Pin Bar Candlestick And Pin Bar Strategy

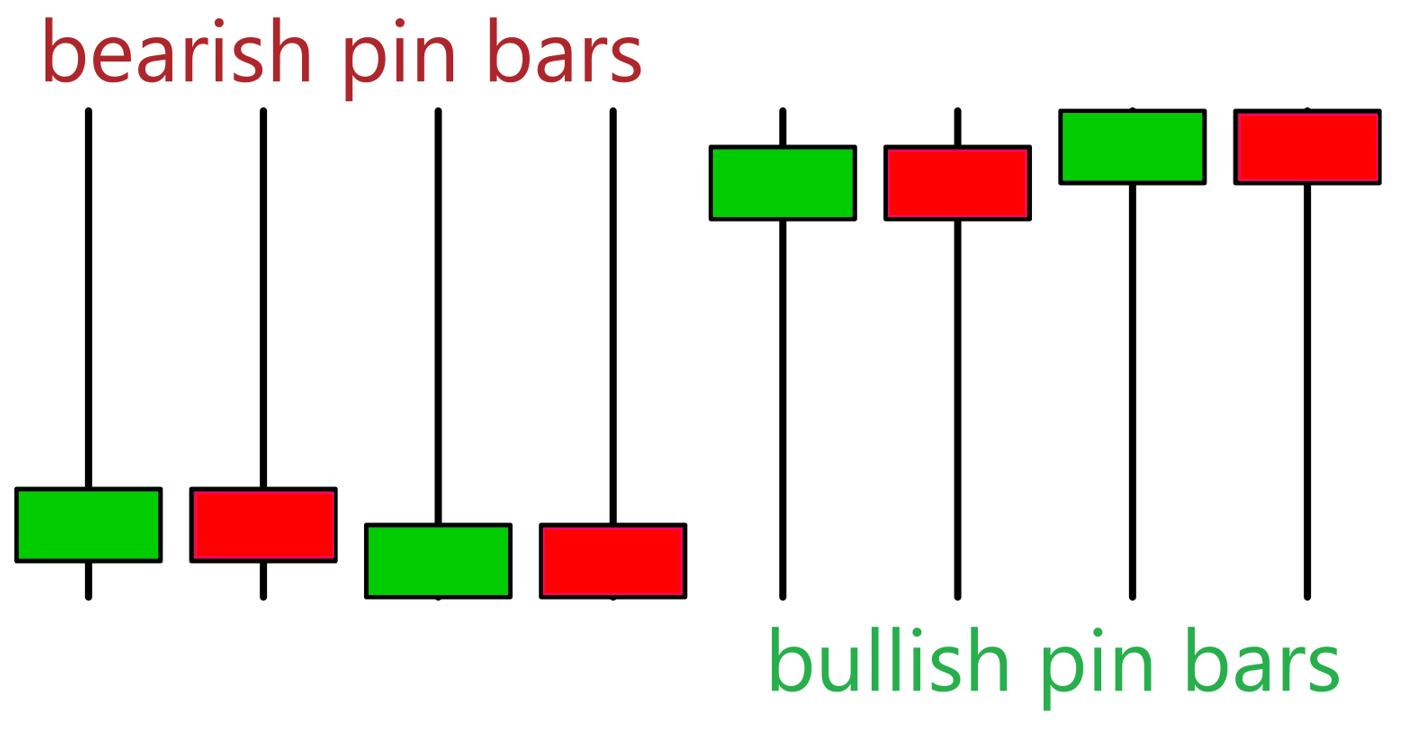

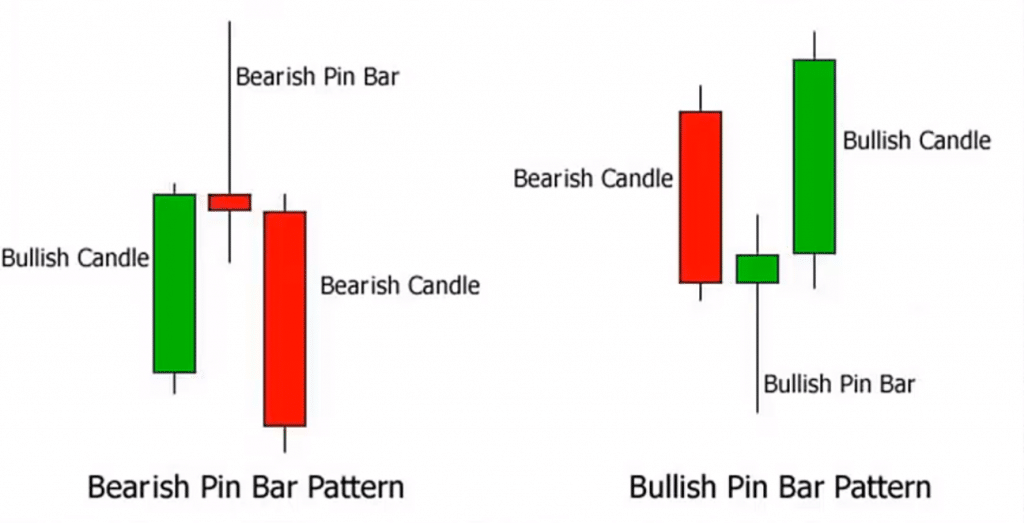

Pin Bar Trading A Detailed Strategy Guide 1. bullish pin bar candle pattern and fibonacci levels. the bullish pin bar candlestick pattern appears in a downtrend and marks the end of the bearish trend, meaning it signals a bullish trend reversal. in essence, bullish pin bars indicate sellers have dominated the market, but now their strength is waning. Pin bar trading strategy. the pin bar pattern (reversal or continuation) a pin bar pattern consists of one price bar, typically a candlestick price bar, which represents a sharp reversal and rejection of price. the pin bar reversal as it is sometimes called, is defined by a long tail, the tail is also referred to as a “shadow” or “wick”.

