Printable 941 Form For 2023 Printable Forms Free Online

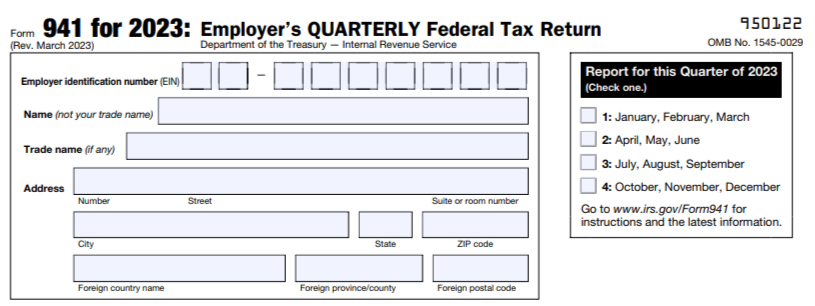

Form 941 For 2023 Pdf Printable Forms Free Online Box 4—name and address. enter your name and address as shown on form 941. enclose your check or money order made payable to “united states treasury.”. be sure to enter your ein, “form 941,” and the tax period (“1st quarter 2023,” “2nd quarter 2023,” “3rd quarter 2023,” or “4th quarter 2023”) on your check or money order. Box 4—name and address. enter your name and address as shown on form 941. enclose your check or money order made payable to “united states treasury.”. be sure to enter your ein, “form 941,” and the tax period (“1st quarter 2024,” “2nd quarter 2024,” “3rd quarter 2024,” or “4th quarter 2024”) on your check or money order.

