Real Income Meaning Formula Example Vs Nominal Income

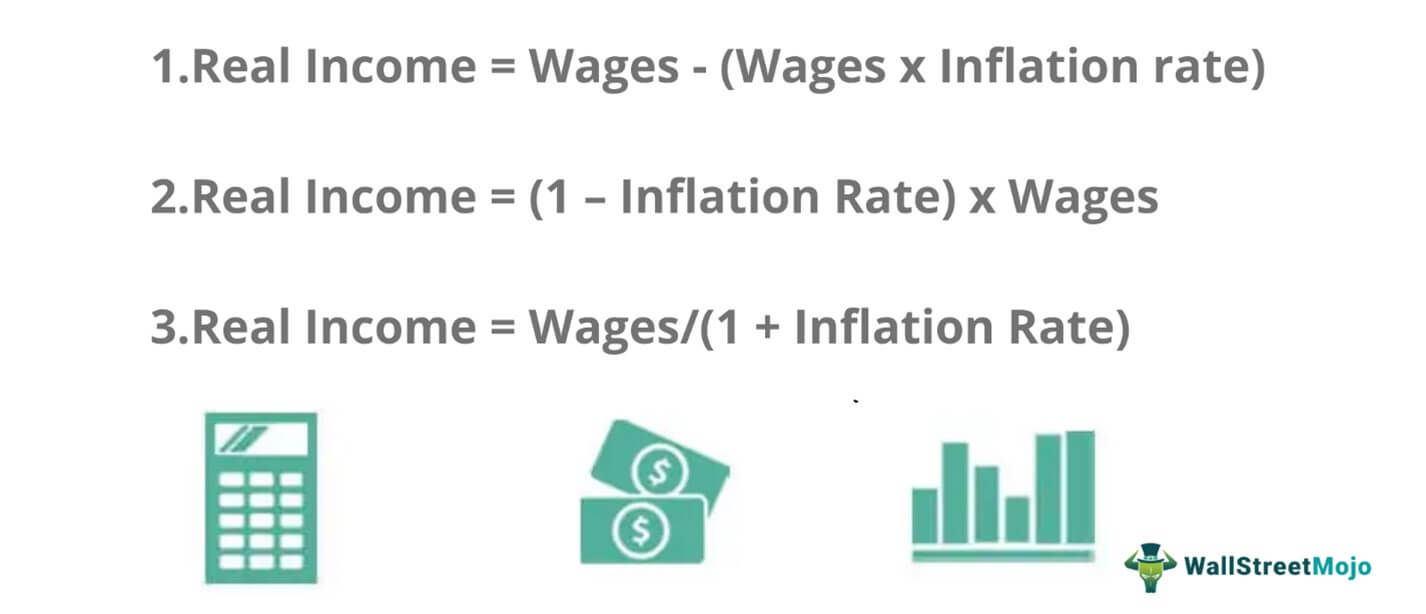

Real Income Meaning Formula Example Vs Nominal Income Real income formula. there are three common formulas for determining real income: real wage = wages (wages x inflation rate) real wage = wages (1 inflation rate) real wage = (1 – inflation rate) x wages. depending on the available variables, one of the formulas is used. The july 2024 real earnings report, for example, rate might look at the percentage of real to nominal wages or the real vs. nominal wage growth rate. on the basic real income formula.

