Ppt Best Child Education Insurance Plan In India Call 8217831004

Ppt Best Child Education Insurance Plan In India Call 8217831004 Title: best child education insurance plan in india | call: 8217831004 1 child insurance plan. how to choose best child education and marriage insurance plan in india call 8217831004; 2 start planning for your childs education. as a parent, your kids are the most important part of your lives. smallest of your happy moments depend on them. Policies under the fund based child education plans are regulated by the securities and exchange board of india (sebi). the features of fund based child education plans are as follows: child.

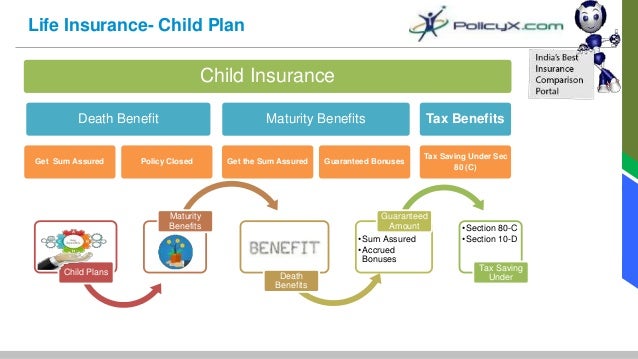

Child Insurance Plan Best Child Education Plan In India Policyx Best child education insurance plan in india | call: 8217831004 an image link below is provided (as is) to download presentation download policy: content on the website is provided to you as is for your information and personal use and may not be sold licensed shared on other websites without getting consent from its author. Importance of child insurance plan • a child insurance policy is a saving cum investment plan that is designed to meet your child’s future financial needs. • the maturity amount of a child life insurance policy is tax free. • tax benefits are offered under section 80c and 10 (10d) of the income tax act, 1961. Generally speaking, different insurers incorporate these features into the child education plans and therefore, conducting an online survey and matching of these features with your projected plans is very essential. a child education plan can be either endowment linked or unit linked. both these types of insurance plans have their individual. Child education insurance plans are a smart way to secure your child's future education and ease the financial burden that comes with it. investing wisely today ensures that your child's dreams are fulfilled, whether they aspire to be doctors, engineers, artists, or entrepreneurs. start early, choose the right plan, and watch your child's.

Best Child Education Insurance Plan In India Call 8217831004 Youtube Generally speaking, different insurers incorporate these features into the child education plans and therefore, conducting an online survey and matching of these features with your projected plans is very essential. a child education plan can be either endowment linked or unit linked. both these types of insurance plans have their individual. Child education insurance plans are a smart way to secure your child's future education and ease the financial burden that comes with it. investing wisely today ensures that your child's dreams are fulfilled, whether they aspire to be doctors, engineers, artists, or entrepreneurs. start early, choose the right plan, and watch your child's. Step 3: click on ‘view plans’. step 4: enter the required information. step 5: all the child education plans list will be displayed. step 6: customize your plan by choosing the (i) investment amount, (ii) the number of years you want to stay invested, and (iii) the number of years you want to withdraw after. A child plan in india allows you the flexibility to invest in your child’s future, helping you align your investments with your child’s education needs, future dreams, and desires, as well as your current financial status. the best child plan typically provides life insurance of 10 times your annual income.

Ppt Best Child Insurance Plan In India Powerpoint Presentation Free Step 3: click on ‘view plans’. step 4: enter the required information. step 5: all the child education plans list will be displayed. step 6: customize your plan by choosing the (i) investment amount, (ii) the number of years you want to stay invested, and (iii) the number of years you want to withdraw after. A child plan in india allows you the flexibility to invest in your child’s future, helping you align your investments with your child’s education needs, future dreams, and desires, as well as your current financial status. the best child plan typically provides life insurance of 10 times your annual income.

Comments are closed.