Ppt Credit Risk Loan Portfolio And Concentration Risk Chapter 12

Ppt Credit Risk Loan Portfolio And Concentration Risk Chapter 12 Irwin mcgraw hill 1 credit risk: loan portfolio and concentration risk: chapter 12 financial institutions management, 3 e by anthony saunders. value at risk concepts, data, industry estimates –adam hoppes –moses chao portfolio applications –cathy li –muthu ramanujam comparison to volatility and. Credit risk – loan portfolio and concentration risk. credit risk – loan portfolio and concentration risk. class 15; chap 12. lecture outline. purpose: gain a working knowledge of how fis measure and manage the risk of a loan portfolio simple models migration analysis concentration limits modern portfolio theory models. 1.29k views • 29 slides.

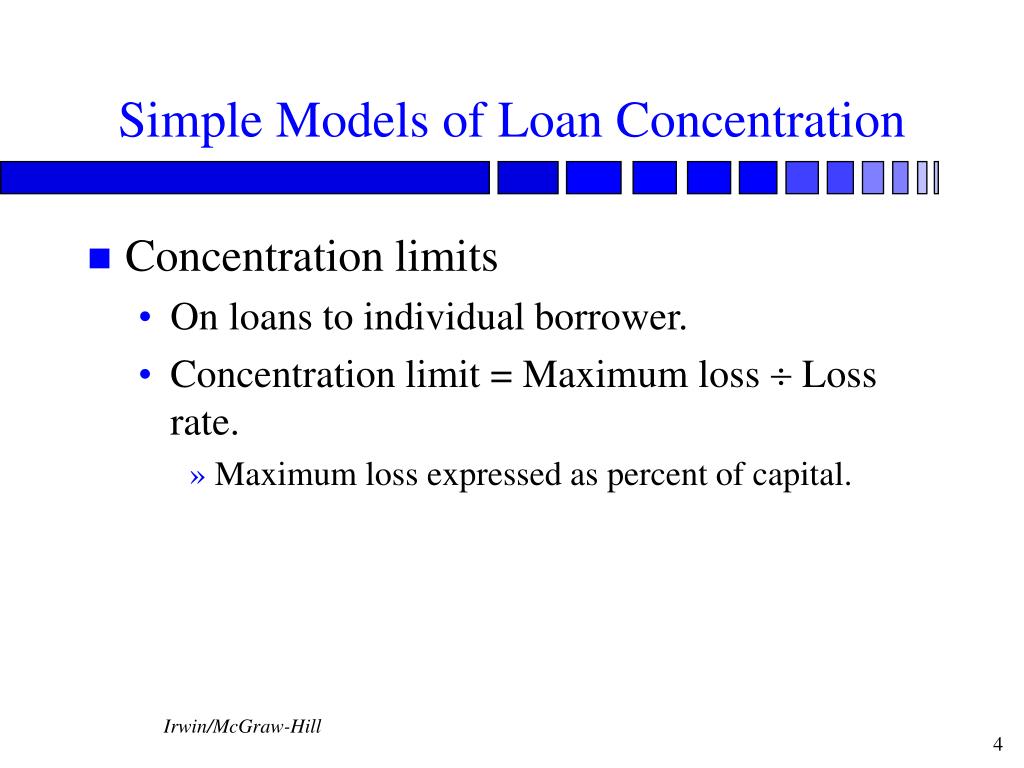

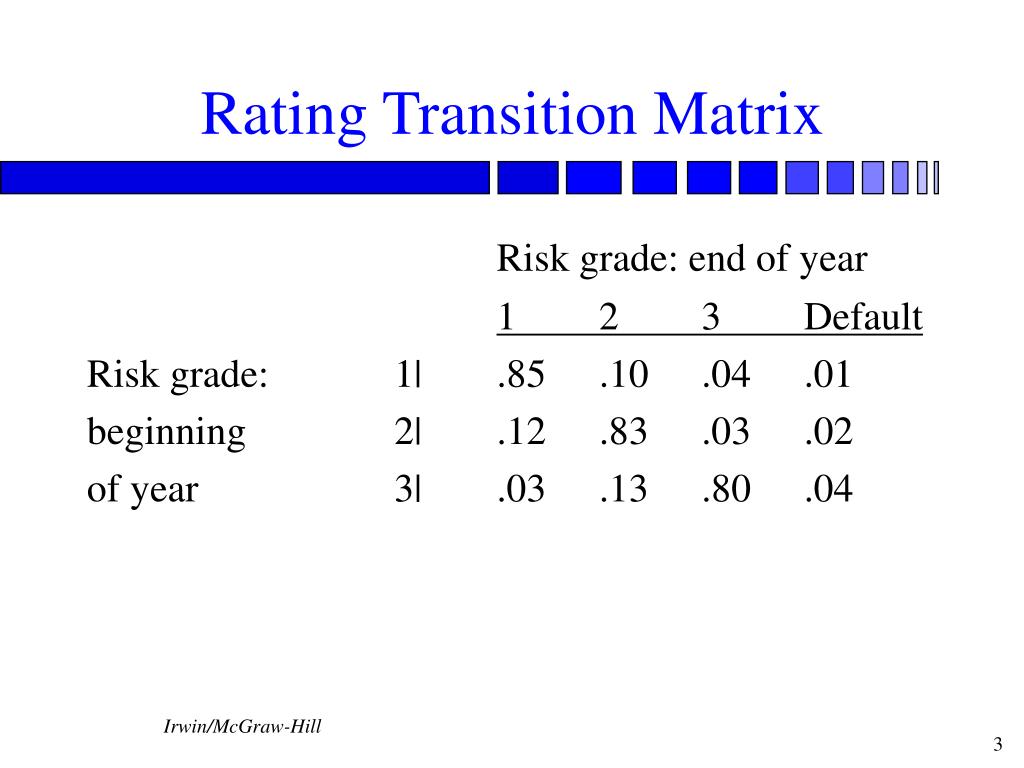

Ppt Credit Risk Loan Portfolio And Concentration Risk Chapter 12 Download ppt "irwin mcgraw hill 1 credit risk: loan portfolio and concentration risk: chapter 12 financial institutions management, 3 e by anthony saunders." similar presentations actuarieel genootschap – afir working party credit risk an introduction to credit risk with a link to insurance r.j.a. laeven, university of amsterdam. Credit risk – loan portfolio and concentration risk. class 15; chap 12. lecture outline. purpose: gain a working knowledge of how fis measure and manage the risk of a loan portfolio simple models migration analysis concentration limits modern portfolio theory models. Title: credit risk: loan portfolio and concentration risk: chapter 12 1 credit risk loan portfolio and concentration risk chapter 12. financial institutions management, 3 e ; by anthony saunders ; 2 simple models of loan concentration. migration analysis ; track credit rating changes within sector or pool of loans. rating transition matrix. 3. Given the following portfolio of loans calculate the risk and return of the portfolio step #4 calculate the risk (volatility) of the portfolio loan value return on loan return volatility corr 1 30 mill 6.25% 2 20 mill 5.6% .028 .25 portfolio risk = 2.52% portfolio return = 5.99%. 23 example: suppose an fi has holds 2 loans in its portfolio.

