Peer To Peer Lending P2p Investing Basics

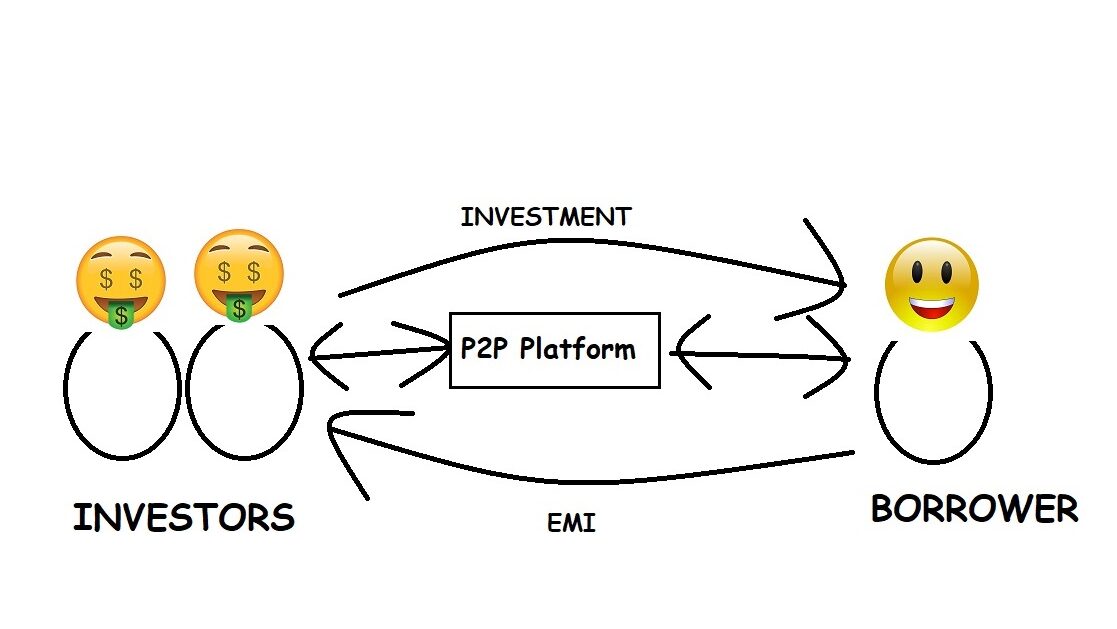

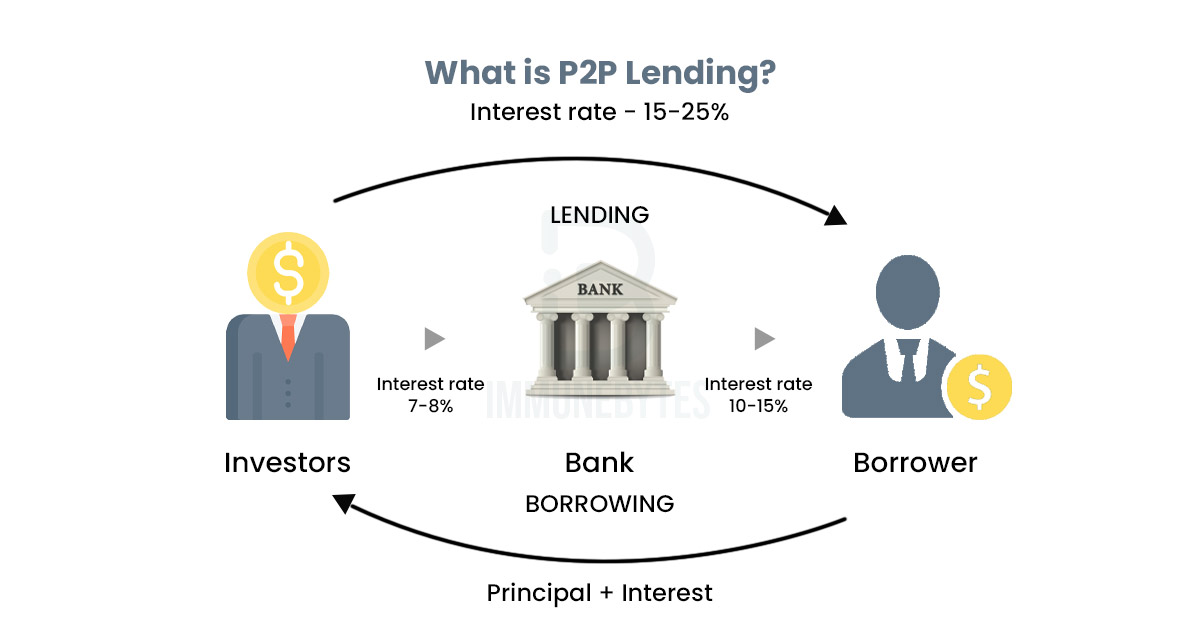

What Is Peer To Peer P2p Lending How It Works Peer to peer lending is an online transaction between a lender and a borrower. the two parties connect through an online p2p lending platform, such as kiva, prosper, or upstart. the lender—an. Benefits of investing through peer to peer lending. there are many things to consider before investing in peer to peer lending. here’s a rundown of some of the advantages of marketplace lending: proven solid returns: the average historical return for loans originating through prosper is 5.5% (as of june 30, 2024) 1.

Peer To Peer Lending P2p Investing Basics Youtube Key takeaways. peer to peer (p2p) lending allows individuals to lend money to or borrow money from other individuals without going through a bank. p2p lenders are individual investors who. Here are five sites that make investing in peer to peer lending both easy and transparent: best for starting small: kiva. best for automatic investing: prosper. best for real estate investors. Peer to peer lending, also called p2p lending, is a form of investing that involves lending to individual borrowers, small businesses or funding development projects, usually via a lending platform. the investor earns interest on what they lend as the borrower is paying interest on the money lent to them. In 2014, peer to peer lending platforms issued $5.5 billion in loans, and pricewaterhousecoopers predicts that peer to peer lending will grow to a $150 billion industry by 2025. [ 1 ] peer to peer lending offers a lot of benefits whether you’re looking to borrow or make money by investing in p2p loans.