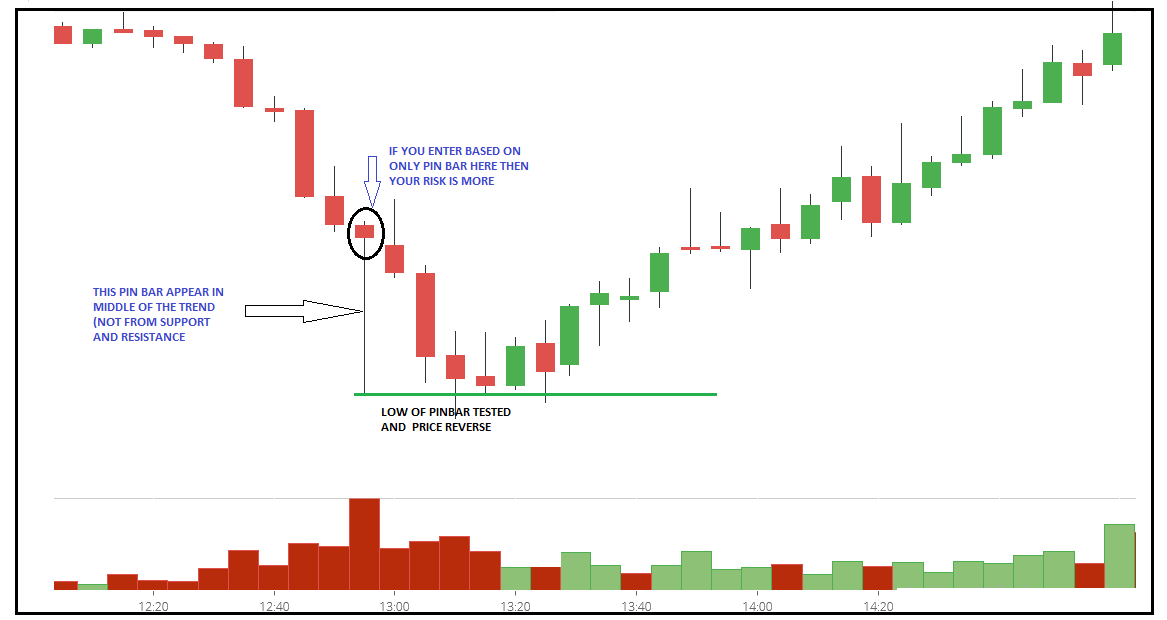

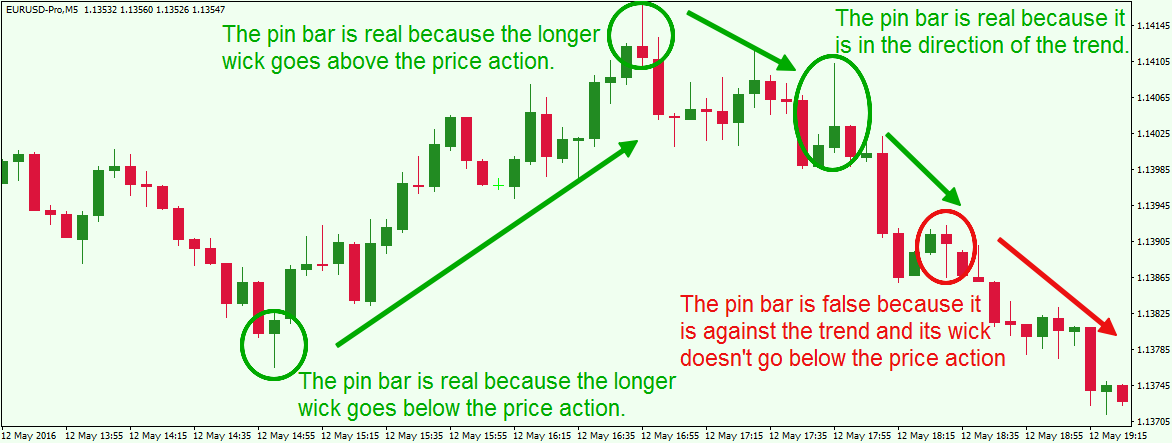

Pin Bar And Two Pin Bar Trading Strategies Analytics Forecasts Entry methods. option #1: use the 50% entry strategy whereby you enter on a 50% retrace of the pin bar. this is my preferred method as it provides me with a much more favorable risk to reward ratio. option #2: the second and less favorable option is to enter on a break of the nose of the pin bar. A pin bar is a single bar candlestick that is made up of a small body and a long upper or lower shadow. in most cases, the bar is formed between a bullish and bearish candlestick. when this happens, it is usually a bearish pin bar pattern. on the other hand, it happens between a large bearish and large bullish candlesticks. Technical analysis pin bar trading strategy: a comprehensive guide. pin bars are a powerful candlestick pattern used widely for reversal pattern trading across all financial markets. with their visually distinct shape forming at key support and resistance levels, pin bars act as early warning signals that a turnaround may be imminent. Include a chart showing a hanging man pin bar at highs. 5. how to trade pin bars. break of high low: enter on the break of the high of a bullish pin bar or the low of a bearish pin bar. this method capitalizes on the momentum of the reversal. retracement: enter on a retracement to the pin bar’s midpoint or a key support resistance level. this.

How To Trade The Forex Pin Bar Setup Forex Training Group Technical analysis pin bar trading strategy: a comprehensive guide. pin bars are a powerful candlestick pattern used widely for reversal pattern trading across all financial markets. with their visually distinct shape forming at key support and resistance levels, pin bars act as early warning signals that a turnaround may be imminent. Include a chart showing a hanging man pin bar at highs. 