Solved Current Attempt In Progress On June 10 Oriole Chegg

Solved Current Attempt In Progress On June 10 Oriole Chegg Step 1. the journa current attempt in progress on june 10, oriole company purchased $9,000 of merchandise on account from blue spruce company, fob shipping point, terms 2 10,n 30. oriole company pays the freight costs of $540 on june 11. goods totaling $800 are returned to blue spruce for credit on june 12. Current attempt in progress on june 10, cullumber company purchased $8,400 of merchandise from oriole company, terms 3 10, n 30. cullumber company pays the freight costs of $380 on june 11. goods totaling $500 are returned to oriole company for credit on june 12. on june 19, cullumber company pays oriole company in full, less the purchase discount.

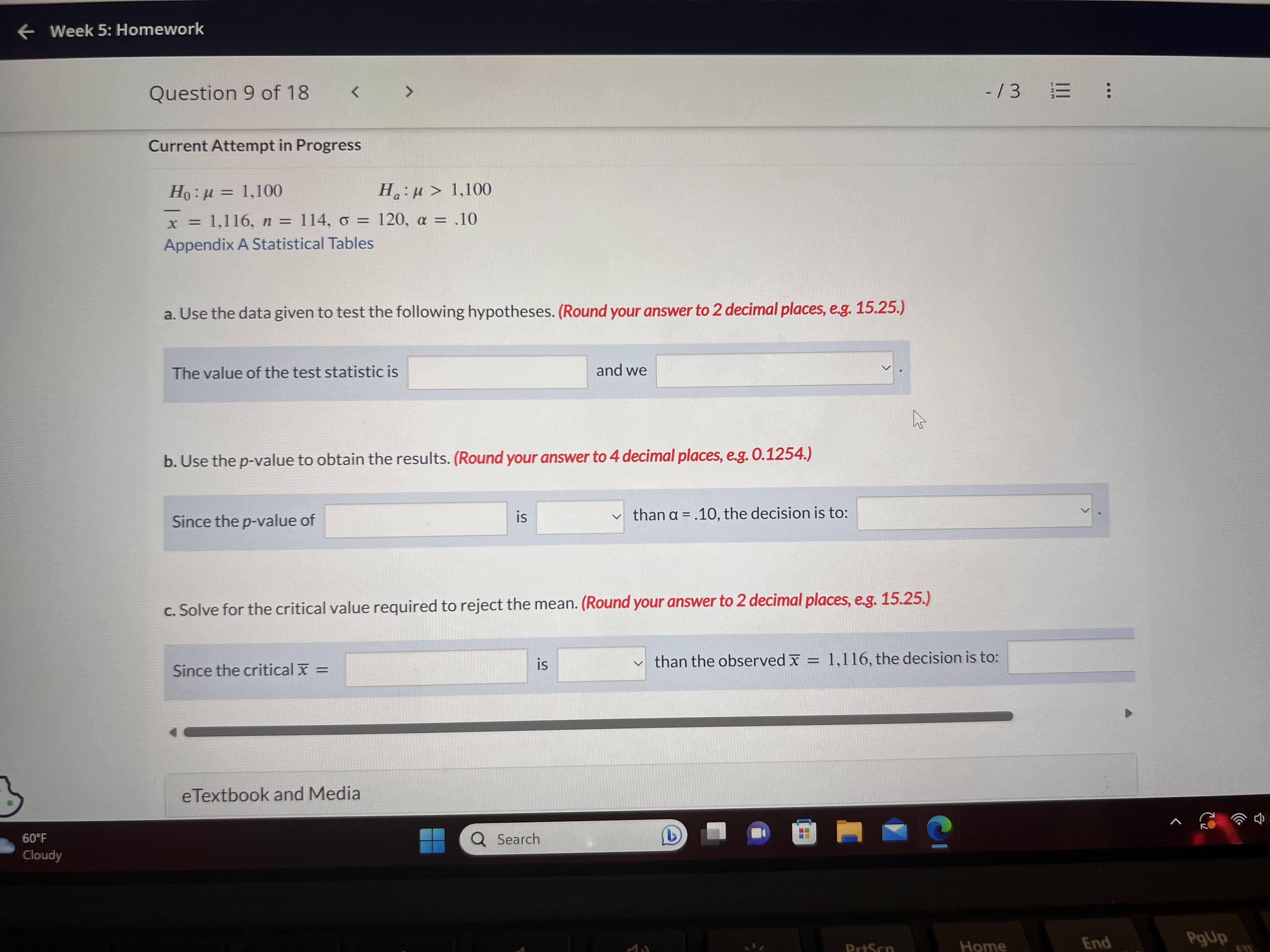

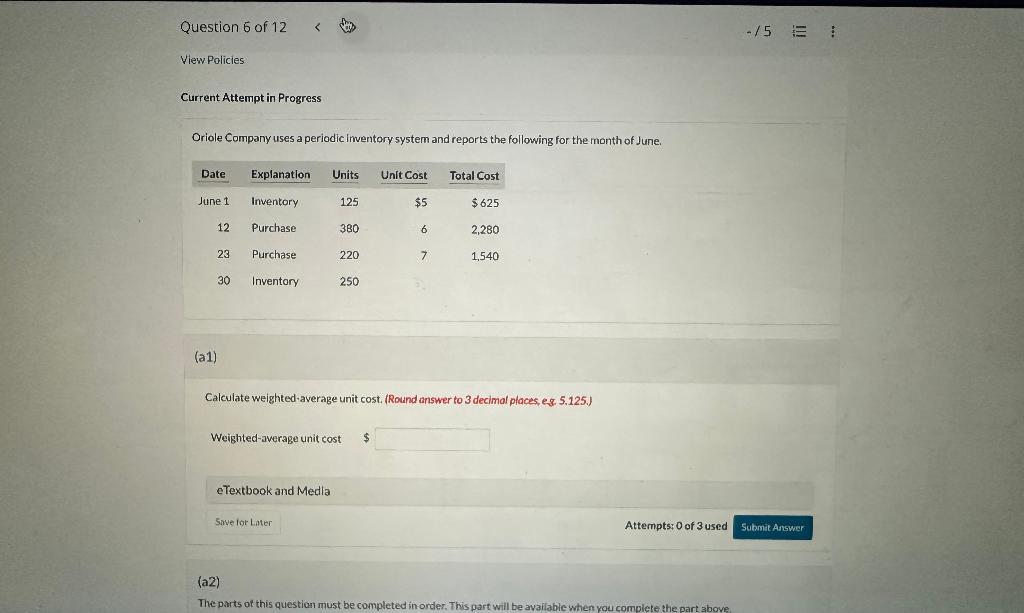

Solved Current Attempt In Progress On June 10 Oriole Chegg Current attempt in progressinventory information for part 311 of oriole corp. discloses the following information for the month of june. (a)your answer is correct.assuming that the periodic inventory method is used, compute the cost of goods sold and ending inventory under (1) lifo and (2) fifo.etextbook and media (b)correct answeryour. Current attempt in progress oriole's manufacturing has 5700 units in beginning work in process inventory, 20% complete as to conversion costs, 14500 units transferred out to finished goods inventory, and 2300 units in ending work in process inventory 10% complete as to conversion costs. To prepare the statement of owner's equity for oriole company for the year ending july 31, 2024, we need to consider various components that affect the owner's equity. the statement begins with the owner's capital at the beginning of the year, and then adjusts for any increases or decreases during the year. Question 5 of 10 view policies current attempt in progress here is financial information for oriole inc december 31 2022 december 31 2021 current assets 122400 100000 plant assets (net) 394362 327000 current liabilities 86325 75000 long term liabilities 133672 88000 common stock 1 par 166374 117000 retained earnings 130391 147000 prepare a schedule showing a horizontal analysis for 2022 using.