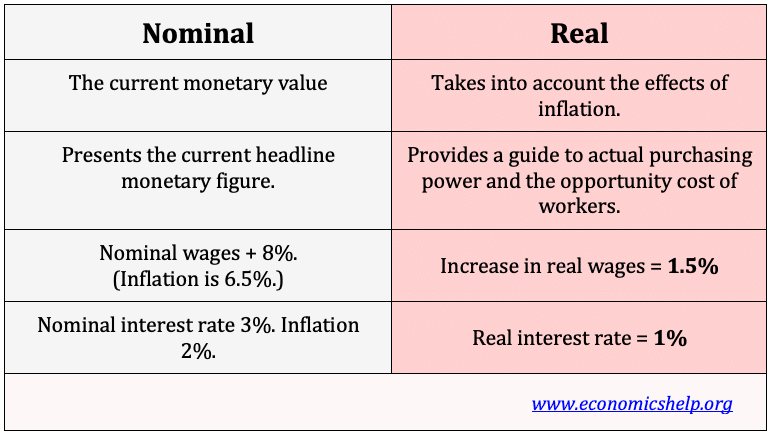

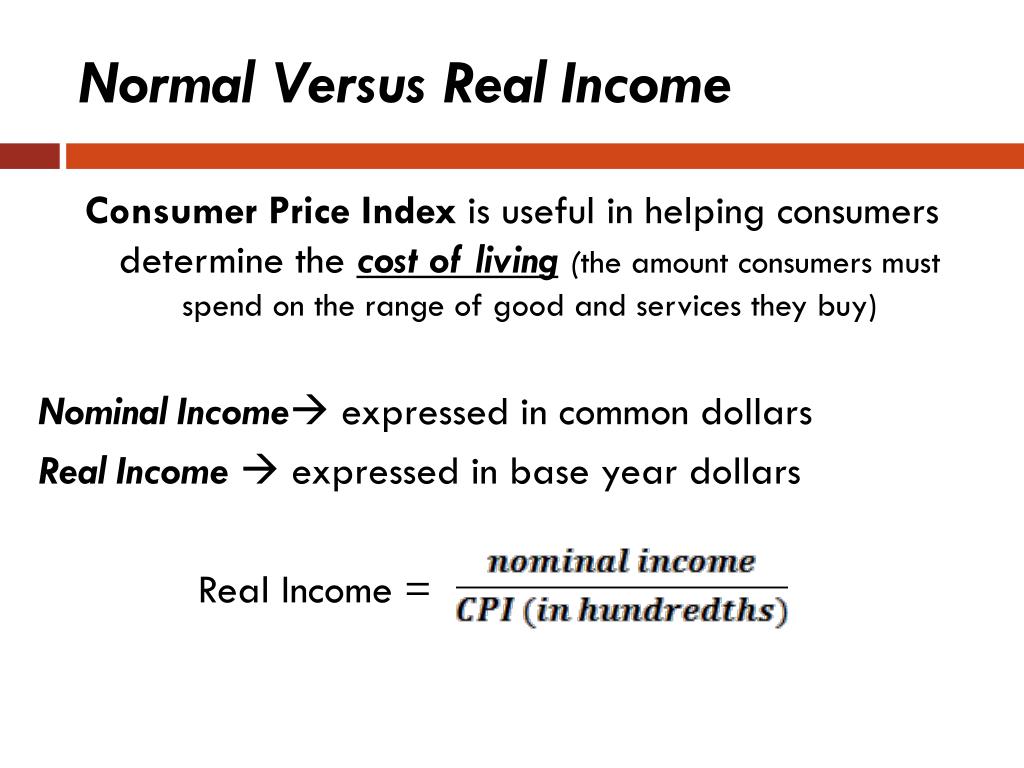

Ppt Inflation Powerpoint Presentation Id 6682252 Real values give a better guide to what you can actually buy and the opportunity costs you face. example of real vs nominal. if you receive an 8% increase in your wages from £100 to £108, this is the nominal increase. however, if inflation is 2%, then the real increase in wages is (8 2%) 6%. the real wage is a better guide to how your living. Formula: real income = (nominal income price index) x 100. let's consider a simple numerical example to illustrate the difference between nominal and real income: suppose you earn a nominal income of £50,000 in the current year (year 2). in the previous year (year 1), you earned a nominal income of £45,000. additionally, let's assume that. Even though your nominal income is unchanged at $3,000, your real income has effectively decreased because you now need $3,300 to maintain the same standard of living. this example highlights how crucial it is to understand real income to truly gauge your financial health and purchasing power. The following formula is used to calculate real income from nominal income. real income = nominal income price. for example, if the nominal income or nominal wage or salary of a person is $800 and the price of a product is $10, then the real income or real wage will be . real income = $800 $10 = 80 units of the product. it means the purchasing.

Nominal And Real Income Youtube Even though your nominal income is unchanged at $3,000, your real income has effectively decreased because you now need $3,300 to maintain the same standard of living. this example highlights how crucial it is to understand real income to truly gauge your financial health and purchasing power. The following formula is used to calculate real income from nominal income. real income = nominal income price. for example, if the nominal income or nominal wage or salary of a person is $800 and the price of a product is $10, then the real income or real wage will be . real income = $800 $10 = 80 units of the product. it means the purchasing. Definition of real income. real income refers to an individual’s purchasing power, or the goods and services that can be purchased with a given amount of money. unlike nominal income, which is the actual amount of money received, real income takes into account changes in purchasing power due to inflation or changes in the cost of living. example. Real income examples: for instance, if the nominal income is £60,000 and total deductions sum up to £10,000, with an inflation rate of 2%, the disposable real income would be £49,019.61. this shows the tangible financial impact of inflation and deductions on income.

Nominal Income Vs Real Income Ppt Powerpoint Presentation Summary Show Definition of real income. real income refers to an individual’s purchasing power, or the goods and services that can be purchased with a given amount of money. unlike nominal income, which is the actual amount of money received, real income takes into account changes in purchasing power due to inflation or changes in the cost of living. example. Real income examples: for instance, if the nominal income is £60,000 and total deductions sum up to £10,000, with an inflation rate of 2%, the disposable real income would be £49,019.61. this shows the tangible financial impact of inflation and deductions on income.

Real Vs Nominal Explained Economics Help

Ppt Chapter 10 Inflation And Unemployment Powerpoint Presentation

Comments are closed.