Retirement Plan Comparison Simple Ira Vs 401 K Focus Hr Inc

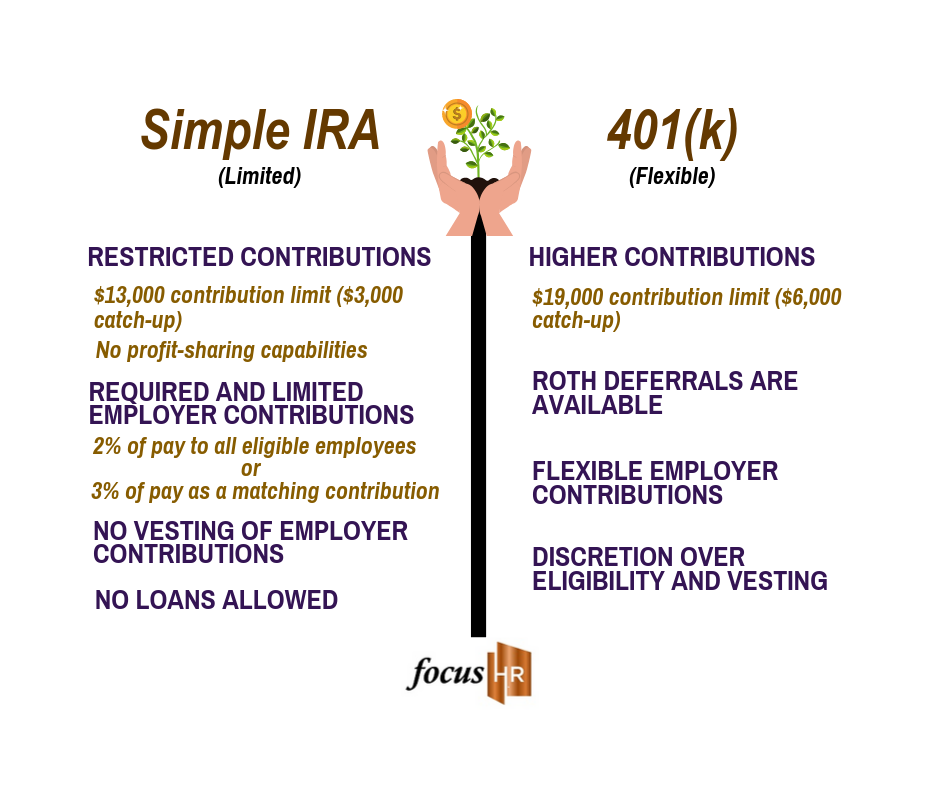

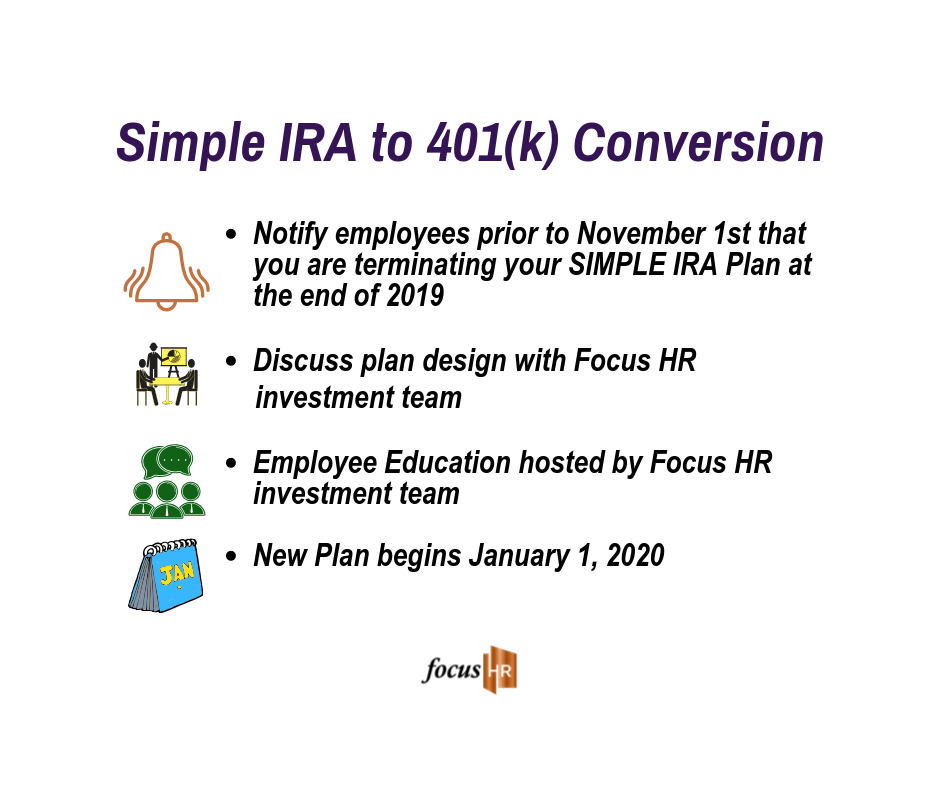

Retirement Plan Comparison Simple Ira Vs 401 K Focus Hr Inc This is the perfect time to select and implement a new plan. here are the four steps: to speak with the focus hr, inc. investment team about your needs in a retirement plan click here. there are important differences between a simple ira plan and the 401 (k.) when it comes to winning the recruiting war, pick your employees' retirement plan wisely. The simple ira vs. 401 (k) decision is, at its core, a choice between simplicity and flexibility for employers. the aptly named simple ira, which stands for savings incentive match plan for.