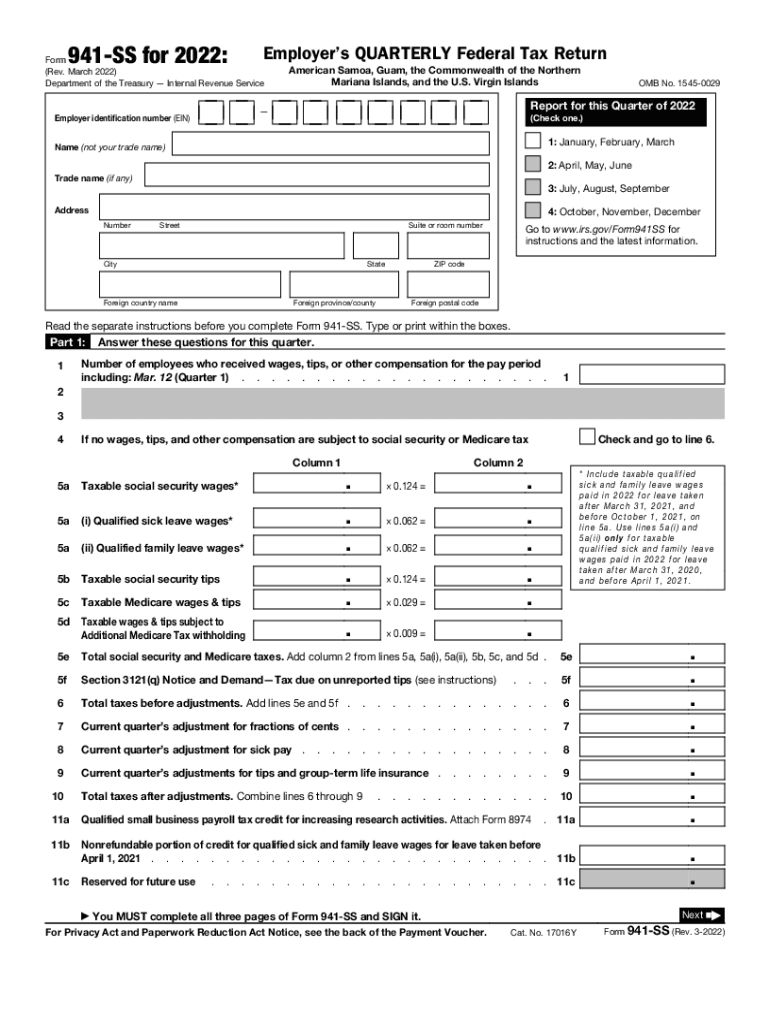

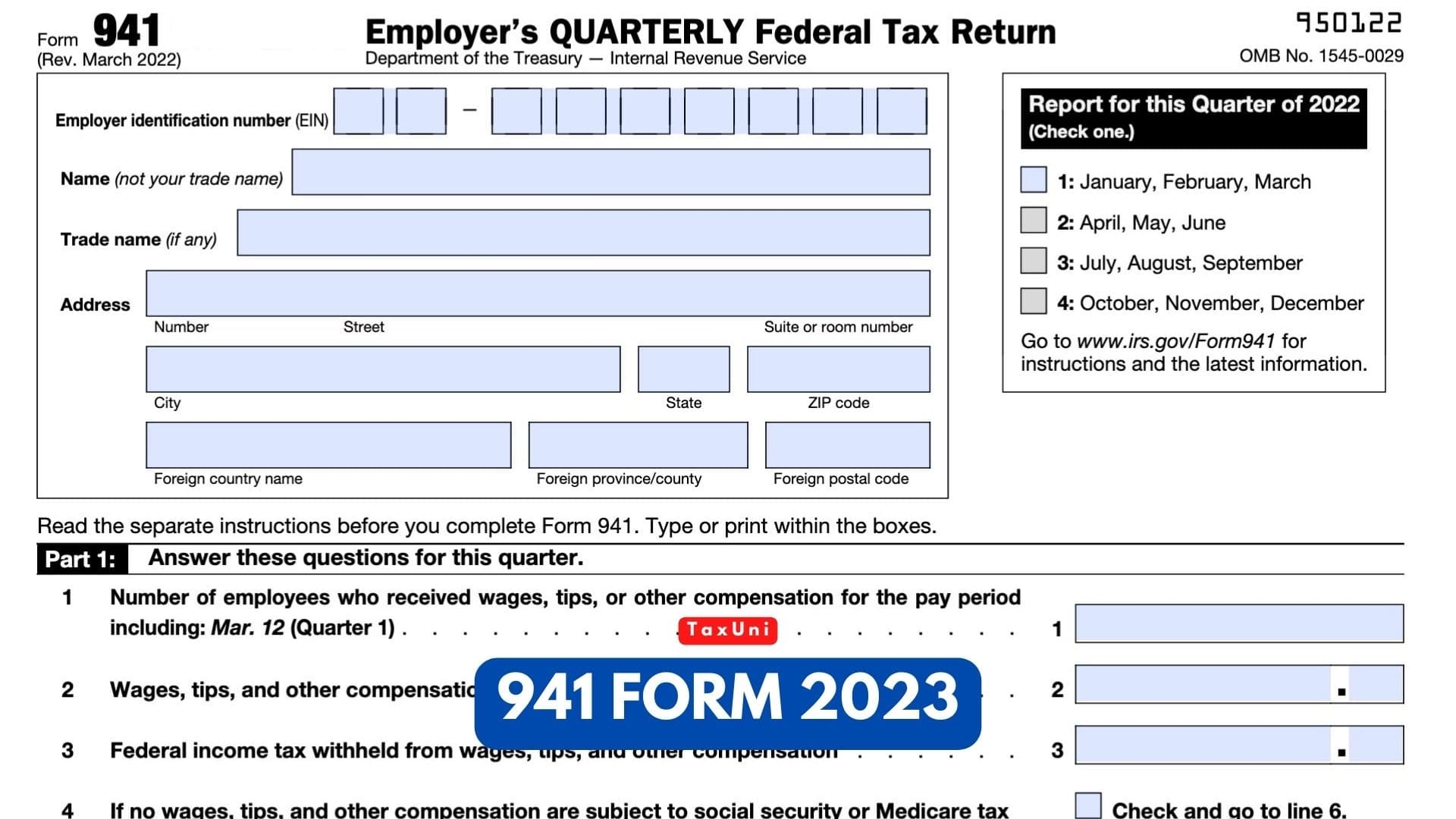

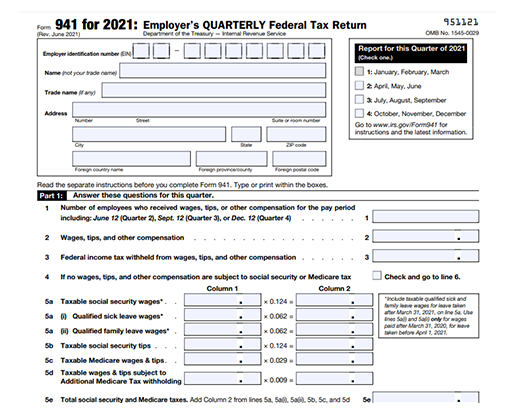

941 Form 2023 Fillable Form 2024 English. español. employers use form 941 to: report income taxes, social security tax, or medicare tax withheld from employee's paychecks. pay the employer's portion of social security or medicare tax. Download fillable irs form 941 in pdf the latest version applicable for 2024. fill out the employer's quarterly federal tax return online and print it out for free. irs form 941 is often used in u.s. department of the treasury, u.s. department of the treasury internal revenue service, united states federal legal forms, legal and united states legal forms. A form 941 (employer's quarterly federal tax return) is an irs document used by employers to report federal payroll taxes withheld from employees' wages on a quarterly basis. federal payroll taxes include income tax and the employer and employee's fica contributions to social security and medicare. pdf. More about the federal form 941. we last updated federal form 941 in january 2024 from the federal internal revenue service. this form is for income earned in tax year 2023, with tax returns due in april 2024. we will update this page with a new version of the form for 2025 as soon as it is made available by the federal government.

Fillable Form 941 2023 Printable Forms Free Online A form 941 (employer's quarterly federal tax return) is an irs document used by employers to report federal payroll taxes withheld from employees' wages on a quarterly basis. federal payroll taxes include income tax and the employer and employee's fica contributions to social security