Solved Journal Entry Worksheet

Solved Journal Entry Worksheet Problems 2: prepare general journal entries for the following transactions of a business called pose for pics in 2016: aug. 1: hashim khan, the owner, invested rs. 57,500 cash and rs. 32,500 of photography equipment in the business. 04: paid rs. 3,000 cash for an insurance policy covering the next 24 months. Capital is an internal liability for the business hence credit the increase in liabilities. example – max started a business with 10,000 in cash. cash a c. 10,000. to capital a c. 10,000. (capital introduced by max in cash for 10,000) related topic – all journal entries on one page. 2.

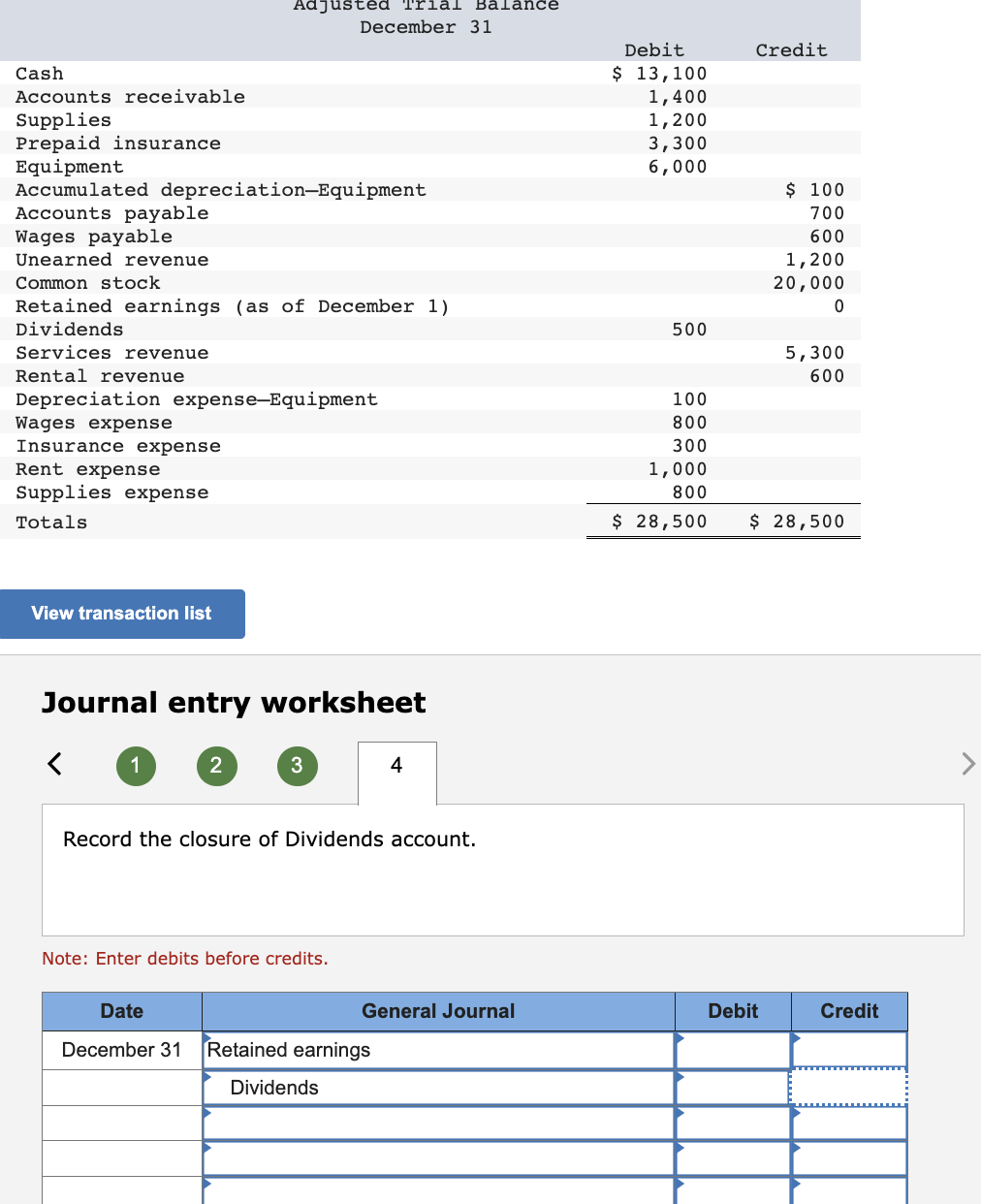

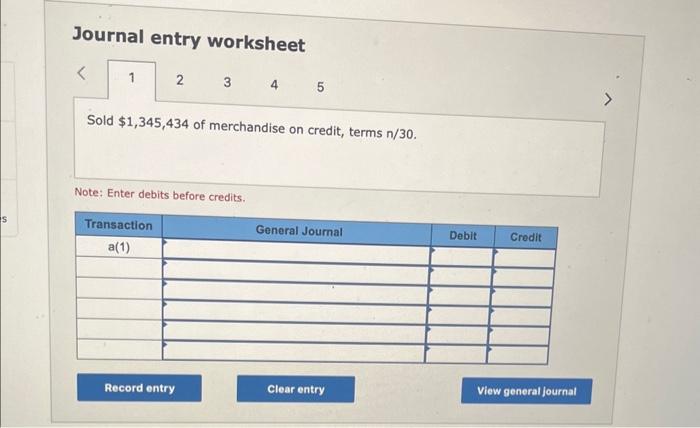

Solved Journal Entry Worksheet 1 2 Note Enter Debits Chegg 2. post the journal entries from part 1 to the ledger accounts. 3. prepare a trial balance as of the end of september. complete this question by entering your answers in the tabs below. post the journal entries from part 1 to the ledger accounts. journal entry worksheet the company paid $1, 800 cash salary to an assistant. note: enter debits. Journal entry questions and solutions. pass the necessary journal entries related to the ‘opening entry’. (a) on 1st april 2023, ram started a business with cash ₹5,00,000. (b) on 1st april 2023, vinod started business with cash ₹1,00,000, furniture ₹2,00,000, and building ₹10,00,000. (c) on 1st april 2023, mohan’s books of. Accounting questions and answers. journal entry worksheet: sold merchandise to lennox, incorporated, for $36,000 and accepted a 10%, 7 month note. 10% is an appropriate rate for this type of note. record the transaction. (feb.28, 2024)sold merchandise to. Journal entry worksheet the computer system, acquired on october 1 , is expected to have a four year life with no salvage value. note: enter debits before credits.reimbursed s. rey for business automobile mileage ( 400 miles at $0.29 per mile). note: enter debits before credits.journal entry worksheet (1). 2 (7) 8….

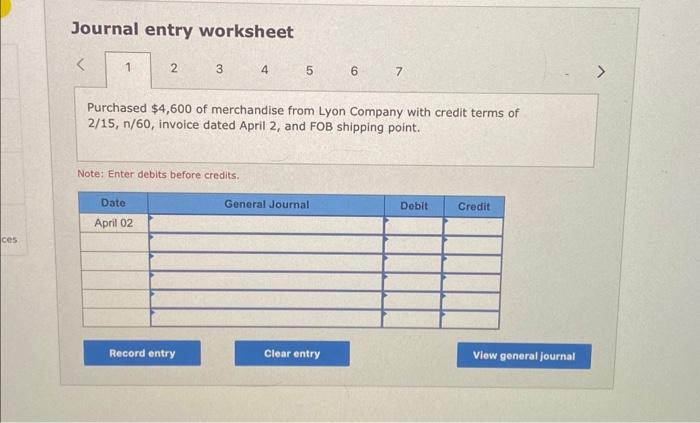