Solved Current Attempt In Progress Chegg To prepare the statement of owner's equity for oriole company for the year ending july 31, 2024, we need to consider various components that affect the owner's equity. the statement begins with the owner's capital at the beginning of the year, and then adjusts for any increases or decreases during the year. Question 5 of 10 view policies current attempt in progress here is financial information for oriole inc december 31 2022 december 31 2021 current assets 122400 100000 plant assets (net) 394362 327000 current liabilities 86325 75000 long term liabilities 133672 88000 common stock 1 par 166374 117000 retained earnings 130391 147000 prepare a schedule showing a horizontal analysis for 2022 using. Current attempt in progress on june 1, 2025, oriole service co. was started with an initial investment in the company of $23,100 cash. here are the assets, liabilities, and common stock of the company at june 30, 2025, and the revenues and expenses for the month of june, its first month of operations: cash accounts receivable service revenue supplies advertising expense equipment common stock. Current attempt in progress oriole inc. is considering two alternatives to finance its construction of a new $\$ 1.80$ million plant. (a) issuance of 180,000 shares of common stock at the market price of $\$ 10$ per share. (b) issuance of $\$ 1,800,000,6 \%$ bonds at face value. complete the following table.

Solved Current Attempt In Progress Oriole Company Uses A Chegg Current attempt in progress on june 1, 2025, oriole service co. was started with an initial investment in the company of $23,100 cash. here are the assets, liabilities, and common stock of the company at june 30, 2025, and the revenues and expenses for the month of june, its first month of operations: cash accounts receivable service revenue supplies advertising expense equipment common stock. Current attempt in progress oriole inc. is considering two alternatives to finance its construction of a new $\$ 1.80$ million plant. (a) issuance of 180,000 shares of common stock at the market price of $\$ 10$ per share. (b) issuance of $\$ 1,800,000,6 \%$ bonds at face value. complete the following table.

Solved Current Attempt In Progress Oriole Company Has The Chegg

Comments are closed.