Solved Ea1 A2 Record Journal Entries Us Exercise You Will Chegg

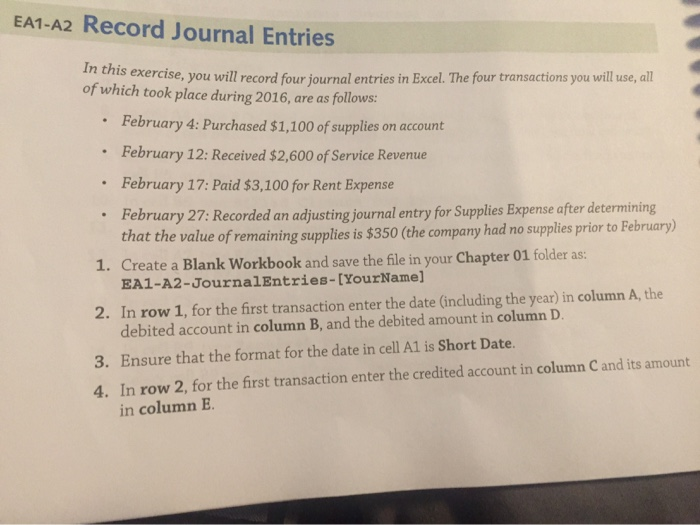

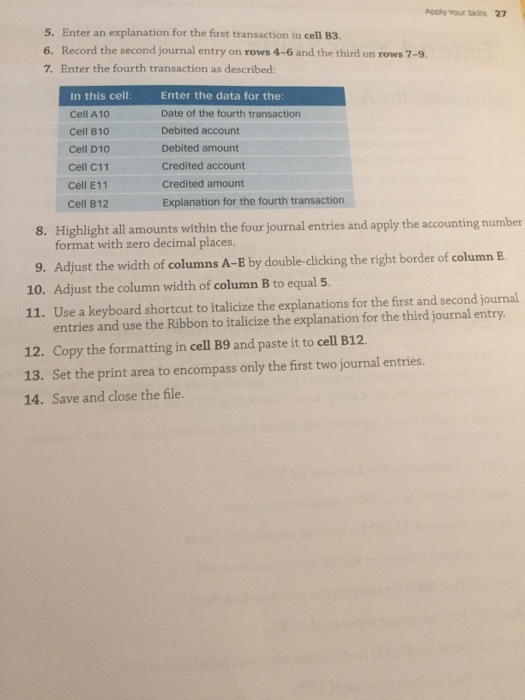

Solved Ea1 A2 Record Journal Entries Us Exercise You Will Chegg Accounting questions and answers. ea1 a2 record journal entries us exercise, you will record four journal entries in excel. the four transactions you will use, all of which took place during 2016, are as follows: • february 4: purchased $1,100 of supplies on account • february 12: received $2,600 of service revenue february 17: paid $3,100. Ea1 a2 record journal entries in this exercise, you will record four journal entries in excel. the four transactions you will use, all of which took place during 2016, are as follows: • february 4: purchased $1,100 of supplies on account • february 12: received $2,600 of service revenue • february 17: paid $3,100 for rent expense • february 27: recorded an adjusting journal entry for.

Solved Ea1 A2 Record Journal Entries Us Exercise You Will Chegg Ea1 a2 record journal entries. in this exercise, you will record four journal entries in excel. access the proper file. (your starting file is intentionally blank.) transactions (all took place in 2026) february 4: purchased $1,100 of supplies on account. february 12: received $2,600 of service revenue. february 17: paid $3,100 for rent expense. Answered step by step. ea1 a2 record jornal entries. ea1 a2 record journal entries us exercise, you will record four journal entries in excel. the four transactions you will use, all of which took place during 2016, are as follows: • february 4: purchased $1,100 of supplies on account • february 12: received $2,600 of service revenue. Q hi, can you please help me with these transactions , i just need the journal entry for this transaction from february 1 answered over 90d ago q please answer question 1, part a & b. a. prepare a 10 column worksheet for the year ended 30 june 2016. 15.2 describe how a partnership is created, including the associated journal entries; 15.3 compute and allocate partners’ share of income and loss; 15.4 prepare journal entries to record the admission and withdrawal of a partner; 15.5 discuss and record entries for the dissolution of a partnership; key terms; summary; multiple choice.

Comments are closed.