Retirement Plans For Small Business Owners Sep And Simple

Sep Simple And Individual K Plans Navigating The Retirement Plan Sep ira: self employed individual or small business owner, primarily those with only a few employees. 1. fidelity advantage 401(k): small and medium sized businesses looking to offer a 401(k) for the first time. simple ira: self employed individuals or businesses with 100 or fewer employees. Read it carefully. fidelity brokerage services llc, member nyse, sipc, 900 salem street, smithfield, ri 02917. 903811.16.0. simplified employee pension plans (sep iras) from fidelity help small business employees and self employed individuals save for retirement and take advantage of tax benefits.

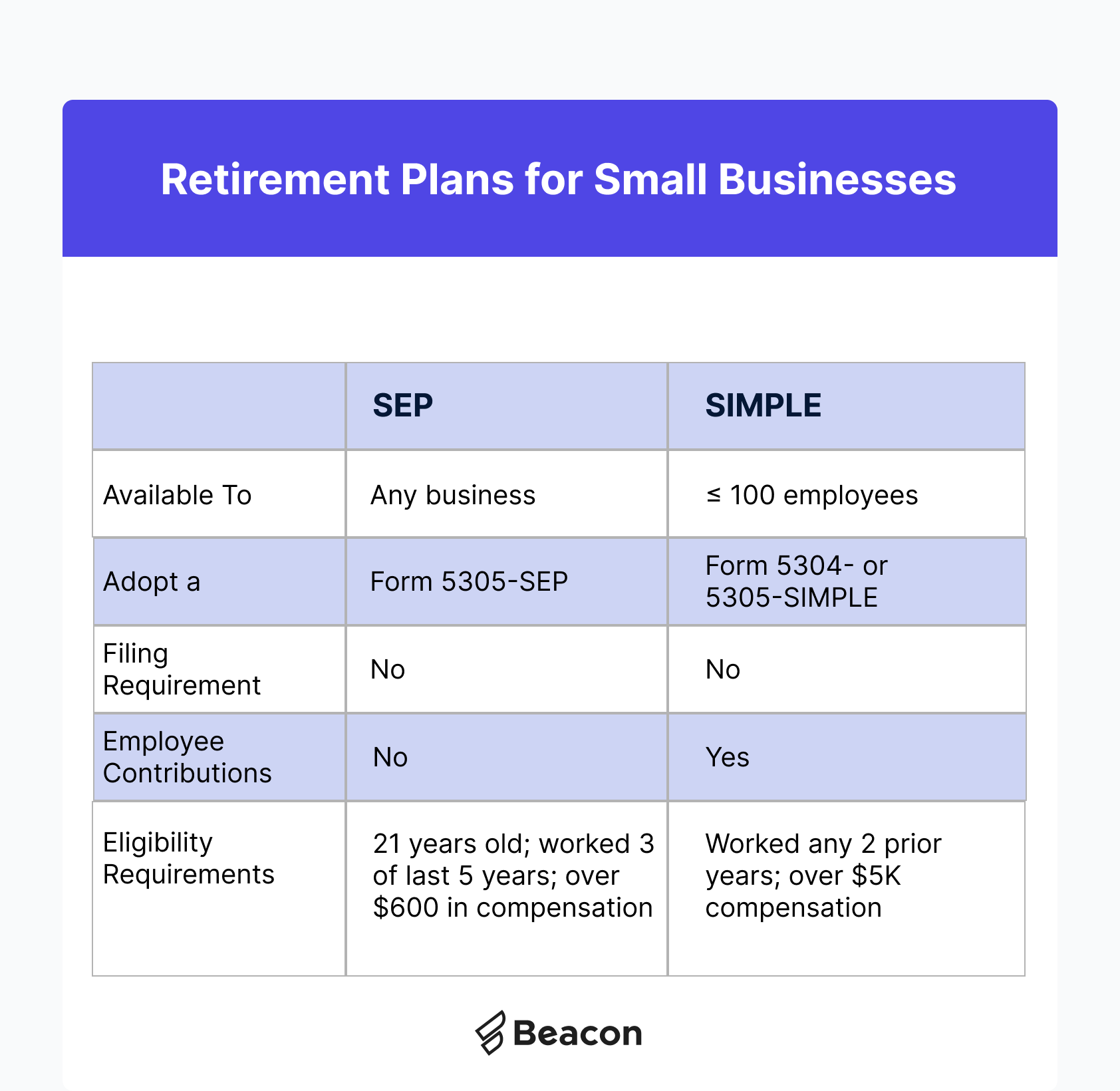

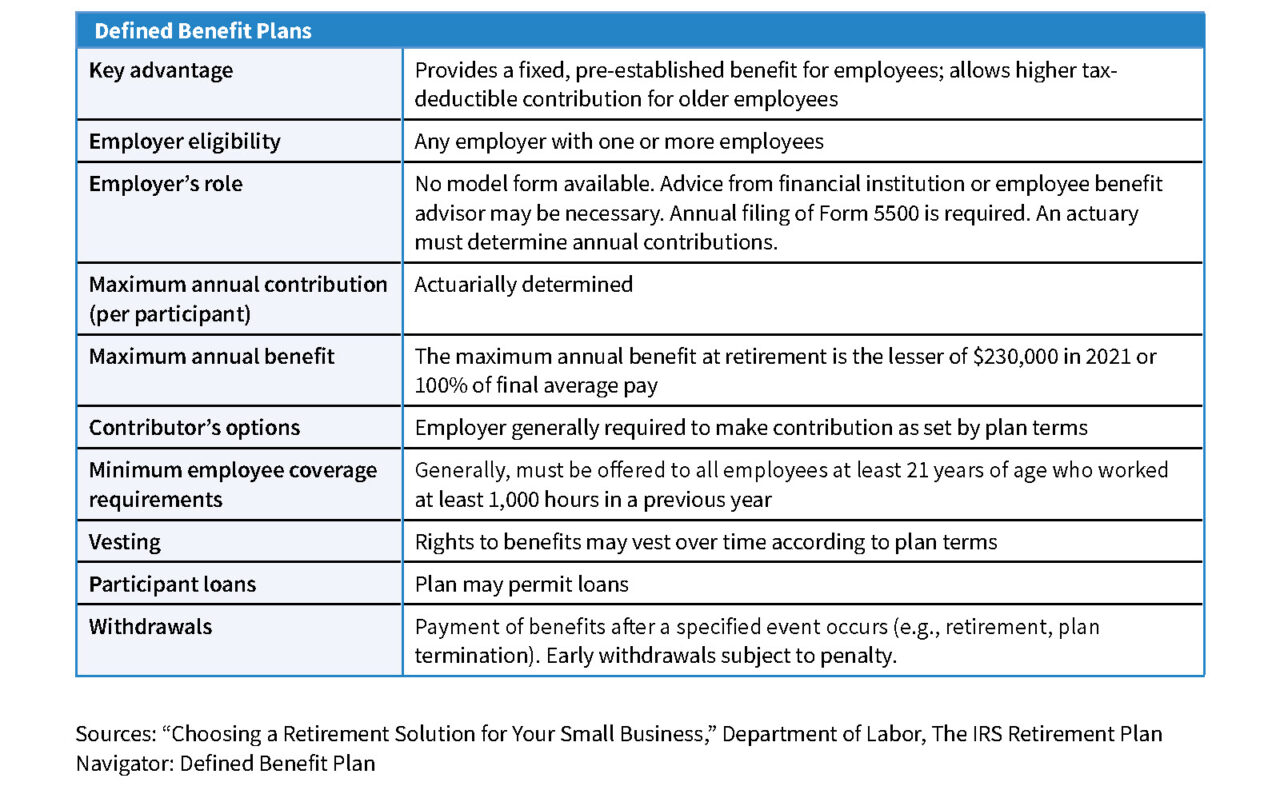

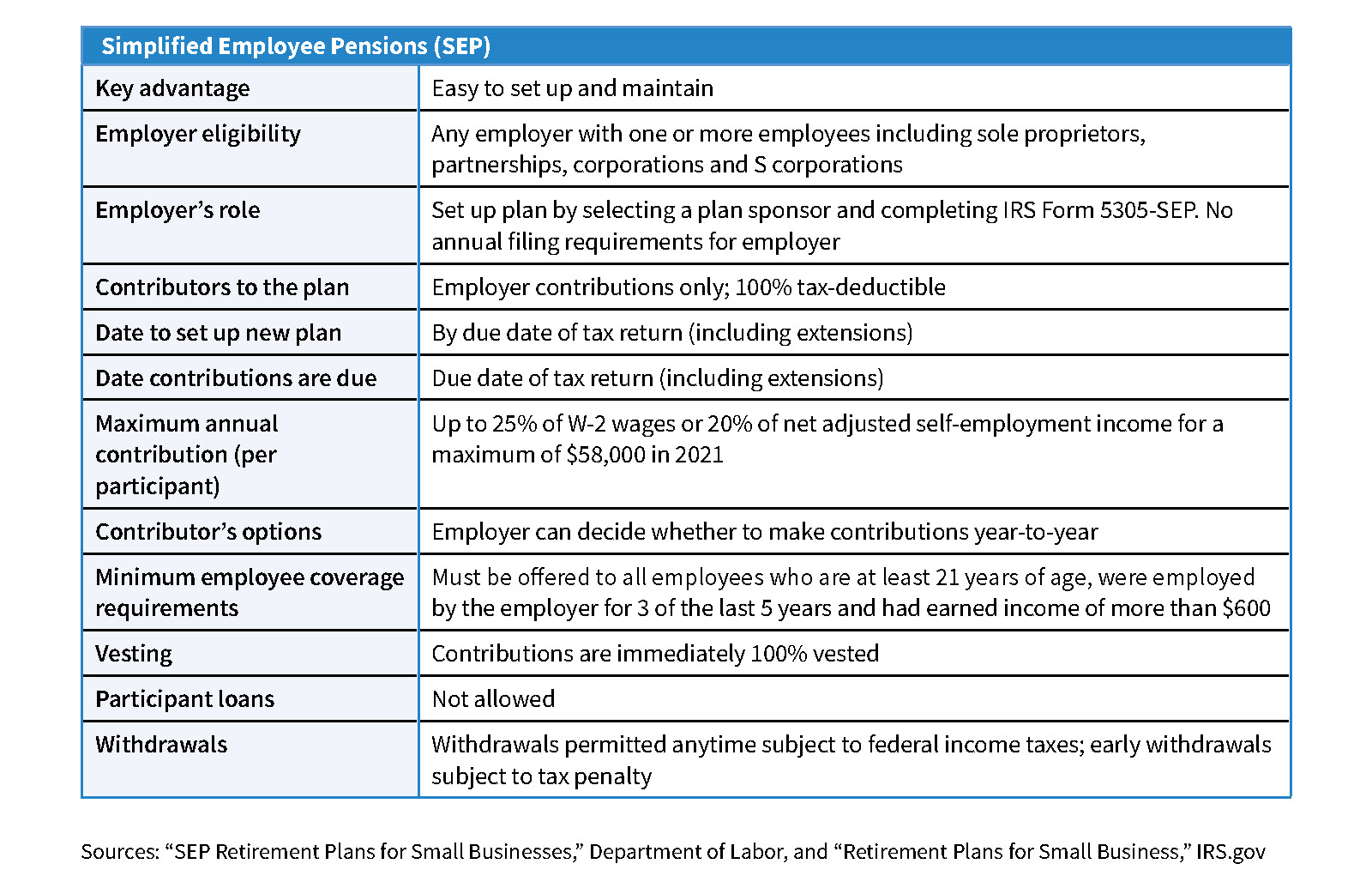

Retirement Plans For Small Businesses Sep Vs Simple 855 490 4668. open a vanguard sep ira. other plan types for small business owners can be opened directly through ascensus. visit their website to learn more. go to ascensus. vanguard is only responsible for content on our own website. all investing is subject to risk, including the possible loss of the money you invest. Small businesses that want to provide a retirement benefit to all employees (including the business owners) solely through employer contributions. none. for 2024, up to $23,000, not to exceed 100% of compensation. roth contributions are accepted. for 2024, up to $16,000, not to exceed 