Ppt вђ Capital Budgeting Decision Criteria Powerpoint Presentation

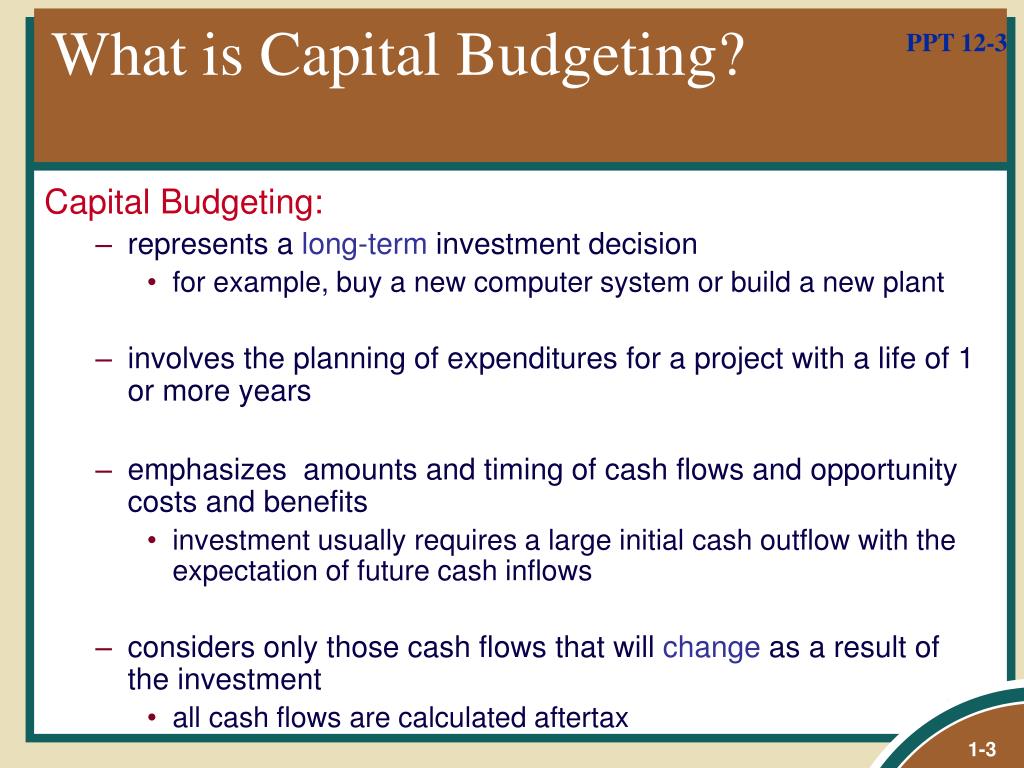

Ppt Capital Budgeting Decision Criteria Powerpoint Presentation Free The capital budgeting process involves project generation, evaluation using techniques like npv or irr, and selection of projects that meet acceptance criteria. working capital management describes operating cost, estimation of working capital, working capital finance. working capital refers to a company's short term assets and liabilities. Ashish khera. capital budgeting decisions involve investing current funds into long term assets to generate expected cash flows over several years. these decisions include expansion, acquisition, modernization, replacement, and new product investments. cash flows provide a better estimate of a project's return than accounting profits because.

Ppt The Capital Budgeting Decision Powerpoint Presentation Free Chapter 9: capital budgeting techniques capital budgeting decision criteria 1999, prentice hall, inc. example: suppose our firm must decide whether to purchase a new plastic molding machine for $125,000. | powerpoint ppt presentation | free to view. Chapter 9 capital budgeting decision criteria. chapter 9 capital budgeting decision criteria. capital budgeting : the process of planning for purchases of long term assets. for example : suppose our firm must decide whether to purchase a new plastic molding machine for $125,000. how do we decide? will the machine be profitable ?. Chapter 11: capital budgeting: decision criteria • overview and “vocabulary” • methods • payback, discounted payback • npv • irr, mirr • profitability index • unequal lives • economic life. steps in capital budgeting • estimate cash flows (inflows & outflows). • assess risk of cash flows. • determine r = wacc for project. Chapter 9 capital budgeting decision criteria. chapter 9 capital budgeting decision criteria. capital budgeting : the process of planning for purchases of long term assets. for example : suppose our firm must decide whether to purchase a new plastic molding machine for $125,000. how do we decide? will the machine be profitable ?.

Ch 9 Capital Budgeting Decision Criteria Ppt Download Chapter 11: capital budgeting: decision criteria • overview and “vocabulary” • methods • payback, discounted payback • npv • irr, mirr • profitability index • unequal lives • economic life. steps in capital budgeting • estimate cash flows (inflows & outflows). • assess risk of cash flows. • determine r = wacc for project. Chapter 9 capital budgeting decision criteria. chapter 9 capital budgeting decision criteria. capital budgeting : the process of planning for purchases of long term assets. for example : suppose our firm must decide whether to purchase a new plastic molding machine for $125,000. how do we decide? will the machine be profitable ?. Title: capital budgeting decision criteria 1 chapter 9. capital budgeting decision criteria ; 2 introduction. this chapter looks at capital budgeting decision models. it discusses and illustrates their relative strengths and weaknesses. it examines project review and post audit procedures, and traces a sample project through the capital. 1) capital budgeting is the process of planning for capital expenditures that are expected to generate returns over multiple years. it involves evaluating potential long term investment projects and determining which ones to undertake. 2) the document discusses various capital budgeting techniques for evaluating projects, including payback.

Chapter 7 Capital Budgeting Decision Criteria Ppt Download Title: capital budgeting decision criteria 1 chapter 9. capital budgeting decision criteria ; 2 introduction. this chapter looks at capital budgeting decision models. it discusses and illustrates their relative strengths and weaknesses. it examines project review and post audit procedures, and traces a sample project through the capital. 1) capital budgeting is the process of planning for capital expenditures that are expected to generate returns over multiple years. it involves evaluating potential long term investment projects and determining which ones to undertake. 2) the document discusses various capital budgeting techniques for evaluating projects, including payback.

Capital Budgeting Decision Criteria Ppt Download

Comments are closed.