Small Business Owners Do You Know Your Retirement Plan Options

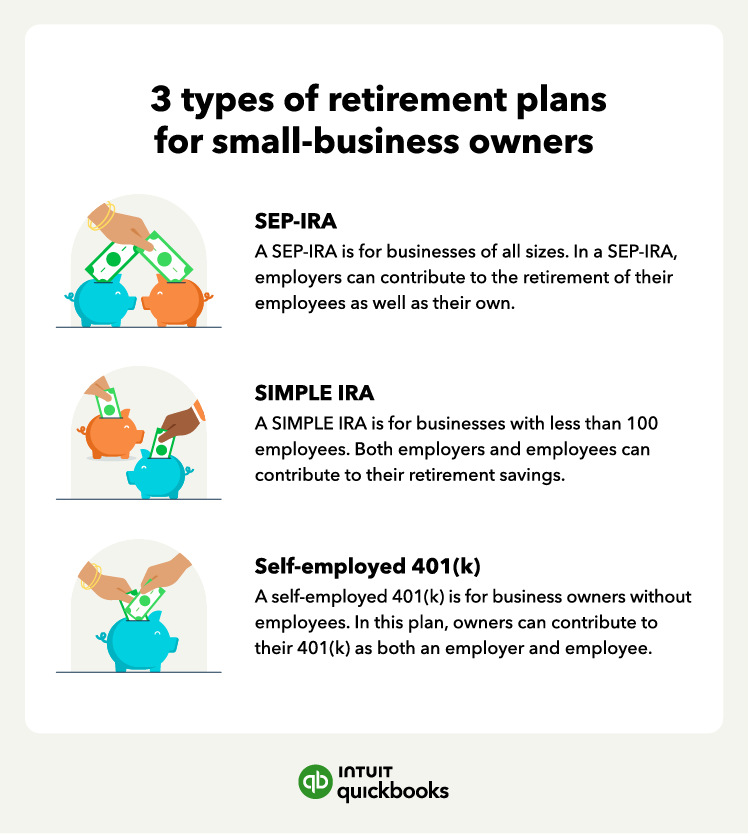

How To Retire As A Small Business Owner In 2023 Quickbooks Best for: self employed people or small business owners with no or few employees. contribution limit: the lesser of $69,000 in 2024, or up to 25% of compensation or net self employment earnings. Small business retirement plans. understand retirement planning options that help you keep more of what you earn, while also investing in your future. help take the guesswork out of which plan could be right for you with a 5 minute quiz. launch the small business plan selector. explore our plans. compare plans.

Sep Simple And Individual K Plans Navigating The Retirement Plan Contributions are 100% vested. self employed people who choose this plan can contribute to it as both employee and employer. 2023 contribution limit: $15,500 for employees; employees who are 50. Small businesses that want to provide a retirement benefit to all employees (including the business owners) solely through employer contributions. none. for 2024, up to $23,000, not to exceed 100% of compensation. roth contributions are accepted. for 2024, up to $16,000, not to exceed 100% of compensation. none. Dol has a toll free publication hotline (1 866 444 3272) to distribute publications geared to educating participants and employers about saving and protecting their benefits. the saving matters initiative, part of the u.s. department of labor's retirement savings education campaign, provides resources for employers and workers on retirement saving. See the irs's website. (link is external) for annual updates. $6,500 for 2023 and $7,000 for 2024. participants age 50 or over can make additional contributions up to $1,000. up to 25% of compensation(1) but no more than $66,000 for 2023 and $69,000 for 2024. employee: $15,500 in 2023 and $16,000 in 2024.

Best Retirement Plans For Small Business Owners In 2024 Idfc First Bank Dol has a toll free publication hotline (1 866 444 3272) to distribute publications geared to educating participants and employers about saving and protecting their benefits. the saving matters initiative, part of the u.s. department of labor's retirement savings education campaign, provides resources for employers and workers on retirement saving. See the irs's website. (link is external) for annual updates. $6,500 for 2023 and $7,000 for 2024. participants age 50 or over can make additional contributions up to $1,000. up to 25% of compensation(1) but no more than $66,000 for 2023 and $69,000 for 2024. employee: $15,500 in 2023 and $16,000 in 2024. Small business 401 (k) features. contribute more than 3 times the limit of a traditional ira 2. access potential tax advantages for you, your business and your employees 1. choose from a menu of funds chosen by morningstar. 3. sep ira. contribute as your cash flow allows with limits nearly 10 times higher than the limits for a traditional ira. 1. Retirement strategies for small business owners. if you own a company, it's a smart choice to delve into retirement plans for small business owners. here's what you need to know.

The Definitive Small Business Guide To Retirement Planning Above The Small business 401 (k) features. contribute more than 3 times the limit of a traditional ira 2. access potential tax advantages for you, your business and your employees 1. choose from a menu of funds chosen by morningstar. 3. sep ira. contribute as your cash flow allows with limits nearly 10 times higher than the limits for a traditional ira. 1. Retirement strategies for small business owners. if you own a company, it's a smart choice to delve into retirement plans for small business owners. here's what you need to know.

A Quick Guide To Retirement Plans For Small Business Owners Lifetime

Choosing The Right Retirement Plan For Your Small Business

Comments are closed.