use tax is also due on taxable services sourced to north carolina. use tax is paid to the north carolina department of.

Download Instructions For Form E 554 Consumer Use Tax Return Pdf North carolina department of revenue po box 25000 raleigh, nc 27640 0640 general information: 1 877 252 3052 individual income tax refund inquiries: 1 877 252 4052. In the nc portion of the tax return yes. the "consume use tax" on line 18 for the form d 400, refers to the sales tax added to yoru tax return for the purchases you made that were not assessed a sales tax by some tax authority. usually on most internet sales. (technically, it is more detailed than that. Taxslayer support. do i owe north carolina use tax? if you purchased items to be used or consumed in north carolina but did not pay north carolina sales tax on those items, you must pay sales or use tax to north carolina. examples of purchases where sales tax may not be collected are those made via the internet, mail order catalog or out of state. Sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. north carolina first adopted a general state sales tax in 1933, and since that time, the rate has risen to 4.75 percent. on top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes.

Form E 500 Sales And Use Tax Return North Carolina Department Of Taxslayer support. do i owe north carolina use tax? if you purchased items to be used or consumed in north carolina but did not pay north carolina sales tax on those items, you must pay sales or use tax to north carolina. examples of purchases where sales tax may not be collected are those made via the internet, mail order catalog or out of state. Sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. north carolina first adopted a general state sales tax in 1933, and since that time, the rate has risen to 4.75 percent. on top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes. The 2024 north carolina use tax. 4.75%. 2024 north carolina state use tax. the nc use tax only applies to certain purchases. the north carolina use tax is a special excise tax assessed on property purchased for use in north carolina in a jurisdiction where a lower (or no) sales tax was collected on the purchase. Greeting cards. if a sale is taxable in north carolina, then the base tax rate of 4.75% must be charged as well as the local sales and use tax for the jurisdictions where you are engaged in business. generally, local sales tax is based on the location of the seller’s place of business. local use tax is based on the location where the customer.

Form E 554 Fill Out Sign Online And Download Printable Pdf North The 2024 north carolina use tax. 4.75%. 2024 north carolina state use tax. the nc use tax only applies to certain purchases. the north carolina use tax is a special excise tax assessed on property purchased for use in north carolina in a jurisdiction where a lower (or no) sales tax was collected on the purchase. Greeting cards. if a sale is taxable in north carolina, then the base tax rate of 4.75% must be charged as well as the local sales and use tax for the jurisdictions where you are engaged in business. generally, local sales tax is based on the location of the seller’s place of business. local use tax is based on the location where the customer.

Comments are closed.