Principal And Interest What Is The Difference For Mortgage Payments

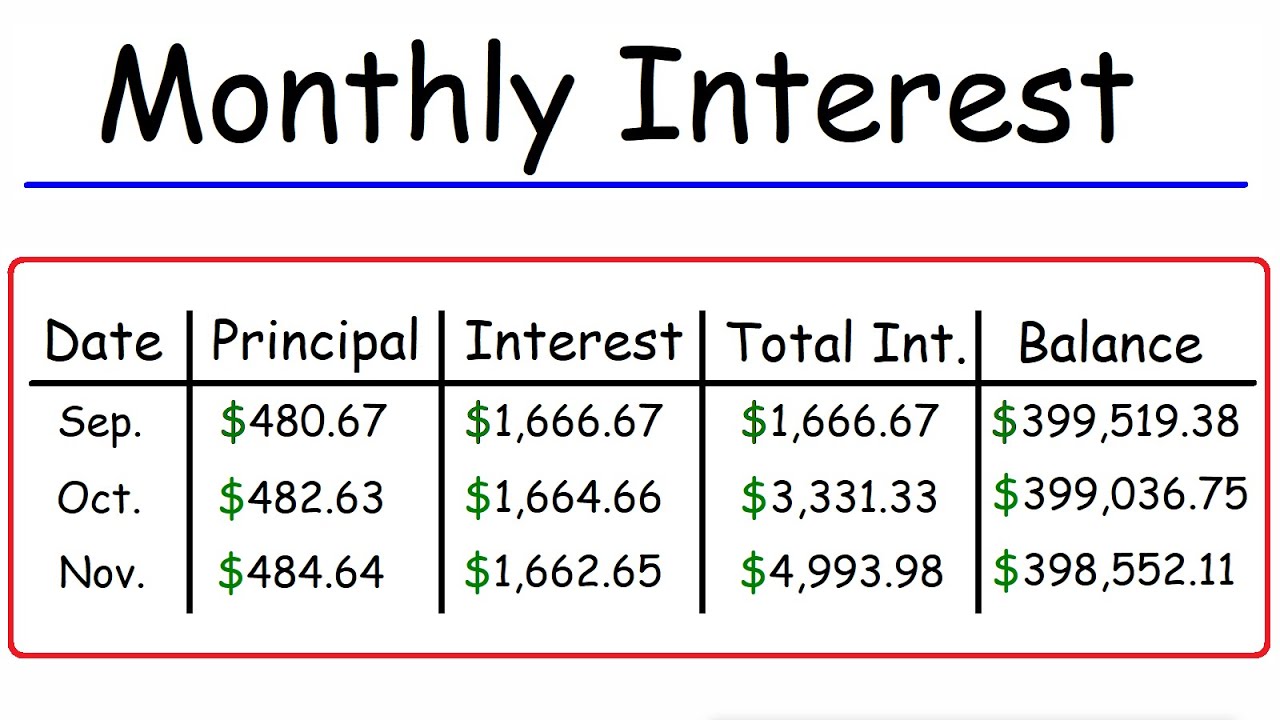

How To Calculate The Monthly Interest And Principal On A Mortgage Loan At 0.0025% monthly interest, $499.14 of your next mortgage payment will go toward interest, and $343.86 will go toward principal. and for each month going forward until you pay off your loan, two. The monthly payment would be $3,033.19 throughout the duration of the loan. in the first payment $1,666.67 would go toward interest while $1,366.52 goes toward principal. in the final payment only $20.09 is spent on interest while $3,013.12 goes toward principal. an amortization chart for this example is listed below. payment number.

Principal And Interest Vs Interest Only One Click Life To calculate your mortgage principal, simply subtract your down payment from your home’s final selling price. for example, let’s say you buy a home for $300,000 and make a 20% down payment. in this instance, you’d put $60,000 down on your loan. your mortgage lender would then cover the remaining amount by way of a loan for $240,000. Mortgage principal is calculated by subtracting the down payment from the total purchase price. if you use a mortgage to purchase a $300,000 home with a 10% down payment ($30,000), that means your principal is $270,000. you’ll pay interest on this total principal balance, and both the interest and principal will get divided into equal monthly. If the interest rate on our $100,000 mortgage is 6%, the combined principal and interest monthly payment on a 30 year mortgage would be about $599.55—$500 interest $99.55 principal. Here’s how you would perform the calculation. principal payment = $1,500 [$150,000 x (0.07 12) ] principal payment = $1,500 $875. principal payment = $625. at this point, less than half of.

Principal Vs Interest Mortgage Chart A Visual Reference Of Charts If the interest rate on our $100,000 mortgage is 6%, the combined principal and interest monthly payment on a 30 year mortgage would be about $599.55—$500 interest $99.55 principal. Here’s how you would perform the calculation. principal payment = $1,500 [$150,000 x (0.07 12) ] principal payment = $1,500 $875. principal payment = $625. at this point, less than half of. After a year of mortgage payments, 31% of your money starts to go toward the principal. you see 45% going toward principal after ten years and 67% going toward principal after year 20. over 30 years you'll pay a total of $343,739, again based on an estimated monthly mortgage payment of $955. key takeaway:. The principal is the amount you borrowed and have to pay back, and interest is what the lender charges for lending you the money. for most borrowers, the total monthly payment you send to your mortgage company includes other things, such as homeowners insurance and taxes that may be held in an escrow account. if you have an escrow account, you.

What S In A Mortgage Payment After a year of mortgage payments, 31% of your money starts to go toward the principal. you see 45% going toward principal after ten years and 67% going toward principal after year 20. over 30 years you'll pay a total of $343,739, again based on an estimated monthly mortgage payment of $955. key takeaway:. The principal is the amount you borrowed and have to pay back, and interest is what the lender charges for lending you the money. for most borrowers, the total monthly payment you send to your mortgage company includes other things, such as homeowners insurance and taxes that may be held in an escrow account. if you have an escrow account, you.

Comments are closed.