Online And Mobile Banking Adoption Rates And Benchmarks

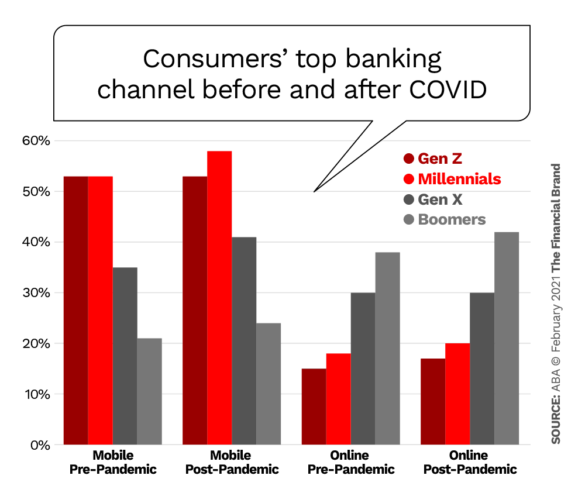

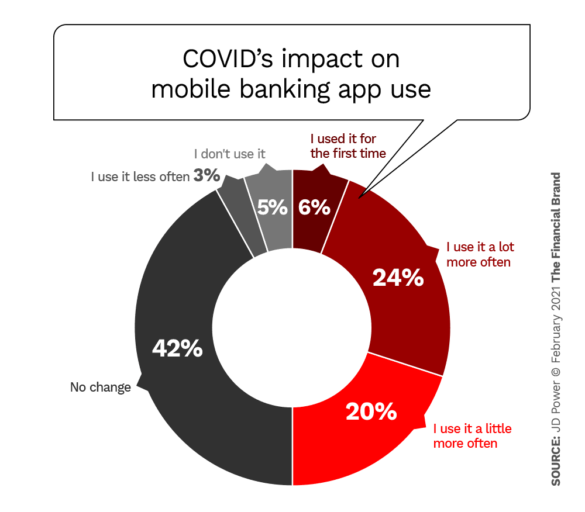

Online And Mobile Banking Adoption Rates And Benchmarks Now, 71% of all americans look primarily to online and mobile channels for their banking needs, according to the american bankers association (aba). these days, news about how covid 19 has spurred greater adoption of digital banking channels is everywhere. a study by lightico found that 63% of u.s. consumers said they were more inclined to try. Use of mobile banking as primary method to access account in u.s. 2021, by location. mobile banking customers of four largest banks in the u.s. 2023. number of mobile banking users of jpmorgan.

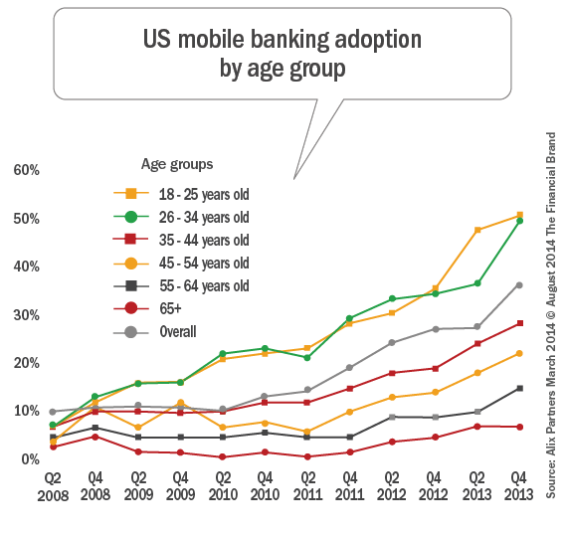

Online And Mobile Banking Adoption Rates And Benchmarks The use of bank tellers was down to 21%, and telephone banking use was at just 2.4%. mobile banking access rose steadily from 9.5% in 2015 to 34% in 2019. the use of online banking remained. Online and mobile banking adoption soars, setting new benchmarks for 2021. adoption rates covidby garret reich, staff writer at the financial brandcovid 19 ac. elerated the adoption of technologies in every vertical around the world. experts in the financial sector estimate the pandemic expedited the. trajectory of digital banking solutions. As of 2023, mobile banking is the primary choice of account access for 48 percent of u.s. consumers, making it the most prevalent banking method. (aba) digital wallets, such as paypal and apple. Two recent studies from cornerstone advisors underscore the change in adoption. as of may 2021, mobile banking penetration has grown to 95% of gen zers, 91% of millennials, 85% of gen xers, 60% of.

Online And Mobile Banking Adoption Rates And Benchmarks As of 2023, mobile banking is the primary choice of account access for 48 percent of u.s. consumers, making it the most prevalent banking method. (aba) digital wallets, such as paypal and apple. Two recent studies from cornerstone advisors underscore the change in adoption. as of may 2021, mobile banking penetration has grown to 95% of gen zers, 91% of millennials, 85% of gen xers, 60% of. Overview. the 2024 mobile banking scorecard highlights the growing importance to consumers of an intuitive experience and a secure application to manage their accounts. together these two areas account for nearly two thirds (63%) of consumers’ satisfaction with mobile banking, per javelin’s most recent digital banking satisfaction driver. Circle with letter i in it. 4.70% apy for balances of $5,000 or more; otherwise, 0.25% apy. min. to earn. $100 to open account, $5,000 for max apy. the pandemic affected banking in several ways.

Online And Mobile Banking Adoption Rates And Benchmarks Overview. the 2024 mobile banking scorecard highlights the growing importance to consumers of an intuitive experience and a secure application to manage their accounts. together these two areas account for nearly two thirds (63%) of consumers’ satisfaction with mobile banking, per javelin’s most recent digital banking satisfaction driver. Circle with letter i in it. 4.70% apy for balances of $5,000 or more; otherwise, 0.25% apy. min. to earn. $100 to open account, $5,000 for max apy. the pandemic affected banking in several ways.

Online And Mobile Banking Adoption Rates And Benchmarks

300 Mobile Payment And Digital Banking Trends For The Industry

Comments are closed.