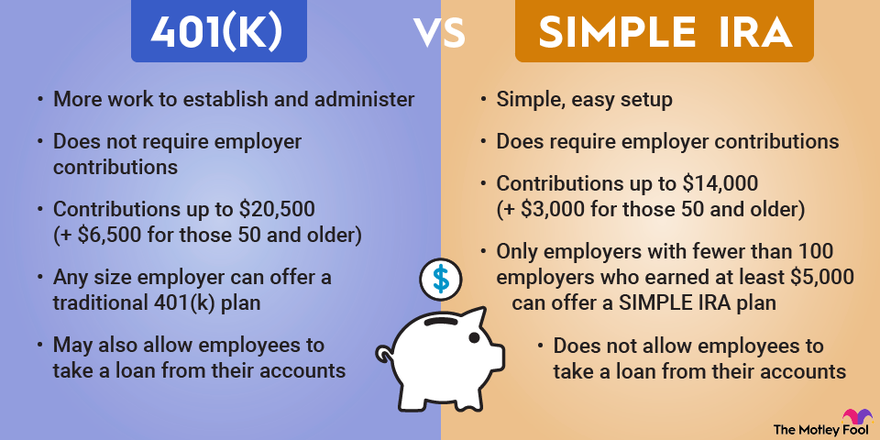

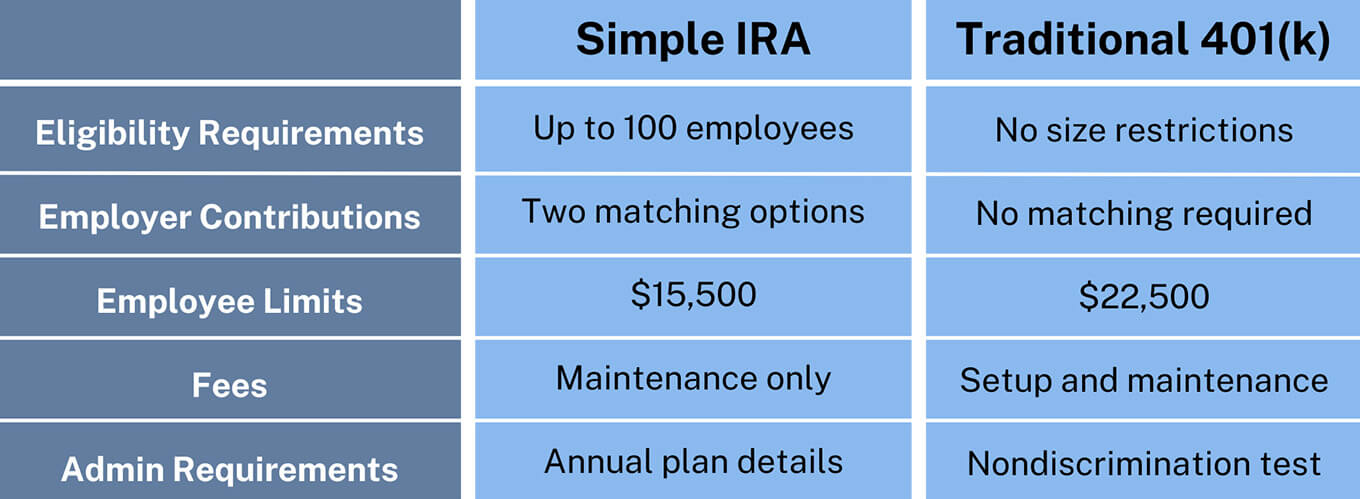

Retirement Plan Comparison Simple Ira Vs 401 K Focus Hr Inc The contribution limit into 401 (k)s for employee salary deferrals is $23,000 in 2024 (up from $22,500 in 2023) $7,000 more than a simple ira. those older than 50 are able to contribute up to. Simple ira vs. simple 401 (k): what's the difference? while simple iras and simple 401 (k)s are very similar retirement plans offered by small businesses, they have a few subtle differences you should know. We’ll also provide a chart that compares some of the features of 401(k), 403(b), solo 401(k), simple ira, and sep ira plans. 401(k): the employer sponsored retirement plan. a 401(k), which is widely used across the united states, is a tax advantaged retirement savings account provided by employers. Contribution limits. in 2024, a simple ira allows employees to contribute up to $16,000 and $19,500 if they are 50 or older. on the employer side, a 2% matching contribution is allowed on employee compensation up to a maximum of $345,000. with a 401 (k), employees can contribute up to $23,000 per year and $30,500 if they are 50 or older.

401 K Vs Simple Ira What S The Difference The Motley Fool We’ll also provide a chart that compares some of the features of 401(k), 403(b), solo 401(k), simple ira, and sep ira plans. 