Sep Simple And Individual K Plans Navigating The Retirement Plan

Sep Simple And Individual K Plans Navigating The Retirement Plan Additionally, eligible employers may not offer any other type of employer sponsored retirement plan. individual(k) plans. an individual(k) plan is an owner only 401(k) profit sharing plan that, like simple ira plans, allows both employer and employee plan contributions. unlike conventional 401(k) plans, individual(k) plans are not subject to. The annual contribution limit per employee is the lesser of. 25 percent of the employee’s compensation (up to a defined compensation cap) or. $66,000 for 2023 ($69,000 for 2024). sep plan contributions and earnings are tax deferred and subject to the same rules as traditional iras, especially when moving, withdrawing, or converting the assets.

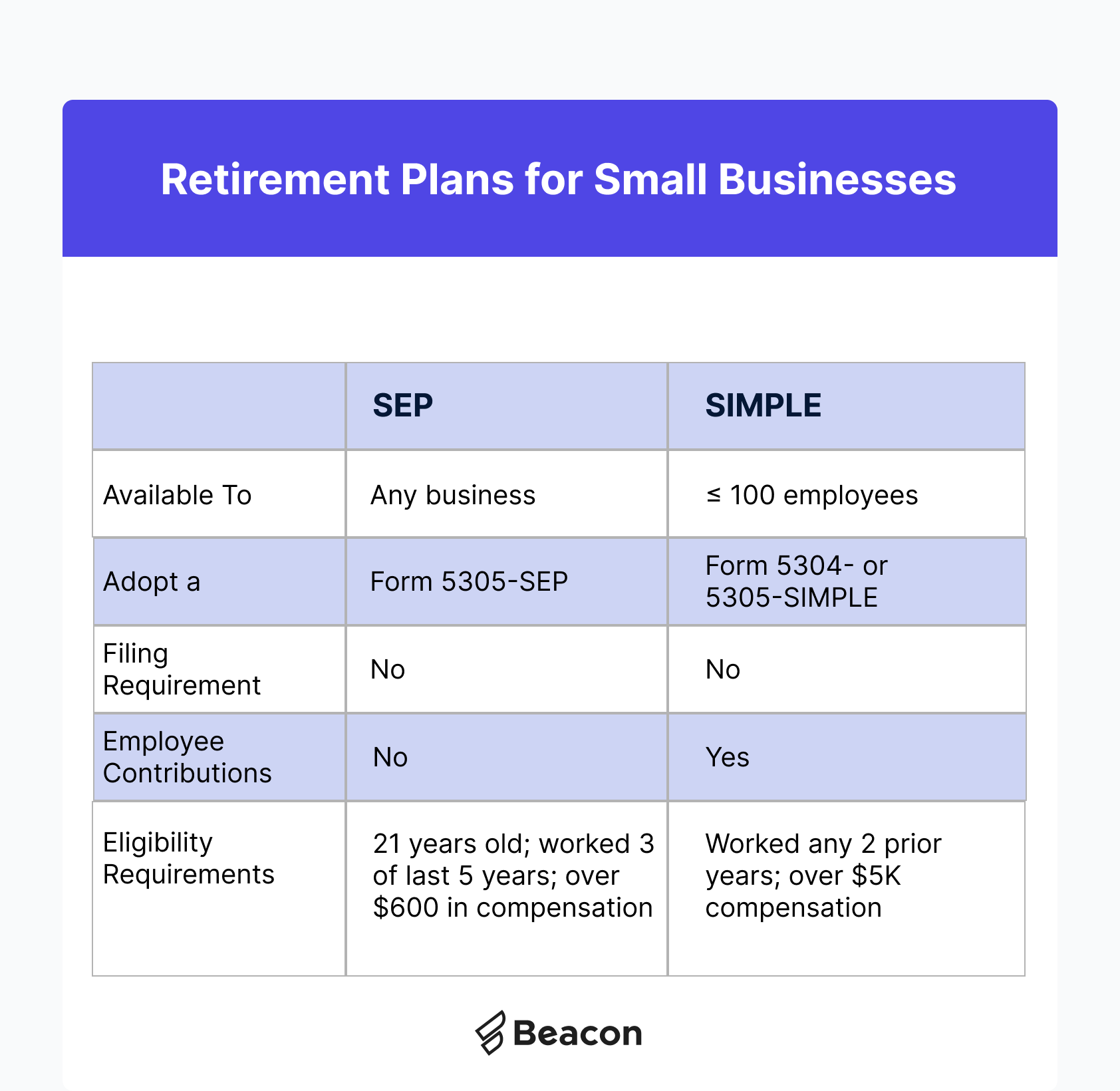

Retirement Plans For Small Businesses Sep Vs Simple For each plan year the employer will contribute an amount to be determined from year to year. option 2: fixed percent of profits formula. percent of the employer’s profits that are in excess of $ . option 3: not applicable. the employer will not make employer contributions to this plan. We’ll also provide a chart that compares some of the features of 401(k), 403(b), solo 401(k), simple ira, and sep ira plans. 401(k): the employer sponsored retirement plan. a 401(k), which is widely used across the united states, is a tax advantaged retirement savings account provided by employers. The simple ira vs. 401 (k) decision is, at its core, a choice between simplicity and flexibility for employers. the aptly named simple ira, which stands for savings incentive match plan for. For example, at net earnings of $50,000, a person 50 or older can contribute as much as $42,500 to an individual 401 (k). this contribution amount for 2023 includes: the maximum individual.

Infographics Sep Simple And Individual 401 K Employer Sponsored The simple ira vs. 401 (k) decision is, at its core, a choice between simplicity and flexibility for employers. the aptly named simple ira, which stands for savings incentive match plan for. For example, at net earnings of $50,000, a person 50 or older can contribute as much as $42,500 to an individual 401 (k). this contribution amount for 2023 includes: the maximum individual. Key differences: sep ira vs simple ira. flexible; limited annually to the lesser of $69,000 for 2024 or 25% of compensation. employers don’t have to contribute every year, but when they do, they must contribute to all participants who performed services during the year for which the contributions are made. 855 490 4668. open a vanguard sep ira. other plan types for small business owners can be opened directly through ascensus. visit their website to learn more. go to ascensus. vanguard is only responsible for content on our own website. all investing is subject to risk, including the possible loss of the money you invest.

Sep Simple And Individual K Plans Navigating The Retirement Plan Key differences: sep ira vs simple ira. flexible; limited annually to the lesser of $69,000 for 2024 or 25% of compensation. employers don’t have to contribute every year, but when they do, they must contribute to all participants who performed services during the year for which the contributions are made. 855 490 4668. open a vanguard sep ira. other plan types for small business owners can be opened directly through ascensus. visit their website to learn more. go to ascensus. vanguard is only responsible for content on our own website. all investing is subject to risk, including the possible loss of the money you invest.

How Sep Simple And Owner Only 401 K Plans Stack Up Ascensus

_Plan.png#keepProtocol)

Simplified Employee Pension Sep Plan How It Works Pros Cons

Comments are closed.