Retirement Plan Chart 2024 Darya Sindee

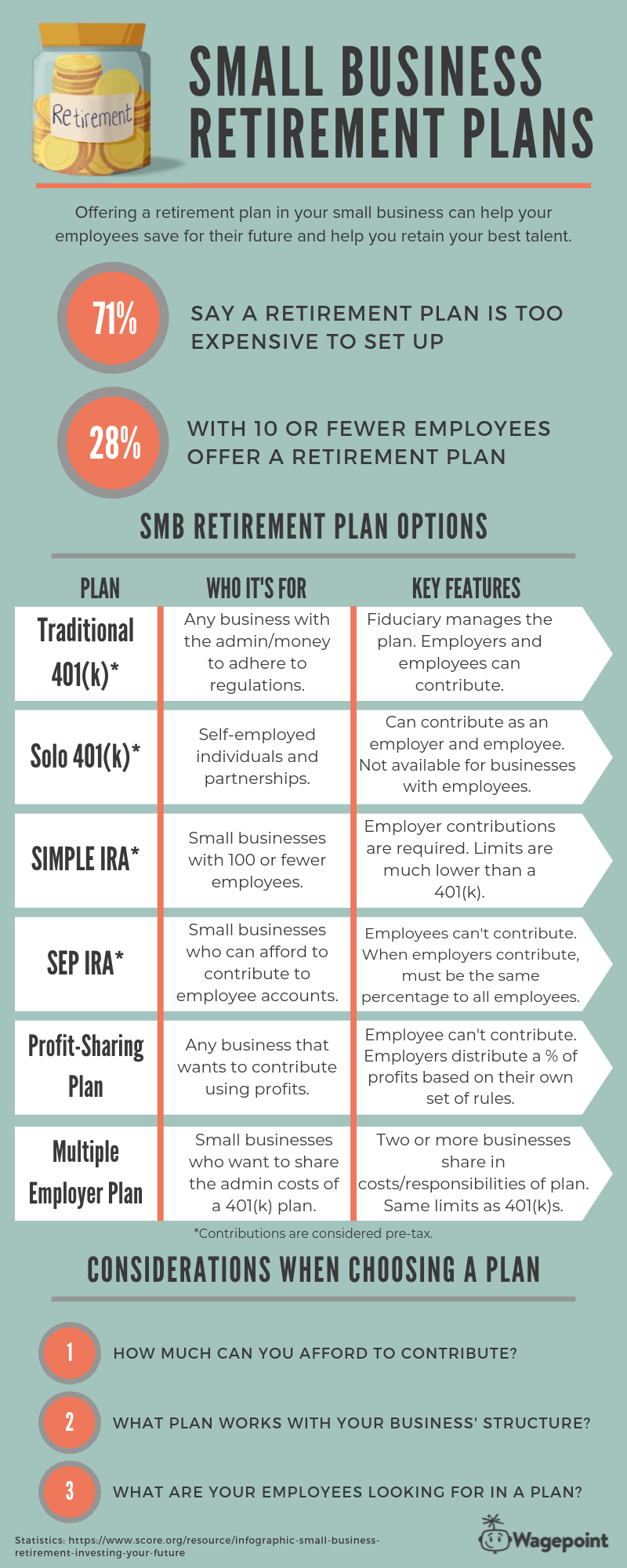

Retirement Plan Chart 2024 Darya Sindee None, unless plan is ; top heavy either . 3 % of compensation . to all eligible employees, or match 100% of the deferral amount up to 3% of compensation and 50% on deferrals of the next 2% of compensation none; yes. vesting schedule: 100 % immediate; 100 % immediate; vesting schedules available. vesting schedules available; 100% immediate vesting. 2024 retirement plan comparison chart not deposits • not insured by fdic or any other government agency • not guaranteed by the bank • subject to risk and may lose value employee withdrawals from a retirement plan made before the age of 59 1 2 may be subject to an irs penalty for early withdrawal, in addition to being subject to ordinary.