Ppt Credit Risk Loan Portfolio And Concentration Risk Chapter 12 Title: credit risk: loan portfolio and concentration risk: chapter 12 1 credit risk loan portfolio and concentration risk chapter 12. financial institutions management, 3 e ; by anthony saunders ; 2 simple models of loan concentration. migration analysis ; track credit rating changes within sector or pool of loans. rating transition matrix. 3. Given the following portfolio of loans calculate the risk and return of the portfolio step #4 calculate the risk (volatility) of the portfolio loan value return on loan return volatility corr 1 30 mill 6.25% 2 20 mill 5.6% .028 .25 portfolio risk = 2.52% portfolio return = 5.99%. 23 example: suppose an fi has holds 2 loans in its portfolio. Partial applications of portfolio theory (2) loan loss ratio based models: • based on the implication of capm that an asset’s risk is determined by its systematic risk – how its return co move with market return • estimates the systematic loan loss risk of a sector by regressing the historical loan loss ratio of the sector on the loan. An fi has a loan portfolio of 10,000 loans of $$\$ 10,000$$ each. the loans have a historical average default rate of 4 percent, and the severity of loss is 40 cents per dollar. a. over the next year, what are the probabilities of having default rates of 2,3, 4,5 , and 8 percent? b.

Ppt Credit Risk Loan Portfolio And Concentration Risk Chapter 12 Partial applications of portfolio theory (2) loan loss ratio based models: • based on the implication of capm that an asset’s risk is determined by its systematic risk – how its return co move with market return • estimates the systematic loan loss risk of a sector by regressing the historical loan loss ratio of the sector on the loan. An fi has a loan portfolio of 10,000 loans of $$\$ 10,000$$ each. the loans have a historical average default rate of 4 percent, and the severity of loss is 40 cents per dollar. a. over the next year, what are the probabilities of having default rates of 2,3, 4,5 , and 8 percent? b.

Ppt Credit Risk Loan Portfolio And Concentration Risk Chapter 12

Comments are closed.