and medicare. pdf. More about the federal form 941. we last updated federal form 941 in january 2024 from the federal internal revenue service. this form is for income earned in tax year 2023, with tax returns due in april 2024. we will update this page with a new version of the form for 2025 as soon as it is made available by the federal government. Product number form 8879 emp. title irs e file signature authorization for forms 940, 940 (pr), 941, 941 (pr), 941 ss, 943, 943 (pr), 944, and 945. revision date dec 2023. posted date 12 19 2023. page last reviewed or updated: 08 oct 2024. the latest versions of irs forms, instructions, and publications. Irs forms and instructions. savings bonds and treasury securities forms. bank secrecy act forms. treasury international capital (tic) forms and instructions. alcohol and tobacco tax and trade bureau (ttb) forms. office of the comptroller of the currency forms. usa.gov forms.

Tax Form 941 For 2023 Printable Forms Free Online Product number form 8879 emp. title irs e file signature authorization for forms 940, 940 (pr), 941, 941 (pr), 941 ss, 943, 943 (pr), 944, and 945. revision date dec 2023. posted date 12 19 2023. page last reviewed or updated: 08 oct 2024. the latest versions of irs forms, instructions, and publications. Irs forms and instructions. savings bonds and treasury securities forms. bank secrecy act forms. treasury international capital (tic) forms and instructions. alcohol and tobacco tax and trade bureau (ttb) forms. office of the comptroller of the currency forms. usa.gov forms.

Form 941 For 2023 1st Quarter Printable Forms Free Online

2023 Fillable 941 Form Printable Forms Free Online

Comments are closed.