5. how to trade pin bars. break of high low: enter on the break of the high of a bullish pin bar or the low of a bearish pin bar. this method capitalizes on the momentum of the reversal. retracement: enter on a retracement to the pin bar’s midpoint or a key support resistance level. this. An effective pin bar trading strategy would be to wait for the price to retrace about half the distance of the wick. a trader can buy near the 50% retracement of the wick, or simply wait for a breakout and place a buy stop above the pin bar’s high. the stop loss would be placed just below the pin bar low. A pin bar is a candlestick pattern that demonstrates a rejection of price and sharp reversal. it has a small body and a long wick or tail. what sets it apart is the prolonged tail that exceeds the surrounding price movement and gives it the appearance of a pin.

1 Pinbar Trading Strategy Tradingwithrayner An effective pin bar trading strategy would be to wait for the price to retrace about half the distance of the wick. a trader can buy near the 50% retracement of the wick, or simply wait for a breakout and place a buy stop above the pin bar’s high. the stop loss would be placed just below the pin bar low. A pin bar is a candlestick pattern that demonstrates a rejection of price and sharp reversal. it has a small body and a long wick or tail. what sets it apart is the prolonged tail that exceeds the surrounding price movement and gives it the appearance of a pin.

Pin Bar Candlestick Trading Strategy With Price Action Stock

Comments are closed.