Stages Of Wealth Management Wealth Planning I C3 Financial Partners

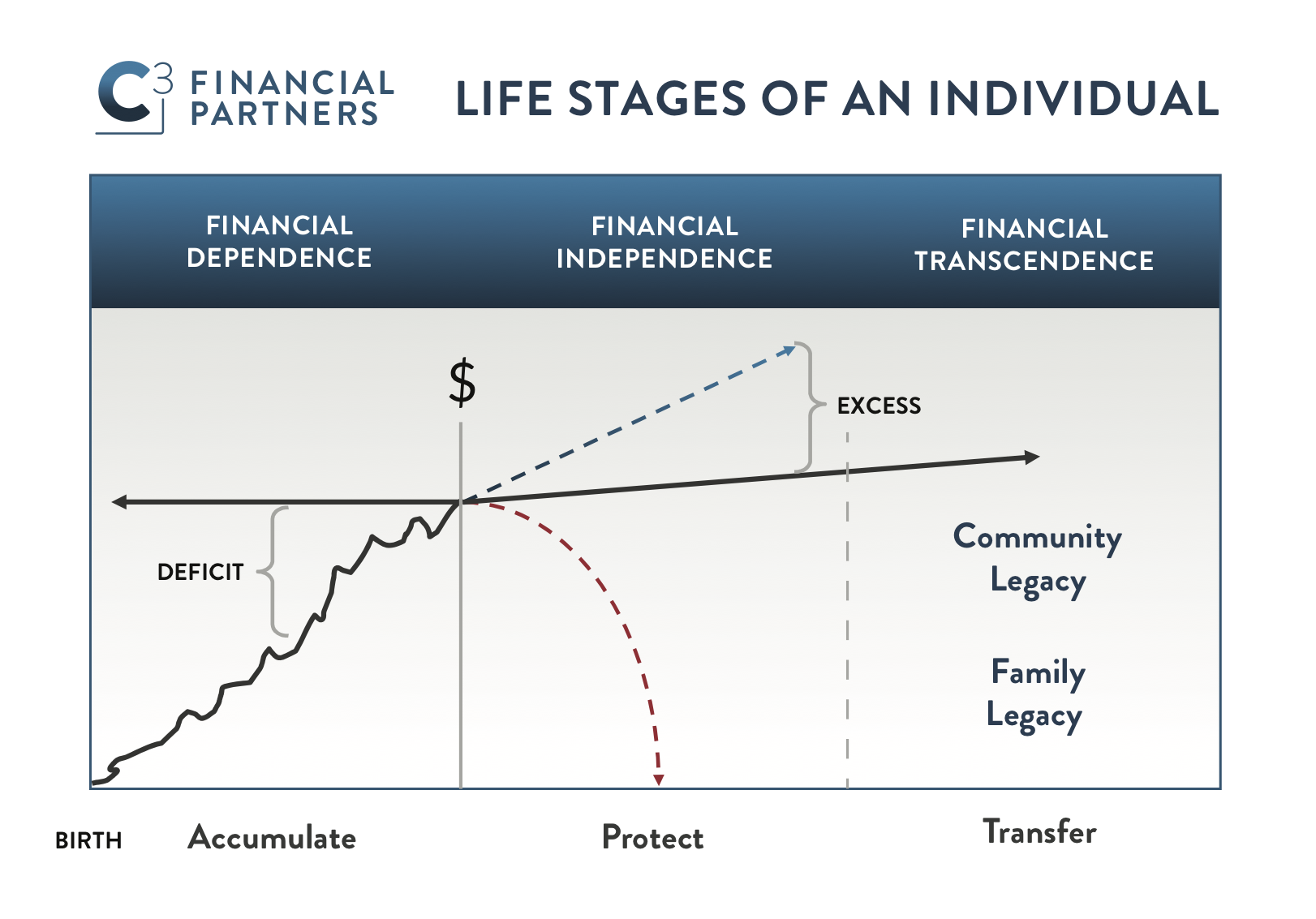

Stages Of Wealth Management Wealth Planning I C3 Financial Partners There are three key life stages to wealth planning and management: accumulate, protect, and transfer. this frame of reference can help wealth holders and their advisors quickly get on the same page so they can start working towards the same goals. as changes occur to health, family, financial situations, tax laws, and more, this framework for. Or maybe it’s been slower. perhaps it’s even your current stage. if you feel that there’s a gap between where you are, financial dependence, and where you want to be, financial independence, you are in the accumulation phase. when you identify yourself as having financial independence or freedom, you have moved to the stage called protect.

Stages Of Wealth Management Wealth Planning I C3 Financial Partners Advanced life insurance solutions. c3 has over 100 years of combined experience in serving ultra affluent clients. we specialize in the design, implementation, and management of sophisticated solutions with the objective of minimizing income and estate tax liabilities. our team of professionals has access to innovative solutions and products. The 6 stages of wealth management. wealth management is a process that involves: gathering financial data. establishing financial goals. auditing and analyzing the portfolio. recommending a financial plan. implementing the plan. monitoring and reporting on the plan. 3. c3 financial partners. 664 followers. 6d. last week, we spoke about the power of life insurance in planning to protect against poor heir quality. for more on using life insurance in estate. Personal wealth management follows three stages: build, preserve and transfer. during these stages, you may need trust and fiduciary specialists, business advisory services, tax specialists, estate services, or legacy trust and philanthropic services. while financial strategies can vary greatly in each of these stages, the need to plan remains.

4 Stages Of Wealth Wealth Wealth Management Finance Investing 3. c3 financial partners. 664 followers. 6d. last week, we spoke about the power of life insurance in planning to protect against poor heir quality. for more on using life insurance in estate. Personal wealth management follows three stages: build, preserve and transfer. during these stages, you may need trust and fiduciary specialists, business advisory services, tax specialists, estate services, or legacy trust and philanthropic services. while financial strategies can vary greatly in each of these stages, the need to plan remains. Wealth management vs. financial planning phases. these processes often intertwine and overlap. however, here is a simple breakdown of what your experience could look like when working with either professional: assessment and goal setting. both financial planning and wealth management start with understanding your current financial situation. Key takeaways. financial planning helps individuals meet specific money goals like saving for a house or retirement, while wealth management is a more holistic approach that caters to high net worth individuals and involves investment management and addressing complex estate planning needs. the wealth manager offers a broader range of services.

Comments are closed.