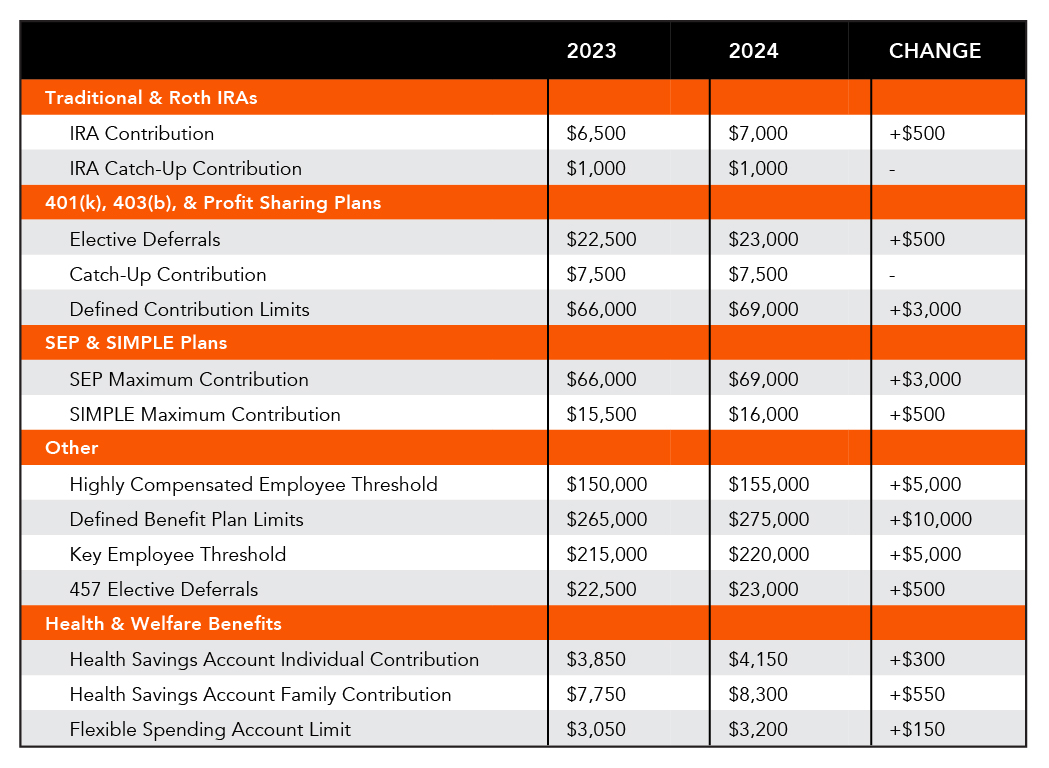

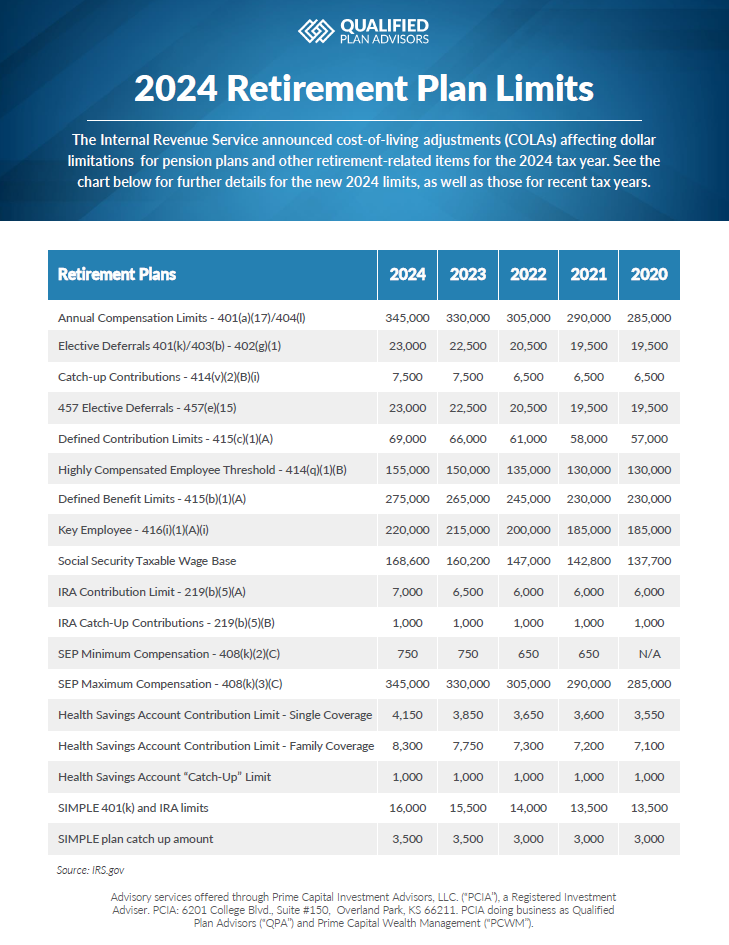

Retirement Plan Chart 2024 Darya Sindee In 2023, you can contribute up to $22,500 per year or 100% of your compensation, whichever is less. employees aged 50 and older may make additional catchup contributions of $7,500. for 2024, the. N a. employees can defer up to $23,000 per year (2024), or 100% of compensation, whichever is less. employees who are age 50 and older can defer an additional $7,500. employee and employer contributions per employee cannot exceed $69,000 or $76,500 if age 50 or older. 401 (k)s are popular retirement savings plans offered by for profit companies. employees can open a traditional 401 (k) or a roth 401 (k). traditional 401 (k)s grow with pre tax dollars, but roth. For 2024, the ability to contribute to a roth ira begins to phase out at magis of $146,000 for single filers and $230,000 for married couples filing jointly. at incomes of $161,000 and $240,000.

Retirement Plan Chart 2024 Darya Sindee 401 (k)s are popular retirement savings plans offered by for profit companies. employees can open a traditional 401 (k) or a roth 401 (k). traditional 401 (k)s grow with pre tax dollars, but roth. For 2024, the ability to contribute to a roth ira begins to phase out at magis of $146,000 for single filers and $230,000 for married couples filing jointly. at incomes of $161,000 and $240,000. 2. ira plans. an ira is a valuable retirement plan created by the u.s. government to help workers save for retirement. individuals can contribute up to $7,000 to an account in 2024, and workers. News update: on nov. 1, 2024, the irs released 2025 contribution limits for retirement accounts. in 2025, the ira contribution limit will remain the same at $7,000 ($8,000 for those 50 or older).

Retirement Plan Comparison Chart 2024 Cordy Dominga 2. ira plans. an ira is a valuable retirement plan created by the u.s. government to help workers save for retirement. individuals can contribute up to $7,000 to an account in 2024, and workers. News update: on nov. 1, 2024, the irs released 2025 contribution limits for retirement accounts. in 2025, the ira contribution limit will remain the same at $7,000 ($8,000 for those 50 or older).

Plan Sponsor Update 2024 Retirement Employee Benefit Plan Limits

2024 Retirement Plan Limits Qualified Plan Advisors Qpa

Comments are closed.