Small Business Retirement Plans Business Owner Retirement Plan

How To Retire As A Small Business Owner In 2023 Quickbooks Small business retirement plans. understand retirement planning options that help you keep more of what you earn, while also investing in your future. help take the guesswork out of which plan could be right for you with a 5 minute quiz. launch the small business plan selector. explore our plans. compare plans. Personal defined benefit plan. who it's for: owner only businesses or those with up to five employees. key features: highest contribution limits. contributions are generally 100% tax deductible. helps target your desired level of income in retirement. who can contribute: employer only.

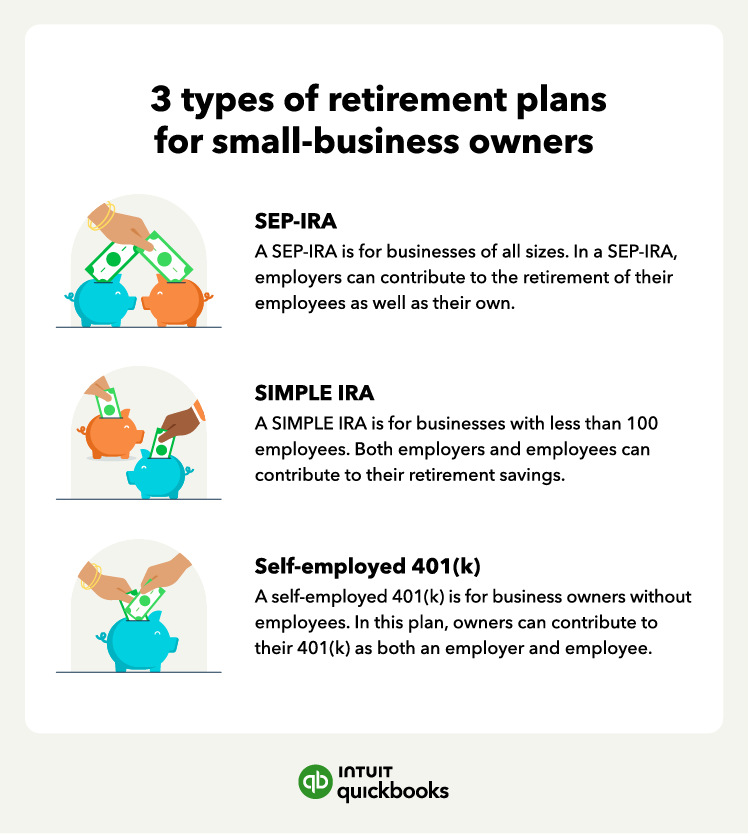

Choosing The Right Retirement Plan For Your Small Business Small businesses that want to provide a retirement benefit to all employees (including the business owners) solely through employer contributions. none. for 2024, up to $23,000, not to exceed 100% of compensation. roth contributions are accepted. for 2024, up to $16,000, not to exceed 100% of compensation. none. 1. retirement plans offer tax advantaged saving opportunities, while helping to attract and retain quality employees. 2. small business owners can utilize iras, 401 (k)s, and profit sharing plans for their businesses. 3. retirement plans have unique filing, compliance, and contribution requirements. if you own a small business—or plan to. You can open a sep ira at vanguard if there is only one person. give us a call so we can help you get started with your plan. 855 490 4668. open a vanguard sep ira. other plan types for small business owners can be opened directly through ascensus. visit their website to learn more. Get relief for certain withdrawals, distributions, and loans from retirement plans and iras if you're affected by the coronavirus. information on retirement plans for small businesses and the self employed. choose a plan. maintain a plan. find or fix plan errors.

Sep Simple And Individual K Plans Navigating The Retirement Plan You can open a sep ira at vanguard if there is only one person. give us a call so we can help you get started with your plan. 855 490 4668. open a vanguard sep ira. other plan types for small business owners can be opened directly through ascensus. visit their website to learn more. Get relief for certain withdrawals, distributions, and loans from retirement plans and iras if you're affected by the coronavirus. information on retirement plans for small businesses and the self employed. choose a plan. maintain a plan. find or fix plan errors. In comparison with other popular retirement plans, the solo 401(k) plan has high contribution limits, which is the key component that attracts owners of small businesses. some other retirement. Schedule an appointment. 4 contribution and compensation limits are subject to a cost of living adjustment annually pursuant to the internal revenue code. contribution and compensation limits for subsequent years may vary. if you're self employed or a business owner with employees, compare our tax advantaged retirement plans for small businesses.

Best Small Business Retirement Plans Powerpoint Slides Diagrams In comparison with other popular retirement plans, the solo 401(k) plan has high contribution limits, which is the key component that attracts owners of small businesses. some other retirement. Schedule an appointment. 4 contribution and compensation limits are subject to a cost of living adjustment annually pursuant to the internal revenue code. contribution and compensation limits for subsequent years may vary. if you're self employed or a business owner with employees, compare our tax advantaged retirement plans for small businesses.

Help Small Businesses Choose The Right Employee Retirement Plans

Comments are closed.