100% of compensation. none. Sales are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. there are costs associated with owning etfs. to learn more about merrill pricing, visit our pricing page. a simplified employee pension plan (sep) ira is a flexible retirement plan for business owners, employees, and self employed people. The retirement landscape. the three most common small business retirement plan options are: 401 (k) sep ira. simple ira. 401 (k) a 401 (k) plan gives employees a tax break on money they contribute. contributions are automatically withdrawn from employee paychecks and invested. the investment options within the plan are selected by you as the.

Retirement Plans For Small Business Owners Sep Iras Taxed Right Sales are subject to a transaction fee of between $0.01 and $0.03 per $1,000 of principal. there are costs associated with owning etfs. to learn more about merrill pricing, visit our pricing page. a simplified employee pension plan (sep) ira is a flexible retirement plan for business owners, employees, and self employed people. The retirement landscape. the three most common small business retirement plan options are: 401 (k) sep ira. simple ira. 401 (k) a 401 (k) plan gives employees a tax break on money they contribute. contributions are automatically withdrawn from employee paychecks and invested. the investment options within the plan are selected by you as the. Employers may contribute up to 25% of each eligible employee's income, but no more than $69,000 per person for 2024 (or $66,000 if the contribution is for 2023). the business owner has complete flexibility in contributions, as long as each employee (including the owner) receiving a contribution meets the plan eligibility requirements in the . Schedule an appointment. 4 contribution and compensation limits are subject to a cost of living adjustment annually pursuant to the internal revenue code. contribution and compensation limits for subsequent years may vary. if you're self employed or a business owner with employees, compare our tax advantaged retirement plans for small businesses.

A Quick Guide To Retirement Plans For Small Business Owners Lifetime Employers may contribute up to 25% of each eligible employee's income, but no more than $69,000 per person for 2024 (or $66,000 if the contribution is for 2023). the business owner has complete flexibility in contributions, as long as each employee (including the owner) receiving a contribution meets the plan eligibility requirements in the . Schedule an appointment. 4 contribution and compensation limits are subject to a cost of living adjustment annually pursuant to the internal revenue code. contribution and compensation limits for subsequent years may vary. if you're self employed or a business owner with employees, compare our tax advantaged retirement plans for small businesses.

A Quick Guide To Retirement Plans For Small Business Owners Lifetime

Small Business Retirement Plans What To Know 2023

Comments are closed.