Stages Of Financial Life Cycle Printable Templates Protal

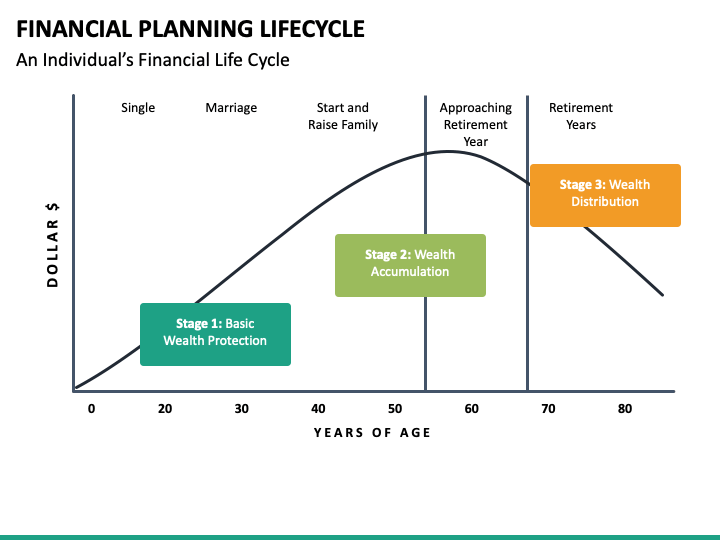

Stages Of Financial Life Cycle Printable Templates Protal Life cycle planning is about knowing where you are—and, crucially, where you’re headed. it helps ensure that you’re financially equipped for each next stage of the journey ahead. consider. Stage four: distribution of wealth (retirement) the fourth and final stage of your financial life cycle is retirement. your working days are over, and you've officially entered your golden years. with your income from work likely at $0, you're now living off your retirement accounts (assuming you're of age to take distributions) and either.

5 Stages Of Financial Life Cycle Printable Templates Protal Financial planning at this stage. at this stage of your life, you may be considering: moving forward in a career. caring for a young or growing family. starting to save for children‘s education. buying a home. health and how it impacts finances and family. investing in general or through a 401 (k). 5 stages of the financial life cycle. there are five stages of the financial life cycle, which are as follows: teenage (13 17 years) young adulthood (18 25 years) starting a family (26 45 years) planning to retirement (45 64 years), and; successful retirement (65 years) 5 stages of the financial life cycle. the financial life cycle is divided. The 5 stages of the personal financial life cycle are: 1) early career and accumulation, 2) family formation and protection, 3) mid career and growth, 4) pre retirement and preservation, and 5) retirement and distribution. these stages represent different financial goals and challenges individuals may face throughout their lives. Planning for each stage of the financial life cycle individually can lead to disjointed decision making and inefficient financial plans. a holistic approach, however, provides several key benefits: 1. offers alignment with both short and long term goals. aligning your personal financial planning with your short and long term goals forges a.

5 Stages Of Financial Life Cycle Printable Templates Protal The 5 stages of the personal financial life cycle are: 1) early career and accumulation, 2) family formation and protection, 3) mid career and growth, 4) pre retirement and preservation, and 5) retirement and distribution. these stages represent different financial goals and challenges individuals may face throughout their lives. Planning for each stage of the financial life cycle individually can lead to disjointed decision making and inefficient financial plans. a holistic approach, however, provides several key benefits: 1. offers alignment with both short and long term goals. aligning your personal financial planning with your short and long term goals forges a. Table of contents. stage 1: entering the workforce – early career years. stage 2: family and career building years. stage 3: the pre retirement years. stage 4: early retirement years. stage 5: later retirement years. final thoughts. Here are the key investing steps for all of life’s stages and some portfolios to get you started. margaret giles oct 23, 2023. as our lives evolve, so do our financial and investment priorities.

5 Stages Of Financial Life Cycle Printable Templates Protal Table of contents. stage 1: entering the workforce – early career years. stage 2: family and career building years. stage 3: the pre retirement years. stage 4: early retirement years. stage 5: later retirement years. final thoughts. Here are the key investing steps for all of life’s stages and some portfolios to get you started. margaret giles oct 23, 2023. as our lives evolve, so do our financial and investment priorities.

Comments are closed.