Powerful Macd Forex Trading Strategy Simple Beginner Friendly 2023

Powerful Macd Forex Trading Strategy Simple Beginner Friendly 2023 📌 hop into our discord: linktr.ee kristinaforex 💬 telegram: t.me kristinaforexsignals🔮 instagram: @kristina.forex💌 email: fxtraderkrist. The first line that gets plotted is the macd line. and it’s calculated by subtracting the 26 days ema from the 12 days ema. then we have a second line that’s plotted by using the 9 days ema of the price. since the second line is 9 days moving average it’ll lag behind but trace out the macd line (first line) and will work as a signal line.

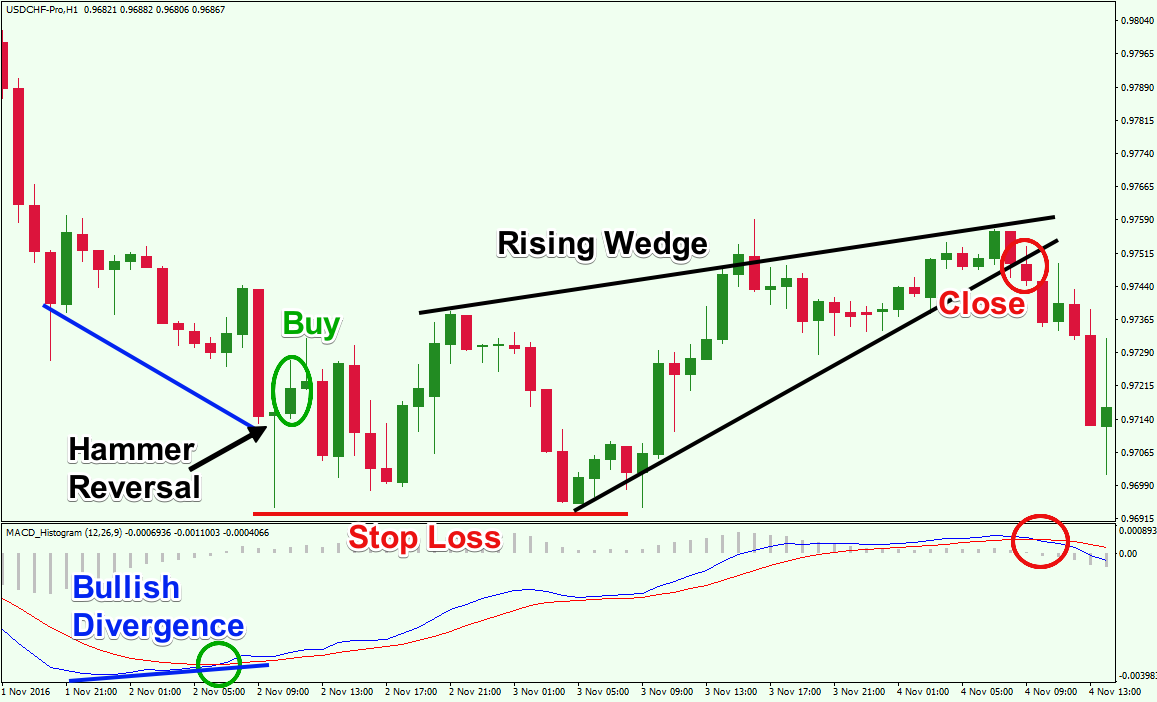

Ultimate Beginners Guide To Using Macd Indicator For Trading 2023 Macd signals can provide valuable insights into the forex market’s current trend and potential reversals. understanding how to interpret these signals is crucial for successful trading. 1. bullish signal: a bullish signal occurs when the macd line crosses above the signal line. this indicates a potential uptrend in the market. Calculate the macd line: subtract the longer term exponential moving average (ema) from the shorter term ema. the commonly used time periods for the emas are 12 and 26 days for daily charts. 2. calculate the signal line: apply a smoothing factor (usually a 9 day ema) to the macd line to generate the signal line. 3. Simple macd strategy. author: the forex geek | published: may 5, 2024. the macd indicator is a popular tool for using in various forex trading strategies. it can be used to spot currency pair trends and momentum, as well as possible market reversals and price divergence. this makes it a versatile technical indicator that can be used standalone. The macd indicator is one of the most widely used indicators for forex trading. macd is an abbreviation for moving average convergence divergence. it is calculated using moving averages, which makes it a lagging indicator. the main function of the macd is to discover new trends and to help find the end of present trends.

Easy Macd Trading Strategy Simple Macd Forex Trading Strategy Youtube Simple macd strategy. author: the forex geek | published: may 5, 2024. the macd indicator is a popular tool for using in various forex trading strategies. it can be used to spot currency pair trends and momentum, as well as possible market reversals and price divergence. this makes it a versatile technical indicator that can be used standalone. The macd indicator is one of the most widely used indicators for forex trading. macd is an abbreviation for moving average convergence divergence. it is calculated using moving averages, which makes it a lagging indicator. the main function of the macd is to discover new trends and to help find the end of present trends. Mastering macd for successful trading strategies. to effectively use macd for successful trading strategies, traders need to understand its strengths and limitations. here are some tips to help master macd: 1. confirming trends: macd is most effective when used in conjunction with other indicators or chart patterns to confirm trends. It’s composed of three main components: the macd line (blue), the signal line (orange), and the histogram. the macd line is calculated by subtracting a long term exponential moving average (ema) from a short term ema. the signal line is a 9 day ema of this line. when these two lines cross, it often suggests a potential entry or exit point.

Trading With Macd Simple Effective Strategies Explained Forex Mastering macd for successful trading strategies. to effectively use macd for successful trading strategies, traders need to understand its strengths and limitations. here are some tips to help master macd: 1. confirming trends: macd is most effective when used in conjunction with other indicators or chart patterns to confirm trends. It’s composed of three main components: the macd line (blue), the signal line (orange), and the histogram. the macd line is calculated by subtracting a long term exponential moving average (ema) from a short term ema. the signal line is a 9 day ema of this line. when these two lines cross, it often suggests a potential entry or exit point.

How To Use Macd Indicator Simple Effective Forex Trading Strategies

Comments are closed.