Retirement Account Explained For Beginners Roth Ira Roth 401k Ira

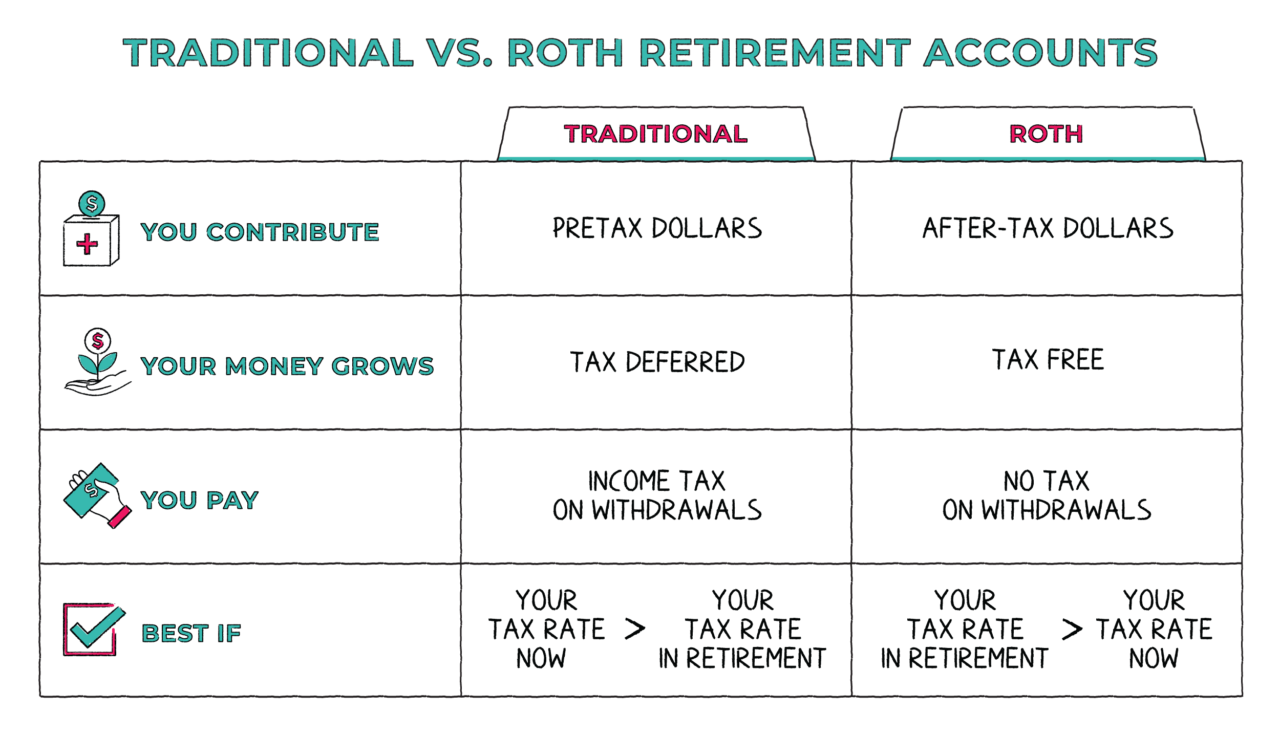

The Beginner S Guide To Retirement 401 K Ira A roth individual retirement account (ira) is a retirement account that gives you a chance to grow your money over time by investing already taxed dollars in a range of different securities, from stocks and bonds, to mutual funds, to exchange traded funds (etfs). the exact investment mix available will depend on your investing style and. The main draw of a roth ira is that the money grows tax free and can be withdrawn tax free after age 59 ½ as long as the account has been open for at least five years. the main difference between.

Retirement Account Explained For Beginners Roth Ira Roth 401k Ira A roth ira is an individual retirement plan that bears many similarities to the traditional ira, but contributions aren't tax deductible, and qualified distributions are tax free. your guide to. The bottom line. a roth ira is an individual retirement account (ira) that allows you to withdraw money (without paying a penalty) on a tax free basis after age 59½ and after you have owned the. A roth ira is a type of individual retirement account (ira) that holds investments to provide you with income in retirement. the money you contribute to a roth ira comes from earned income after. Investments personalized for you. fidelity go ® is one of several managed account services that can help you with both financial planning and investing. no minimum to open an account—invest with as little as $10 4. $0 advisory fee for balances under $25k (0.35% for balances of $25k ) 4. designed for investing goals of 3 years.