Know About Peer To Peer Lending P2p Lending Financenerd Peer to peer lending, also called p2p lending, is a form of investing that involves lending to individual borrowers, small businesses or funding development projects, usually via a lending platform. the investor earns interest on what they lend as the borrower is paying interest on the money lent to them. In 2014, peer to peer lending platforms issued $5.5 billion in loans, and pricewaterhousecoopers predicts that peer to peer lending will grow to a $150 billion industry by 2025. [ 1 ] peer to peer lending offers a lot of benefits whether you’re looking to borrow or make money by investing in p2p loans. Its roots trace back centuries, evolving from local practices to global online platforms. p2p lending offers diverse loan types and attracts investors with its low entry barrier, potential for high yields, and monthly income. successful p2p investing requires diversification, careful platform selection, and a strategic focus on creditworthy. Peer to peer (p2p) lenders fees. peer to peer lending platforms can charge fees to both borrowers and investors. which fees apply and the amount of these fees can vary from lender to lender. a common fee that borrowers may encounter is an origination fee, which is typically a percentage of the loan amount.

What Is Peer To Peer P2p Lending A Quick Introduction Its roots trace back centuries, evolving from local practices to global online platforms. p2p lending offers diverse loan types and attracts investors with its low entry barrier, potential for high yields, and monthly income. successful p2p investing requires diversification, careful platform selection, and a strategic focus on creditworthy. Peer to peer (p2p) lenders fees. peer to peer lending platforms can charge fees to both borrowers and investors. which fees apply and the amount of these fees can vary from lender to lender. a common fee that borrowers may encounter is an origination fee, which is typically a percentage of the loan amount.

A Guide To Peer To Peer Lending And Ings New P2p Lending Defi Project

Comments are closed.