Plan F вђ Blue Compass Solutions

Plan F Blue Compass Solutions This coverage picks up all the costs original medicare leaves for you to pay. in addition to these costs, medicare supplement plan f also includes foreign travel emergency coverage. medicare supplement plan f will cover a lifetime limit of $50,000 of emergency foreign travel coverage after a $250 deductible. Medigap plan f is no longer available for adults who turned 65 on or after jan. 1, 2020. however, you may still be able to enroll in plan f if it’s available in your state and zip code and you.

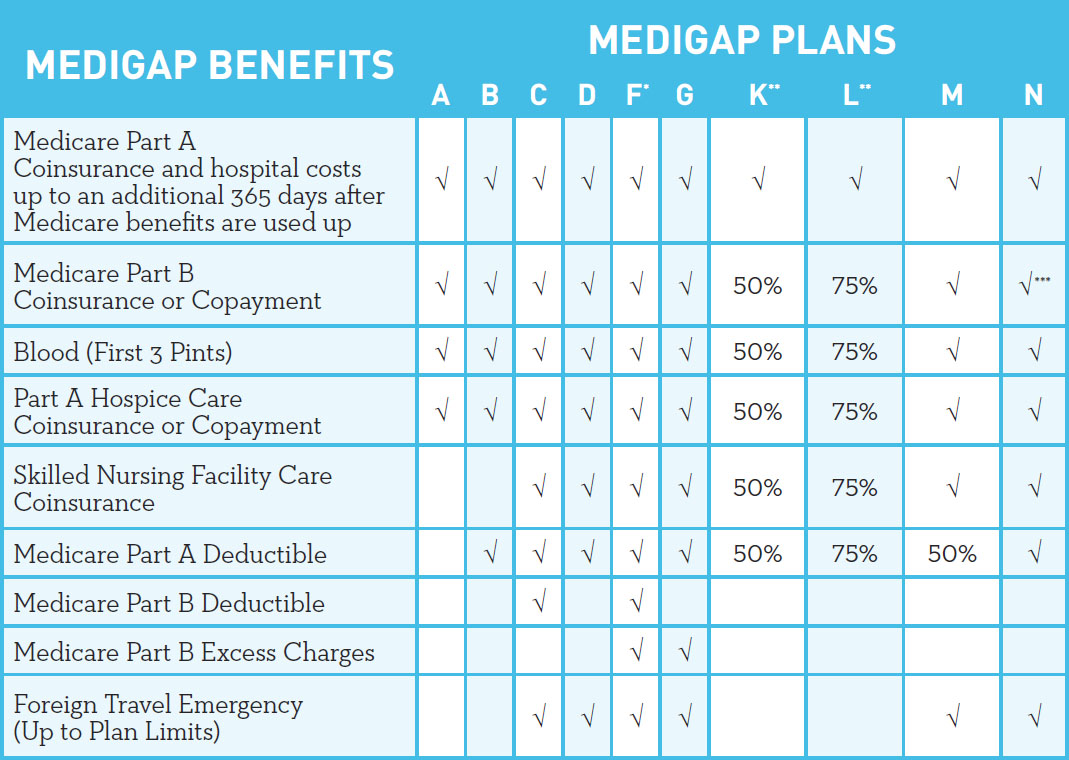

Blue Compass Solutions 1 plans f and g offer high deductible plans that each have an annual deductible of $2,800 in 2024. once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. the high deductible plan f is not available to new beneficiaries who became eligible for medicare on or after january 1, 2020. Simplicity: plan f covers most out of pocket costs for medicare part a and part b, so you don’t need to worry much about copays, coinsurance and deductibles. cons. cost: plan f premiums can get. Medicare plan f vs. g vs. n: deductibles. the other major difference to consider when comparing plans f, g and n is that plan f covers the annual part b deductible of $240, but plans g and n don. The 6 best medicare supplement plan f providers. best overall: humana. best discounts for people new to medicare: aarp by unitedhealthcare. best for cost and overall price transparency: aetna. best for discounts: blue cross blue shield. best for user experience: cigna. best for high deductible plan f: mutual of omaha.

2 Bp Blogspot 05aeaoxhywk Vudyvp8b3ui Aaaaaaaaht4 Df6rty6scss Medicare plan f vs. g vs. n: deductibles. the other major difference to consider when comparing plans f, g and n is that plan f covers the annual part b deductible of $240, but plans g and n don. The 6 best medicare supplement plan f providers. best overall: humana. best discounts for people new to medicare: aarp by unitedhealthcare. best for cost and overall price transparency: aetna. best for discounts: blue cross blue shield. best for user experience: cigna. best for high deductible plan f: mutual of omaha. However, the reason for the higher premium is that this plan provides the highest level of benefits to enrollees. the plan’s average cost is about $230 per month. however, many factors impact the premium price. premium costs for medigap plan f can range from around $150 $400 per month or more. Medicare supplement plan f is a popular supplement because it minimizes any out of pocket health care costs. it covers your medicare deductibles, plus copays and coinsurance. as of january 1, 2020, medicare supplements sold to people who are new to medicare** are no longer allowed to cover the part b deductible.

Compass Solutions Concept Stock Vector By Kosecki 45454755 However, the reason for the higher premium is that this plan provides the highest level of benefits to enrollees. the plan’s average cost is about $230 per month. however, many factors impact the premium price. premium costs for medigap plan f can range from around $150 $400 per month or more. Medicare supplement plan f is a popular supplement because it minimizes any out of pocket health care costs. it covers your medicare deductibles, plus copays and coinsurance. as of january 1, 2020, medicare supplements sold to people who are new to medicare** are no longer allowed to cover the part b deductible.

D0 92 D1 8f D0 B7 D0 B0 D0 Bd D1 8b D0 B9 D0 B6 D0 B8 D0 Bb D0 B5 D1

Comments are closed.