Solved Journal Entry Worksheet 567 Purchased 4 600 Of Chegg Accounting questions and answers. journal entry worksheet: sold merchandise to lennox, incorporated, for $36,000 and accepted a 10%, 7 month note. 10% is an appropriate rate for this type of note. record the transaction. (feb.28, 2024)sold merchandise to. Journal entry worksheet the computer system, acquired on october 1 , is expected to have a four year life with no salvage value. note: enter debits before credits.reimbursed s. rey for business automobile mileage ( 400 miles at $0.29 per mile). note: enter debits before credits.journal entry worksheet (1). 2 (7) 8…. Let's start. transaction #1: on december 1, 2021, mr. donald gray started gray electronic repair services by investing $10,000. the journal entry should increase the company's cash, and increase (establish) the capital account of mr. gray; hence: transaction #2: on december 5, gray electronic repair services paid registration and licensing fees. The document defines journal, ledger, and trial balance. it then provides two problems to practice journal entries, ledger accounts, and preparing a trial balance. the first problem involves transactions from january 1 10, 2020 including purchases, sales, and asset acquisitions. the solution shows journal entries, various ledger accounts, and the resulting trial balance. the second problem.

Solved Journal Entry Worksheet 1journal Entry Worksheet Chegg Let's start. transaction #1: on december 1, 2021, mr. donald gray started gray electronic repair services by investing $10,000. the journal entry should increase the company's cash, and increase (establish) the capital account of mr. gray; hence: transaction #2: on december 5, gray electronic repair services paid registration and licensing fees. The document defines journal, ledger, and trial balance. it then provides two problems to practice journal entries, ledger accounts, and preparing a trial balance. the first problem involves transactions from january 1 10, 2020 including purchases, sales, and asset acquisitions. the solution shows journal entries, various ledger accounts, and the resulting trial balance. the second problem.

Solved Journal Entry Worksheet Journal Entry Chegg

Solved Journal Entry Worksheet 5journal Entry Worksheet

Comments are closed.