Peer To Peer Lending Aka P2p Loans Or Crowdlending Explained In One Minute

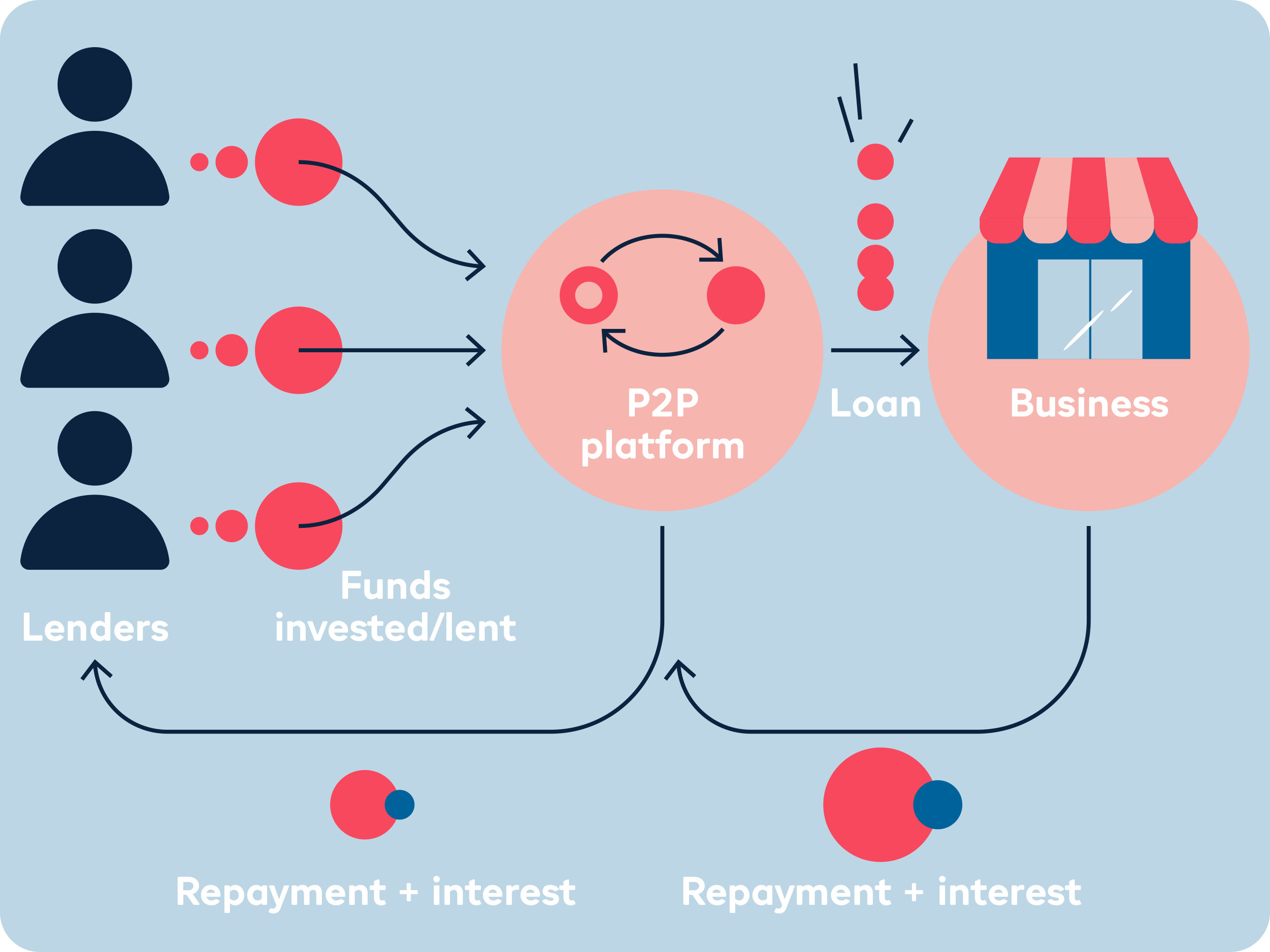

What Is Peer To Peer P2p Lending How It Works Peer to peer lending (sometimes referred to as p2p lending or crowdlending) is basically an alternative to "traditional" banking or in other words, a way for. Key takeaways. peer to peer (p2p) lending allows individuals to lend money to or borrow money from other individuals without going through a bank. p2p lenders are individual investors who.

What Is Peer To Peer P2p Lending Iwoca Peer to peer lending, however, usually requires a formal application. most peer to peer investors use one of the big p2p lending platforms (like funding circle). that means the platform itself creates and accepts your application. it will probably be the one that analyzes your application and decides whether or not you get approved. Peer to peer lending enables individuals to obtain loans directly from other individuals, without the need for an intermediary such as a bank. due to this dynamic, p2p lending is also known as “social lending” or “crowdlending,” and it has experienced tremendous growth as an alternative source of financing in recent years. Types of peer to peer (p2p) lending websites. peer to peer lending can come in a variety of different models and types, including personal loans, business loans, student loans, and mortgage financing. most sites specialize in one or two specific types of borrowers. personal loans are the most common type of loan offered via peer to peer platforms. Compare interest rates and fees. similar to personal loans, interest rates on peer to peer loans generally range from 6% to 36%. many lenders impose origination fees between 1% and 8% of the loan.

Peer To Peer Lending Aka P2p Loans Or Crowdlending Explained In One Types of peer to peer (p2p) lending websites. peer to peer lending can come in a variety of different models and types, including personal loans, business loans, student loans, and mortgage financing. most sites specialize in one or two specific types of borrowers. personal loans are the most common type of loan offered via peer to peer platforms. Compare interest rates and fees. similar to personal loans, interest rates on peer to peer loans generally range from 6% to 36%. many lenders impose origination fees between 1% and 8% of the loan. Ibusiness funding (formerly funding circle) is an online lender that offers peer to peer term loans of up to seven years. its qualifications are similar to those of banks and other online lenders. Published: jan 10, 2024 by kevin ocasio in small business loans. peer to peer lending is a relatively new form of borrowing, and lending type that cuts out the middleman. peer to peer business lending can be an appealing option for both borrowers and online lenders, as it often offers lower interest rates, is more cost effective, and has faster.

Comments are closed.