Peer To Peer Lending Advantages And Disadvantages Estateguru P2p

Peer To Peer P2p Lending What Is That Desfran Things happen faster online, and peer2peer lending is no different. compared to banks, which are mired in protocol and procedure, p2p lenders are often faster and more flexible. estateguru, for example, provides financing without unnecessary admin, red tape, or waiting periods. comprehensive and responsive assessment is carried out by our team. Crowdlending, also known as peer to peer (p2p) lending, is a rapidly evolving financial model that has changed the way businesses and entrepreneurs get funding. it allows companies and individual entrepreneurs to acquire funding from a large and diverse pool of investors, without having to approach a bank or traditional financial institution.

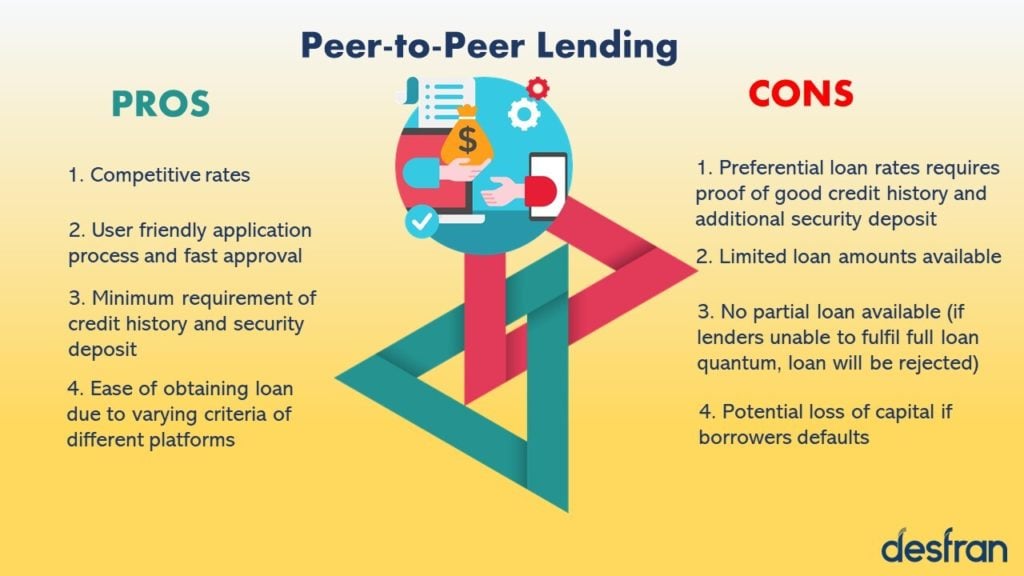

Peer To Peer Lending Advantages And Disadvantages Estateguru P2p As with any investment, it’s crucial to know the risks involved in peer to peer (p2p) lending before you put up your hard earned cash. equally important is how platforms evaluate, manage, and present those risks. we take a look at two of the main categories of risk when it comes to p2p lending platforms and the different measures that are. European lender estateguru recently commented on the advantages as well as the potential disadvantages of p2p lending. peer to peer lending provides investors and borrowers various advantages over. Advantages of peer to peer lending. 1. lower interest rates for borrowers. one of the key advantages of p2p lending for borrowers is the potential for lower interest rates compared to traditional banks. p2p loans are often more affordable than loans from a financial institution. p2p lending platforms may offer better terms for those with solid. The advantages of p2p lending for investors are numerous and can be quite lucrative. here are some of the key benefits: 1. higher returns. p2p lending offers higher returns to investors than traditional means of investing such as stocks, bonds, and mutual funds. while rare, p2p lending returns can be as large as 20%.

What Is Peer To Peer P2p Lending How It Works Advantages of peer to peer lending. 1. lower interest rates for borrowers. one of the key advantages of p2p lending for borrowers is the potential for lower interest rates compared to traditional banks. p2p loans are often more affordable than loans from a financial institution. p2p lending platforms may offer better terms for those with solid. The advantages of p2p lending for investors are numerous and can be quite lucrative. here are some of the key benefits: 1. higher returns. p2p lending offers higher returns to investors than traditional means of investing such as stocks, bonds, and mutual funds. while rare, p2p lending returns can be as large as 20%. Peer to peer (p2p) lending connects individual borrowers and lenders. from high risk to high returns, there are advantages and disadvantages for both parties. Peer to peer lending involves borrowing money from one or more private investors instead of a bank or other organization. it’s a kind of crowd funded personal loan—instead of borrowing, say.

Peer To Peer P2p Lending The Advantages And Disadvantages P2p Peer to peer (p2p) lending connects individual borrowers and lenders. from high risk to high returns, there are advantages and disadvantages for both parties. Peer to peer lending involves borrowing money from one or more private investors instead of a bank or other organization. it’s a kind of crowd funded personal loan—instead of borrowing, say.

The Advantages And Disadvantages Of Peer To Peer Lending

Comments are closed.