401(k): the employer sponsored retirement plan. a 401(k), which is widely used across the united states, is a tax advantaged retirement savings account provided by employers. Contribution limits. in 2024, a simple ira allows employees to contribute up to $16,000 and $19,500 if they are 50 or older. on the employer side, a 2% matching contribution is allowed on employee compensation up to a maximum of $345,000. with a 401 (k), employees can contribute up to $23,000 per year and $30,500 if they are 50 or older. Simple 401 (k) the simple 401 (k) plan is a cross between a simple ira and a traditional 401 (k) plan and offers some features of both plans. for both the simple ira and the simple 401 (k. One of the biggest differences between a simple ira vs 401 (k), though, is the annual contribution limit. for the 2023 calendar year, you can contribute up to $15,500 to a simple ira, or $19,000 for those 50 or older. these limits increase to $16,000 and $19,500 in 2024. the contribution limit is higher with a 401 (k), with $22,500 as a limit.

Simple Ira Vs 401k Choose The Right Plan For Your Business Simple 401 (k) the simple 401 (k) plan is a cross between a simple ira and a traditional 401 (k) plan and offers some features of both plans. for both the simple ira and the simple 401 (k. One of the biggest differences between a simple ira vs 401 (k), though, is the annual contribution limit. for the 2023 calendar year, you can contribute up to $15,500 to a simple ira, or $19,000 for those 50 or older. these limits increase to $16,000 and $19,500 in 2024. the contribution limit is higher with a 401 (k), with $22,500 as a limit.

Simple Ira Vs 401 K Which Is Right For My Small Business

Retirement Plan Comparison Simple Ira Vs 401 K Focus Hr Inc

Comments are closed.