Parts Of Medicare Senior Financial Group

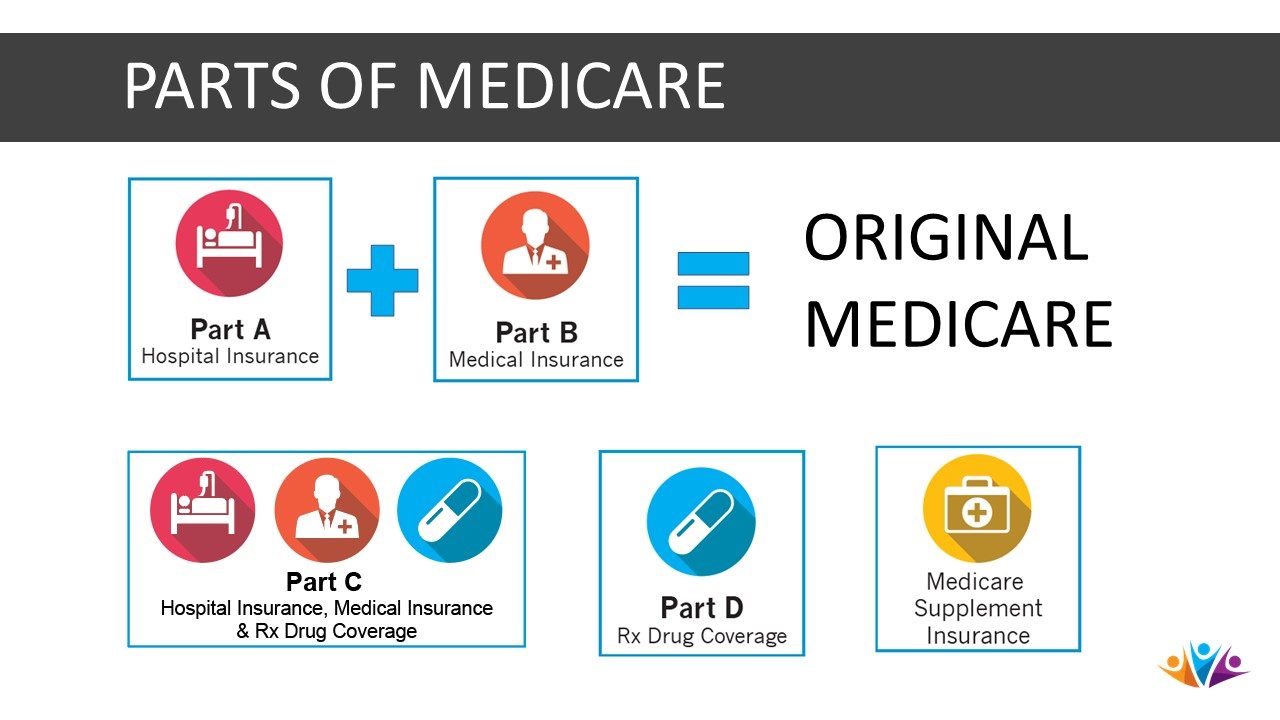

Parts Of Medicare Senior Financial Group There are four parts of medicare, each covers a specific service. part a provides inpatient hospital coverage. part b provides outpatient medical coverage. part c offers an alternate way to receive your medicare benefits. part d provides prescription drug coverage. original medicare is the traditional healthcare program offered through the. If you have questions about original medicare or need help enrolling in part a or part b, contact senior financial group today. our knowledgeable team is ready to assist you in understanding your medicare options and finding the right coverage for your healthcare needs.

The Four Parts Of Medicare Explained Simplified Senior Whether you’ve been enrolled in medicare for years or are just starting to research your options – let us assist you! call 800 677 0153 talk to a medicare advisor. Medicare part b: outpatient medical insurance. medicare part c: medicare advantage. medicare part d: prescription drug coverage. medicare supplement insurance (medigap) more like this medicare. Part a (hospital insurance) part a helps pay for inpatient care at: hospitals. skilled nursing facilities. hospice. it also covers some outpatient home health care. part a is free if you worked and paid medicare taxes for at least 10 years. you may also be eligible because of your current or former spouse’s work. There are four parts to medicare: part a, part b, part c, and part d. part a is hospital insurance and covers hospital stays, skilled nursing facilities, hospice care, and home health care. part b.

Parts Of Medicare Senior Financial Group Part a (hospital insurance) part a helps pay for inpatient care at: hospitals. skilled nursing facilities. hospice. it also covers some outpatient home health care. part a is free if you worked and paid medicare taxes for at least 10 years. you may also be eligible because of your current or former spouse’s work. There are four parts to medicare: part a, part b, part c, and part d. part a is hospital insurance and covers hospital stays, skilled nursing facilities, hospice care, and home health care. part b. Original medicare. original medicare includes part a and part b. you can join a separate medicare drug plan to get medicare drug coverage (part d). you can use any doctor or hospital that takes medicare, anywhere in the u.s. you can also shop for and buy supplemental coverage that helps pay your out of pocket costs (like your 20%. Part c (medicare advantage plans; part d (drug coverage) part a premium. most people don’t pay a premium for part a coverage. this is sometimes called “premium free part a.” you won’t pay a part a premium if you: qualify to get (or are already getting) retirement or disability benefits from social security (or the railroad retirement.

Comments are closed.