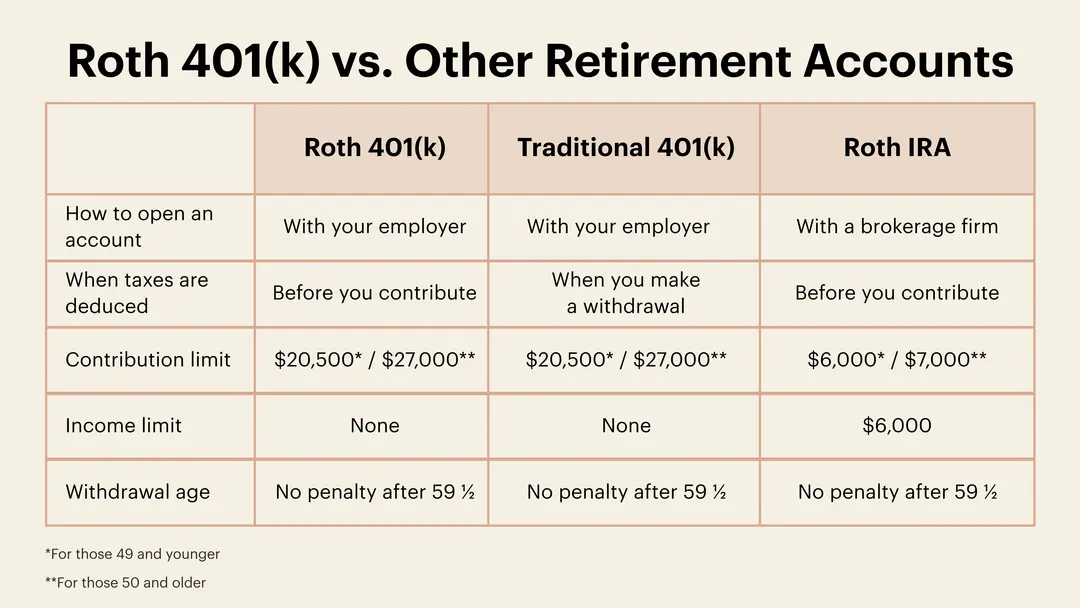

Roth 401 K Vs Roth Ira Which Is Best For You The Motley Fool A roth ira is a type of individual retirement account (ira) that holds investments to provide you with income in retirement. the money you contribute to a roth ira comes from earned income after. Investments personalized for you. fidelity go ® is one of several managed account services that can help you with both financial planning and investing. no minimum to open an account—invest with as little as $10 4. $0 advisory fee for balances under $25k (0.35% for balances of $25k ) 4. designed for investing goals of 3 years. Roth ira contributions and limits. in 2024, you can contribute up to $6,500 to a roth ira (or $7,500) if you’ll be at least age 50 by year end. beginning in 2025, a 25 year old who opens a roth ira and maxes out their contributions this year and every year going forward would have more than $1 million in their account by the time they’re 66. The roth ira contribution limit is $7,000 in both 2024 and 2025, if you are younger than age 50. if you are 50 or older, then the contribution limit increases to $8,000 for both years. that extra.

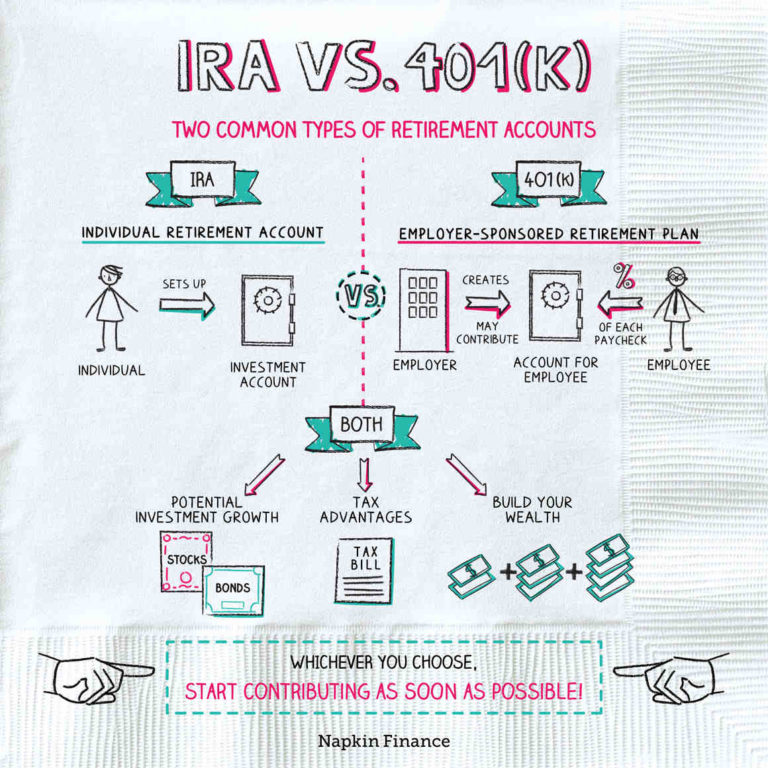

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance Roth ira contributions and limits. in 2024, you can contribute up to $6,500 to a roth ira (or $7,500) if you’ll be at least age 50 by year end. beginning in 2025, a 25 year old who opens a roth ira and maxes out their contributions this year and every year going forward would have more than $1 million in their account by the time they’re 66. The roth ira contribution limit is $7,000 in both 2024 and 2025, if you are younger than age 50. if you are 50 or older, then the contribution limit increases to $8,000 for both years. that extra.

Can I Have A Roth Ira And A 401k Investment Finance News

What Is A Roth 401 K Here S What You Need To Know Theskimm

Comments are closed.