Sep Ira 2020 Retirement Accounts Explained Simple Ira Individual 401k

Sep Ira 2020 Retirement Accounts Explained Simple Ira Have you ever wondered about the different types of retirement plans? deciding which retirement account is best for you can feel overwhelming. quite a bit. The solo 401 (k) annual contribution maximum in 2023 is $66,000 and $69,000 in 2024. unlike sep iras, people age 50 and older can make additional catch up contributions of up to $7,500 a year to a.

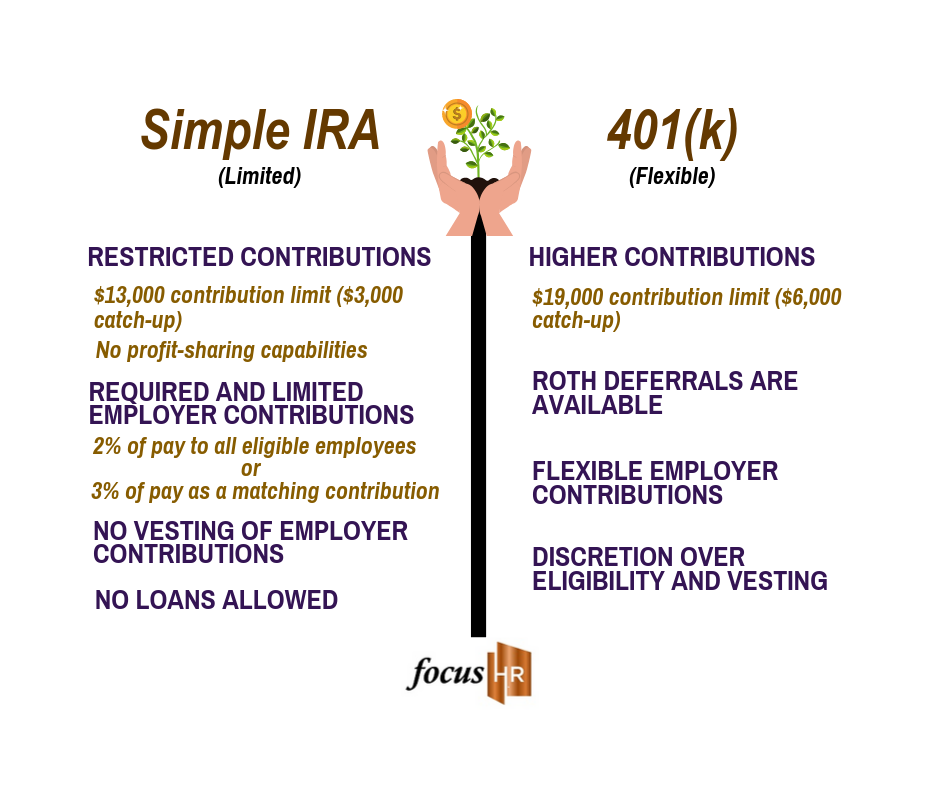

Retirement Plan Comparison Simple Ira Vs 401 K Focus Hr Inc Simple iras and sep iras are both tax advantaged retirement accounts, and each has their own pros and cons. let's compare which is right for you. The first is that although both accounts have the same maximum contribution limit ($69,000 in 2024), you can contribute the maximum to a solo 401(k) at a lower income level than a sep ira. A solo 401 (k) could allow you to save more for retirement on a tax advantaged basis compared to a sep ira. a solo 401 (k) allows catch up contributions if you are 50 or older, and you can also take loans from a solo 401 (k). just be aware that a solo 401 (k) can be more work to set up and maintain than a sep ira. Self employed people may be able to save more in a solo 401 (k) than they can in a sep ira. solo 401 (k)s let you make both employee and employer contributions, meaning you can contribute up to.

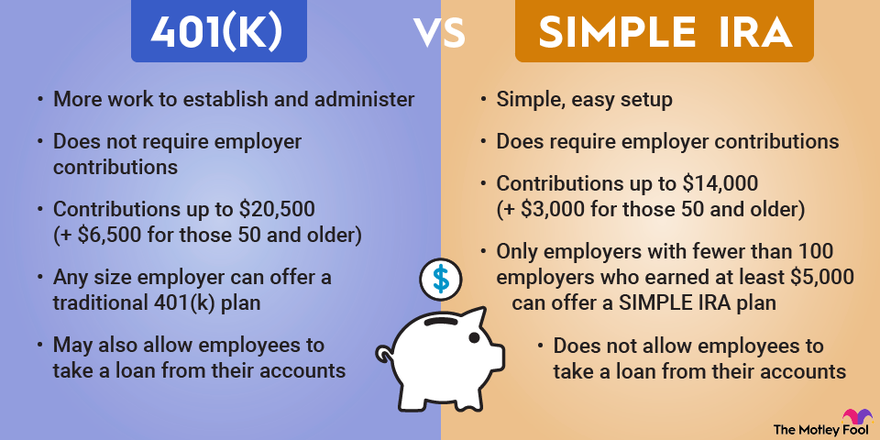

401 K Vs Simple Ira What S The Difference The Motley Fool A solo 401 (k) could allow you to save more for retirement on a tax advantaged basis compared to a sep ira. a solo 401 (k) allows catch up contributions if you are 50 or older, and you can also take loans from a solo 401 (k). just be aware that a solo 401 (k) can be more work to set up and maintain than a sep ira. Self employed people may be able to save more in a solo 401 (k) than they can in a sep ira. solo 401 (k)s let you make both employee and employer contributions, meaning you can contribute up to. High contribution limit. just as with a regular 401(k), an individual can contribute up to $23,000 as the employee to a solo 401(k) account in 2024 ($22,500 in 2023).those 50 and older make an. A sep ira allows significantly higher contributions, $69,000 in 2024, compared to the smaller contributions for a simple ira which are $16,000 in 2024. lastly, simple iras are only available to.

Comments are closed.