Small Business Commercial Letter Of Credit Wells Fargo

Small Business Commercial Letter Of Credit Wells Fargo Call us at 1 844 807 5060 mon – fri: 5:00am – 5:00pm pt. wells fargo bank, n.a. member fdic. qsr 04132025 6021922.1.1. lrc 1023. the wells fargo commercial letter of credit provides backing for international and domestic trade so you can focus on growing your business. Offer valid 10 01 2022 06 30 2023. for customers who select the wells fargo business card rewards ® points based rewards program: to earn the one time 30,000 bonus points, a total of at least $3,000 in qualifying purchases (purchases less returns and credits, and excluding balance transfers, cash advances, and superchecks tm transactions, or any fees or interest posted to the account) must.

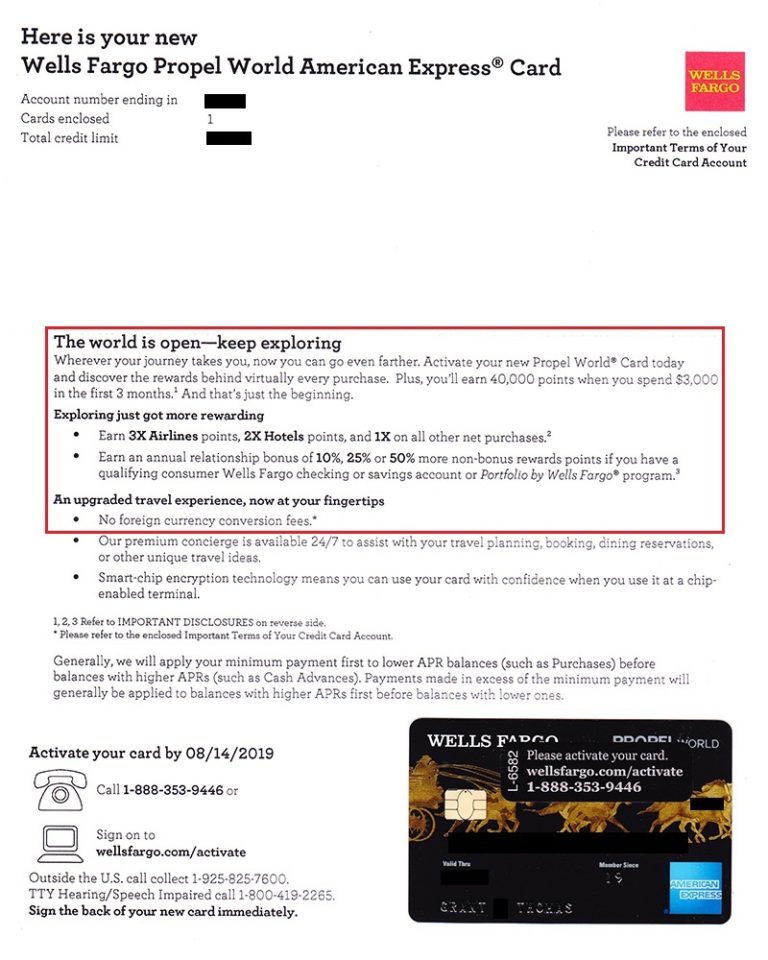

Unboxing Wells Fargo Propel World Credit Card Card Art Welcome Fees. call to learn about the fees associated with a letter of credit. call us at 1 844 807 5060 mon – fri: 5:00am – 5:00pm pt. wells fargo bank, n.a. member fdic. a standby letter of credit secured by wells fargo deposits ensures that you have the products and resources you need to expand your small business. Wells fargo is one example of a lender that offers letters of credit. you can apply for a commercial or a standby letter of credit, both of which are secured by deposits you have with the bank. the provider also offers other lending and banking services that you can utilize as a small business owner. visit wells fargo. frequently asked. These are some of the stages that your application may go through before you hear back from the lender. 1. initial verification. the first group to handle the credit application will check the facts. this group will ensure that the information on the credit application is accurate and that the lender has all the necessary data to make a decision. Qsr 09262025 6507364.1.1. lrc 0324. we're here to help you reach your business goals. get help finding the business accounts, financing, merchant services and resources for your small business.

Unboxing Wells Fargo Business Platinum Credit Card Card Art Slow These are some of the stages that your application may go through before you hear back from the lender. 1. initial verification. the first group to handle the credit application will check the facts. this group will ensure that the information on the credit application is accurate and that the lender has all the necessary data to make a decision. Qsr 09262025 6507364.1.1. lrc 0324. we're here to help you reach your business goals. get help finding the business accounts, financing, merchant services and resources for your small business. Gather financial documents. before filling out your application, locate this information and double check it for accuracy: business revenue reports. personal income reports. tax returns for the past three years. asset and bank account information. proof of ownership. the full legal name of your business. (fees for commercial letters varies.) wells fargo also issues higher amounts through their international business department. types of letters of credit. while we’ve explained the letter of credit, the transaction isn’t always handled the same way each time. in fact, there are a few different variations of the process. commercial letter of.

Comments are closed.